Get the free uaa payroll - uaa alaska

Show details

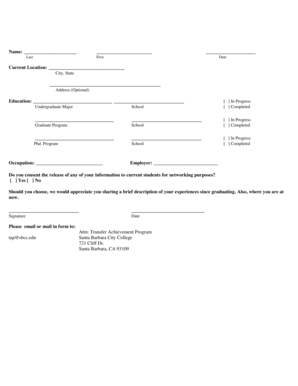

Reset Form NONEXEMPT TIME SHEET FOR BIWEEKLY PAYROLL OVERRIDE DISTRIBUTION PAY NO UNIVERSITY OF ALASKA PERIOD ENDING DATE EMPLOYEE NAME (LAST, FIRST, MID.) EMPLOYEE ID TK. LOCATION WEEK ONE ECL SEC.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign uaa payroll form

Edit your uaa payroll - uaa form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your uaa payroll - uaa form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing uaa payroll - uaa online

Follow the steps down below to use a professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit uaa payroll - uaa. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out uaa payroll - uaa

How to fill out UAA Payroll:

01

Start by gathering all the necessary information and forms. You will typically need employee details such as name, address, social security number, and tax withholding information.

02

Enter the employee's information into the payroll system or software. Make sure to input all data accurately to avoid any errors or discrepancies.

03

Determine the pay period and calculate the employee's gross wages. This can include regular hours, overtime hours, bonuses, commissions, or any other forms of compensation.

04

Deduct any applicable federal, state, or local taxes from the employee's gross wages. Follow the tax withholding guidelines provided by the relevant tax authorities to ensure compliance.

05

Deduct any other deductions or withholdings, such as retirement contributions, health insurance premiums, or employee benefits.

06

Calculate the net pay by subtracting all deductions from the gross wages.

07

Print or generate the employee's pay stub, detailing the gross pay, deductions, and net pay. Make sure to provide a clear breakdown for transparency and record-keeping purposes.

08

Submit the necessary payroll reports to the relevant tax authorities, such as quarterly or annual tax filings, ensuring compliance with payroll tax regulations.

Who needs UAA Payroll?

01

Small and medium-sized businesses: UAA Payroll is particularly useful for small and medium-sized businesses that handle payroll processing in-house. It provides a comprehensive and streamlined solution to manage employee compensation and tax obligations efficiently.

02

Human Resources departments: HR departments are responsible for various tasks related to employee management, including payroll. UAA Payroll can help HR professionals accurately calculate wages, withhold taxes, and generate reports, freeing up time to focus on other essential HR functions.

03

Employers with multiple employees: As the number of employees increases, it becomes more challenging to manually calculate payroll. UAA Payroll offers automation and customizable features to handle payroll efficiently, making it suitable for businesses with multiple employees.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send uaa payroll - uaa to be eSigned by others?

uaa payroll - uaa is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I make changes in uaa payroll - uaa?

With pdfFiller, the editing process is straightforward. Open your uaa payroll - uaa in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How can I fill out uaa payroll - uaa on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your uaa payroll - uaa, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is uaa payroll?

UAA (Unemployment Insurance Reporting) Payroll is a report filed by employers to detail their employees' wages and employment information for the purpose of calculating and paying unemployment insurance taxes.

Who is required to file uaa payroll?

All employers who have employees on their payroll are required to file UAA Payroll.

How to fill out uaa payroll?

UAA Payroll can be filled out online through the state's unemployment insurance website or through approved payroll software that can generate the necessary reports.

What is the purpose of uaa payroll?

The purpose of UAA Payroll is to track and report employees' wages for the calculation of unemployment insurance taxes and benefits.

What information must be reported on uaa payroll?

The information reported on UAA Payroll typically includes employees' names, Social Security numbers, wages earned, hours worked, and other relevant employment information.

Fill out your uaa payroll - uaa online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Uaa Payroll - Uaa is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.