Get the free In-Kind Donation Record - Housing Families

Show details

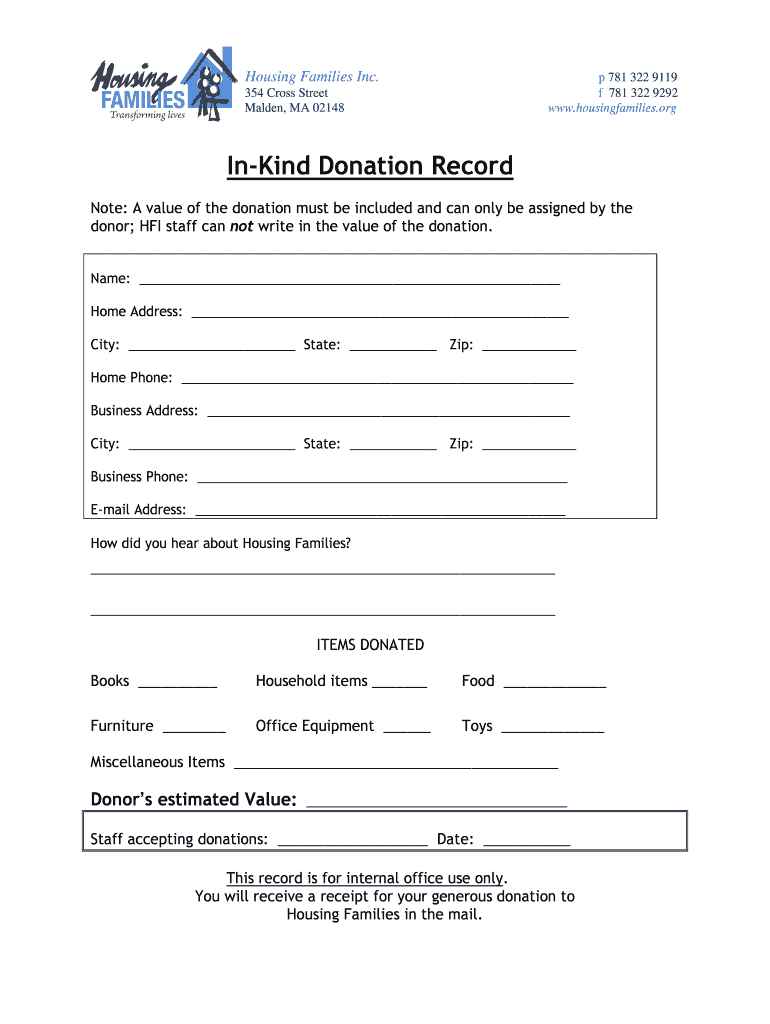

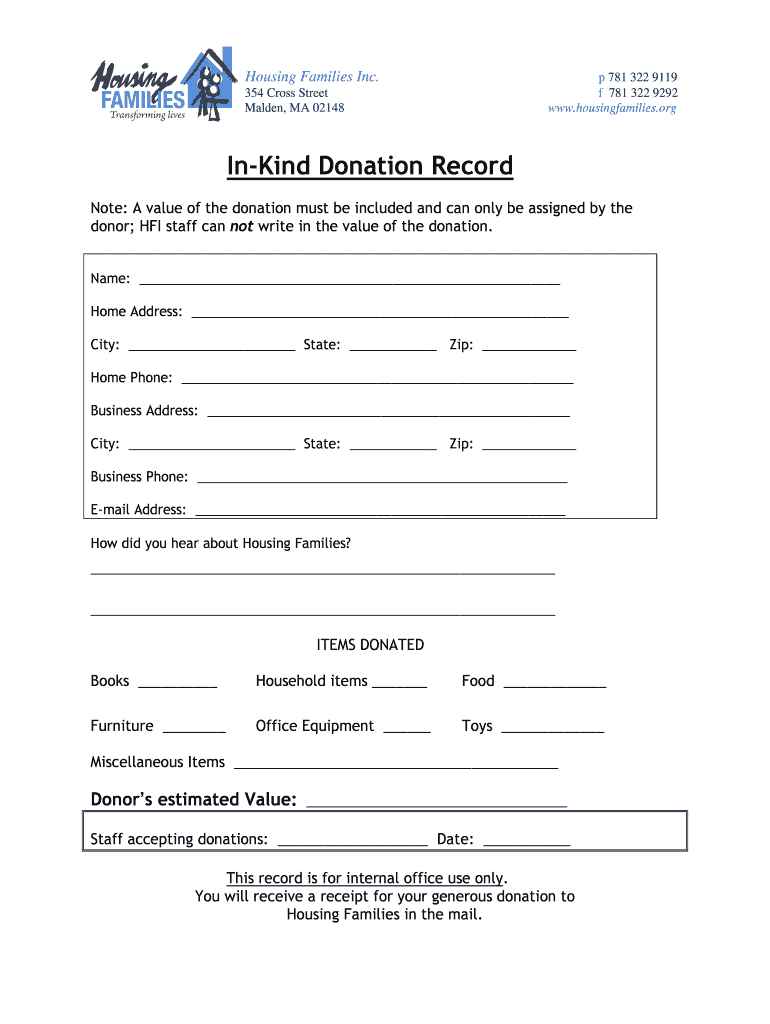

Housing Families Inc.p 781 322 9119 f 781 322 9292 www.housingfamilies.org354 Cross Street Malden, MA 02148InKind Donation Record Note: A value of the donation must be included and can only be assigned

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign in-kind donation record

Edit your in-kind donation record form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your in-kind donation record form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit in-kind donation record online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit in-kind donation record. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is simple using pdfFiller. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out in-kind donation record

How to fill out in-kind donation record

01

To fill out an in-kind donation record, follow these steps:

02

Start by gathering all the necessary information about the donation, including the donor's name and contact information, description of the donated items, quantity, and estimated value.

03

Prepare a document or form specifically designed for recording in-kind donations. You can create your own template or use a pre-existing one.

04

On the document, provide spaces or fields to enter the required information. These may include donor details, date of donation, description of items, condition of items, and any restrictions or specifications imposed by the donor.

05

Enter the donor's name, contact information, and date of donation at the top of the record.

06

List each donated item separately. Include a brief description, quantity, condition, and estimated fair market value for each item.

07

If there are any restrictions or specifications from the donor regarding the use or allocation of the donated items, make sure to note them in the record.

08

Total up the quantity and estimated value of all items donated.

09

Ensure that the record is signed and dated by both the donor and the authorized representative of the organization receiving the donation.

10

Make copies of the completed record for both the donor and your organization's records.

11

Finally, store the in-kind donation record in a safe and organized manner for future reference or auditing purposes.

Who needs in-kind donation record?

01

In-kind donation records are needed by organizations or non-profit entities that receive and rely on donated items from individuals or businesses.

02

These records are particularly important for:

03

- Non-profit organizations that provide various services and use donated items to support their operations or help the intended beneficiaries.

04

- Charitable institutions that rely on in-kind donations to meet the needs of the community they serve.

05

- Schools, colleges, or educational institutions that receive donated supplies, equipment, or materials to support teaching and learning.

06

- Museums, libraries, and art galleries that collect donated artifacts, books, or artworks for public display and preservation.

07

- Hospitals, clinics, or healthcare facilities that accept donated medical equipment, supplies, or pharmaceuticals to improve patient care.

08

By maintaining accurate and detailed in-kind donation records, these organizations can track, acknowledge, and manage the donated items effectively.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit in-kind donation record from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including in-kind donation record. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How can I send in-kind donation record to be eSigned by others?

When you're ready to share your in-kind donation record, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I edit in-kind donation record on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign in-kind donation record on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is in-kind donation record?

In-kind donation record is a documentation of non-monetary contributions given to a organization or individual.

Who is required to file in-kind donation record?

Organizations or individuals who receive in-kind donations are required to file in-kind donation record.

How to fill out in-kind donation record?

In-kind donation record should include details of the donation such as description, value, donor information, and date received.

What is the purpose of in-kind donation record?

The purpose of in-kind donation record is to track and report non-monetary contributions for tax and transparency purposes.

What information must be reported on in-kind donation record?

Information such as description of donation, estimated value, donor name and contact information, date of donation must be reported on in-kind donation record.

Fill out your in-kind donation record online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

In-Kind Donation Record is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.