Get the free Residential Mortgage Loan Originator - Forms

Show details

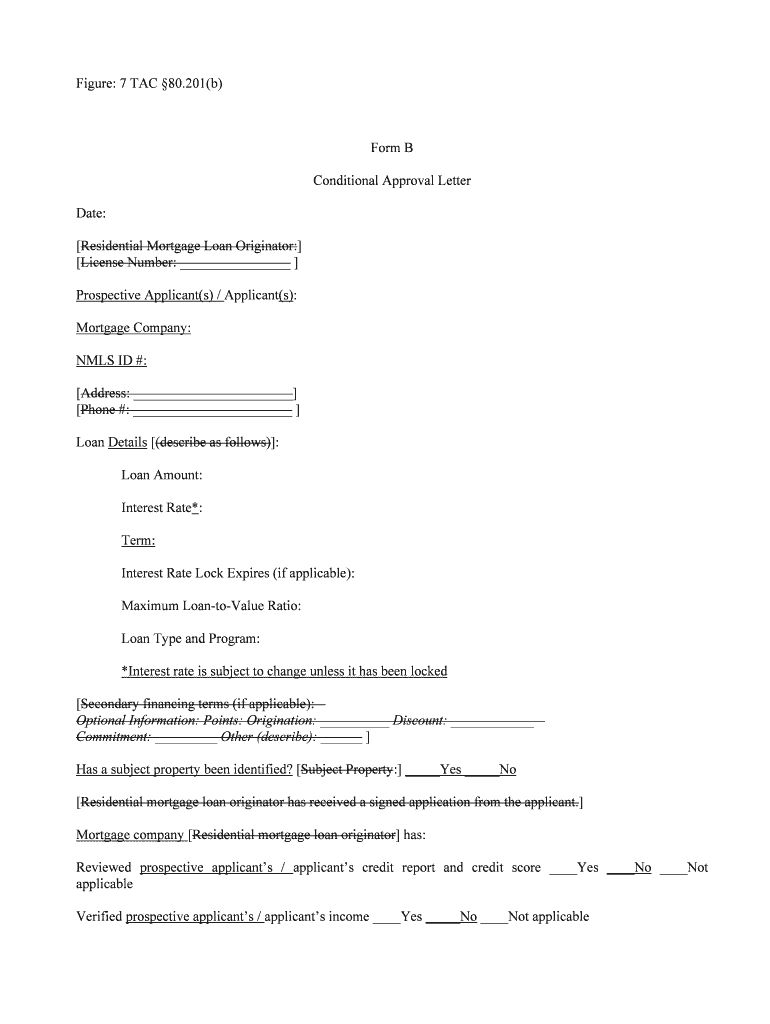

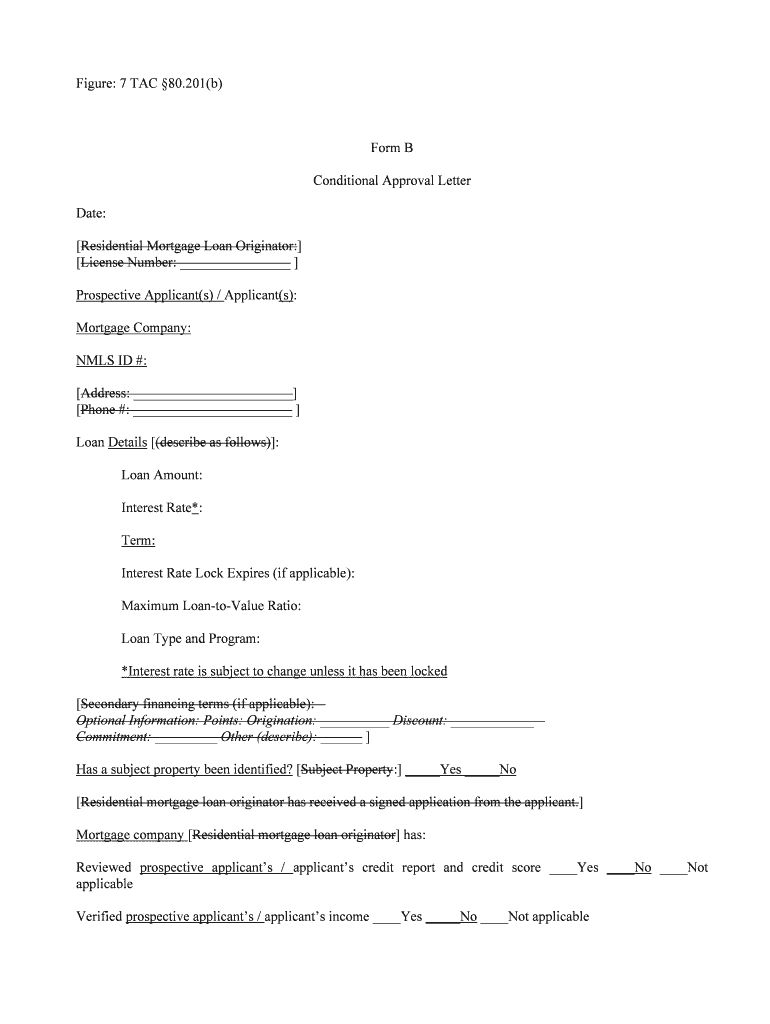

Figure: 7 TAC 80.201(b)Form B Conditional Approval Letter Date: Residential Mortgage Loan Originator: License Number: Prospective Applicant(s) / Applicant(s): Mortgage Company: NLS ID #: Address:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign residential mortgage loan originator

Edit your residential mortgage loan originator form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your residential mortgage loan originator form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit residential mortgage loan originator online

Follow the guidelines below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit residential mortgage loan originator. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out residential mortgage loan originator

How to fill out residential mortgage loan originator

01

Gather all necessary documents such as identification, income proof, employment history, and asset information.

02

Research and compare different lenders to find the best mortgage loan rates and terms.

03

Complete the loan application form provided by the chosen lender, providing accurate and up-to-date information.

04

Attach all required documents to the loan application, ensuring they are properly organized and easy to review.

05

Submit the completed loan application and supporting documents to the lender, either online or in person.

06

Work closely with the lender or loan officer to provide any additional information or clarifications as needed.

07

Review and understand the terms and conditions of the mortgage loan, including interest rate, repayment schedule, and fees.

08

Attend any required meetings or appointments with the lender or loan officer to discuss the loan and address any concerns.

09

Get the property appraised and inspected, if necessary, to ensure its value and condition meet the lender's requirements.

10

Review the loan closing documents carefully, making sure all terms are accurately reflected and understood.

11

Sign the mortgage loan closing documents and provide any required down payment or closing costs.

12

Begin making regular mortgage payments according to the agreed-upon schedule.

13

Keep track of important dates and deadlines related to the mortgage loan, including refinancing options and payment due dates.

14

Stay in contact with the lender or loan servicing company to address any questions, concerns, or changes in financial circumstances.

15

Maintain good financial habits and continue to monitor and improve credit score to ensure ongoing mortgage loan eligibility.

Who needs residential mortgage loan originator?

01

Individuals who are planning to purchase a residential property and require financial assistance to do so.

02

People who want to refinance their existing mortgage loans to secure better interest rates or terms.

03

Homebuyers who need guidance and expertise in navigating the complex mortgage loan application process.

04

Real estate investors who need financing options to purchase residential properties for rental or resale purposes.

05

Individuals who want to take advantage of the tax benefits of homeownership and build equity through mortgage payments.

06

People who are looking to renovate or remodel their current residential properties and require funding for the project.

07

Homeowners who are considering a second mortgage or home equity loan to access the equity in their property.

08

Individuals who want to consolidate their debts and streamline their monthly payments through a mortgage loan.

09

People who are relocating or moving to a new area and need assistance with obtaining a mortgage for their new residence.

10

Homeowners who are facing financial difficulties and need to explore loan modification or foreclosure avoidance options.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get residential mortgage loan originator?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the residential mortgage loan originator in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I execute residential mortgage loan originator online?

Easy online residential mortgage loan originator completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

Can I sign the residential mortgage loan originator electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your residential mortgage loan originator in minutes.

What is residential mortgage loan originator?

A residential mortgage loan originator is an individual who helps borrowers obtain mortgage loans.

Who is required to file residential mortgage loan originator?

Residential mortgage loan originators are required to be licensed and registered with the Nationwide Mortgage Licensing System and Registry (NMLS).

How to fill out residential mortgage loan originator?

To fill out residential mortgage loan originator, the individual must complete a loan application and provide necessary documentation to the lender.

What is the purpose of residential mortgage loan originator?

The purpose of residential mortgage loan originator is to facilitate the process of obtaining a mortgage loan for borrowers.

What information must be reported on residential mortgage loan originator?

Information such as personal details, financial information, credit history, and property details must be reported on residential mortgage loan originator.

Fill out your residential mortgage loan originator online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Residential Mortgage Loan Originator is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.