Get the free Calendar of EventsInternal Revenue Service

Show details

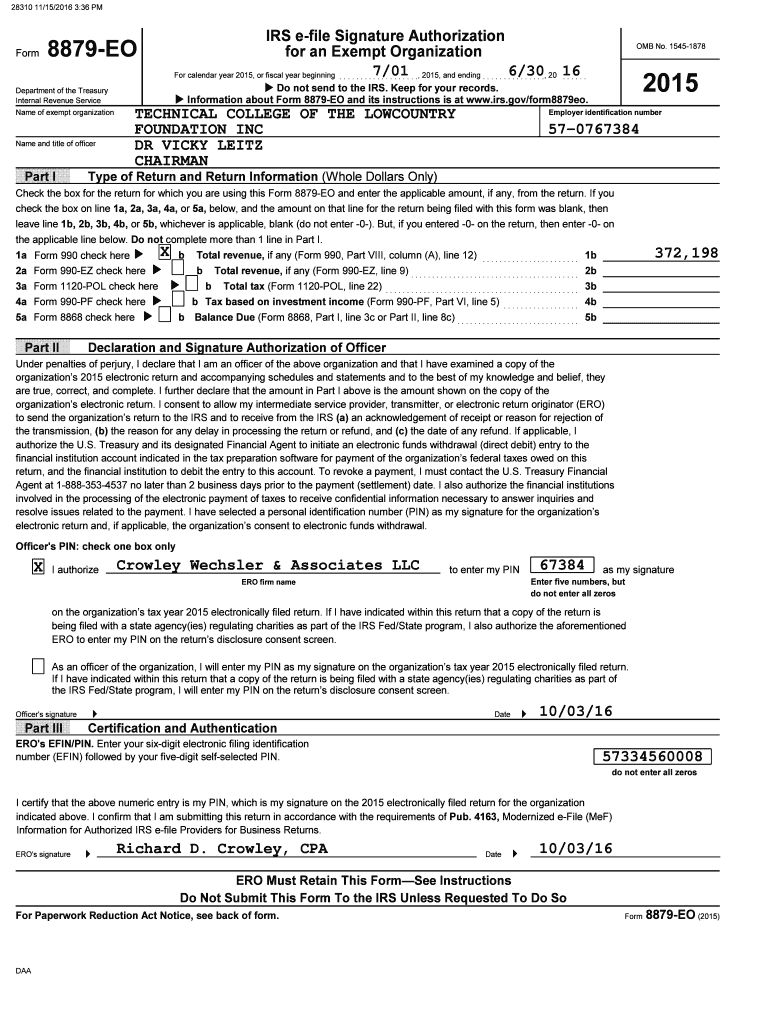

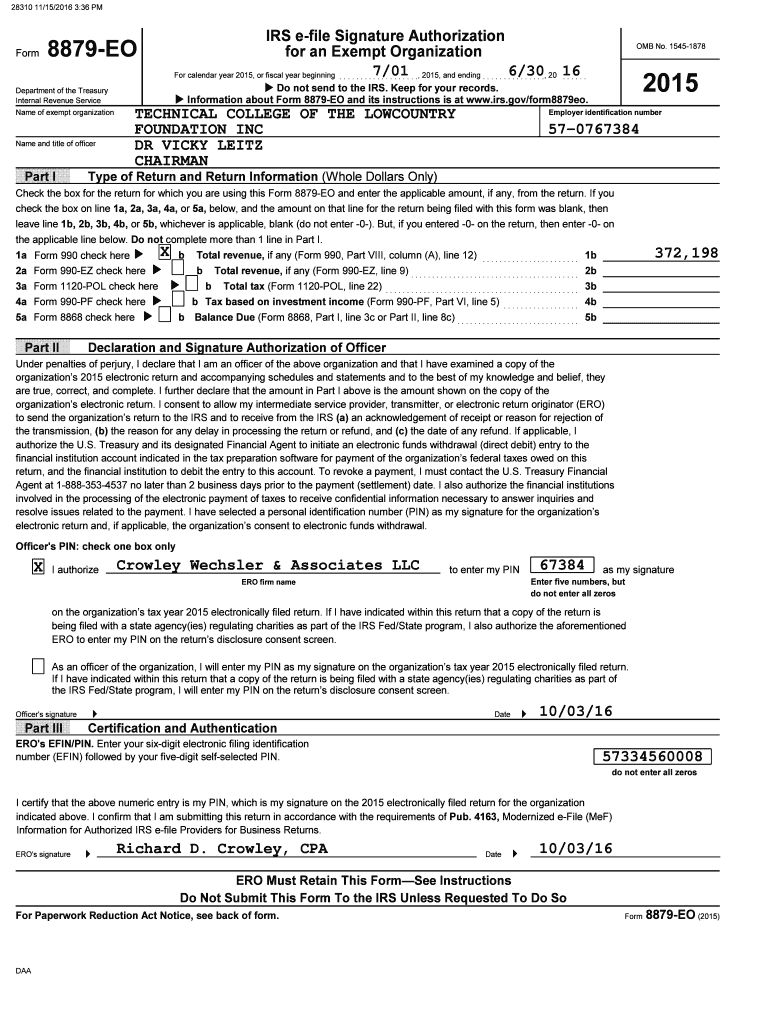

28310 11/15/2016 3:36 PMForm8879EODepartment of the Treasury Internal Revenue Service Name of exempt organizational and title of officerPart AIRS file Signature Authorization for an Exempt Organization

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign calendar of eventsinternal revenue

Edit your calendar of eventsinternal revenue form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your calendar of eventsinternal revenue form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing calendar of eventsinternal revenue online

To use our professional PDF editor, follow these steps:

1

Log into your account. It's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit calendar of eventsinternal revenue. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out calendar of eventsinternal revenue

How to fill out calendar of eventsinternal revenue

01

To fill out the calendar of events for internal revenue, follow these steps:

02

Gather all relevant information: Collect all the important dates and events relating to internal revenue that need to be included in the calendar.

03

Determine the format: Decide on the format or layout you want to use for the calendar. You can choose a traditional monthly calendar format or opt for a more creative design.

04

Create a timeline: Establish a timeline for the calendar, including the start and end dates. This will help you allocate specific events to their respective dates.

05

Allocate events: Assign each event to its appropriate date on the calendar. Make sure to include details such as event name, date, time, and location if necessary.

06

Add descriptions or notes: If needed, include additional information or descriptions for each event to provide more context or instructions.

07

Review and edit: Take the time to carefully review and edit the calendar to ensure accuracy and consistency.

08

Publish or distribute: Once the calendar is complete, decide on how you want to share or distribute it. You can either publish it on a website, share it digitally, or print and distribute physical copies.

09

Update regularly: Keep the calendar updated by adding or removing events as necessary. Stay organized and ensure that any changes or updates are reflected in the calendar.

10

Remember to consult any relevant guidelines or requirements specific to your internal revenue system when creating the calendar.

Who needs calendar of eventsinternal revenue?

01

The calendar of events for internal revenue is beneficial for various individuals and organizations, including:

02

- Taxpayers: They can use the calendar to keep track of important tax-related dates, such as filing deadlines, payment due dates, and tax return submission dates.

03

- Internal Revenue Service (IRS) employees: The calendar helps IRS employees stay organized and informed about important events, meetings, training sessions, or deadlines within the organization.

04

- Accountants and tax professionals: These professionals can utilize the calendar to manage their clients' tax-related activities and deadlines more effectively.

05

- Government agencies: The calendar can be useful for government agencies involved in tax administration and planning.

06

- Business owners: Business owners can benefit from the calendar by keeping track of tax-related dates, such as estimated tax payment due dates and tax filing deadlines.

07

- Financial advisors: Financial advisors can use the calendar to help their clients plan and prepare for important tax-related events.

08

- Individuals or organizations involved in tax advocacy or education: The calendar can serve as a resource for promoting tax education and advocacy initiatives.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify calendar of eventsinternal revenue without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your calendar of eventsinternal revenue into a dynamic fillable form that you can manage and eSign from anywhere.

How do I make edits in calendar of eventsinternal revenue without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your calendar of eventsinternal revenue, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How do I complete calendar of eventsinternal revenue on an Android device?

Complete your calendar of eventsinternal revenue and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is calendar of eventsinternal revenue?

Calendar of eventsinternal revenue is a form used by businesses to report events that may affect their tax liabilities throughout the year.

Who is required to file calendar of eventsinternal revenue?

Businesses that engage in certain activities, such as sales of goods or services, are required to file calendar of eventsinternal revenue.

How to fill out calendar of eventsinternal revenue?

Calendar of eventsinternal revenue can be filled out online or on paper, and businesses must provide information about the events that occurred during the year.

What is the purpose of calendar of eventsinternal revenue?

The purpose of calendar of eventsinternal revenue is to help the Internal Revenue Service (IRS) track business activities and ensure accurate tax reporting.

What information must be reported on calendar of eventsinternal revenue?

Businesses must report events such as sales, purchases, expenses, and other transactions that may affect their tax liabilities.

Fill out your calendar of eventsinternal revenue online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Calendar Of Eventsinternal Revenue is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.