Get the free Property Tax Pre-Payment Plan Application

Show details

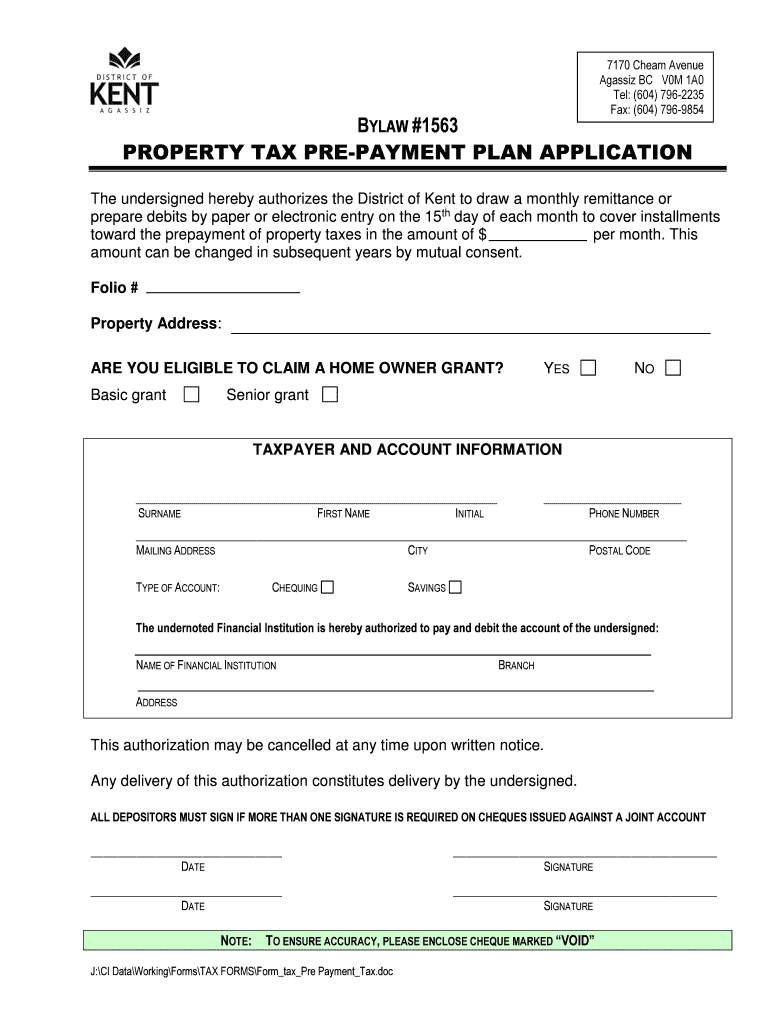

7170 Cheap Avenue

Agassiz BC V0M 1A0

Tel: (604) 7962235

Fax: (604) 7969854BYLAW #1563

PROPERTY TAX PREPAYMENT PLAN Application undersigned hereby authorizes the District of Kent to draw a monthly

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign property tax pre-payment plan

Edit your property tax pre-payment plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your property tax pre-payment plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit property tax pre-payment plan online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit property tax pre-payment plan. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out property tax pre-payment plan

How to fill out property tax pre-payment plan

01

Determine if your local government offers a property tax pre-payment plan. Contact your local tax collector's office or visit their website to find out if this option is available in your area.

02

Gather the necessary information and documents. You will likely need your property tax bill, identification, and proof of residency.

03

Review the eligibility requirements and guidelines for the pre-payment plan. Some plans may have income limitations or specific criteria that must be met.

04

Calculate the amount you want to pre-pay. This can be the full amount of your property taxes or a portion of it.

05

Submit the completed application form and required documents to the tax collector's office. Be sure to include any required payment along with the application.

06

Wait for confirmation from the tax collector's office. They will review your application and notify you of its acceptance or any further instructions.

07

Make the pre-payment according to the instructions provided by the tax collector's office. This may involve mailing a check, making an online payment, or visiting their office in person.

08

Keep records of your pre-payment for future reference and tax purposes.

09

Follow up with the tax collector's office if you have any questions or concerns regarding your pre-payment plan.

Who needs property tax pre-payment plan?

01

Property owners who want to manage their tax payments more effectively

02

Individuals who prefer to pay their property taxes in installments throughout the year rather than as a lump sum

03

People who want to take advantage of potential tax savings or benefits by pre-paying their property taxes

04

Those who want to avoid any late payment penalties or interest charges on their property taxes

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my property tax pre-payment plan in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign property tax pre-payment plan and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I edit property tax pre-payment plan straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing property tax pre-payment plan.

How do I complete property tax pre-payment plan on an Android device?

On an Android device, use the pdfFiller mobile app to finish your property tax pre-payment plan. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is property tax pre-payment plan?

Property tax pre-payment plan is a program that allows property owners to pay their property taxes in advance.

Who is required to file property tax pre-payment plan?

Property owners who wish to pre-pay their property taxes are required to file a property tax pre-payment plan.

How to fill out property tax pre-payment plan?

Property owners can fill out the property tax pre-payment plan form provided by their local tax assessor's office.

What is the purpose of property tax pre-payment plan?

The purpose of property tax pre-payment plan is to allow property owners to manage their tax payments more effectively and potentially save money on interest payments.

What information must be reported on property tax pre-payment plan?

Property owners must report their property information, estimated tax amount, and payment schedule on the property tax pre-payment plan.

Fill out your property tax pre-payment plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Property Tax Pre-Payment Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.