Get the free ANNUAL AUDITED REPO PART lil 444 ... - SEC.gov

Show details

APPROVAL

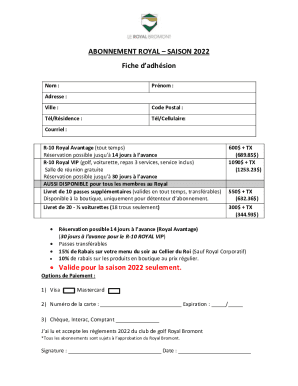

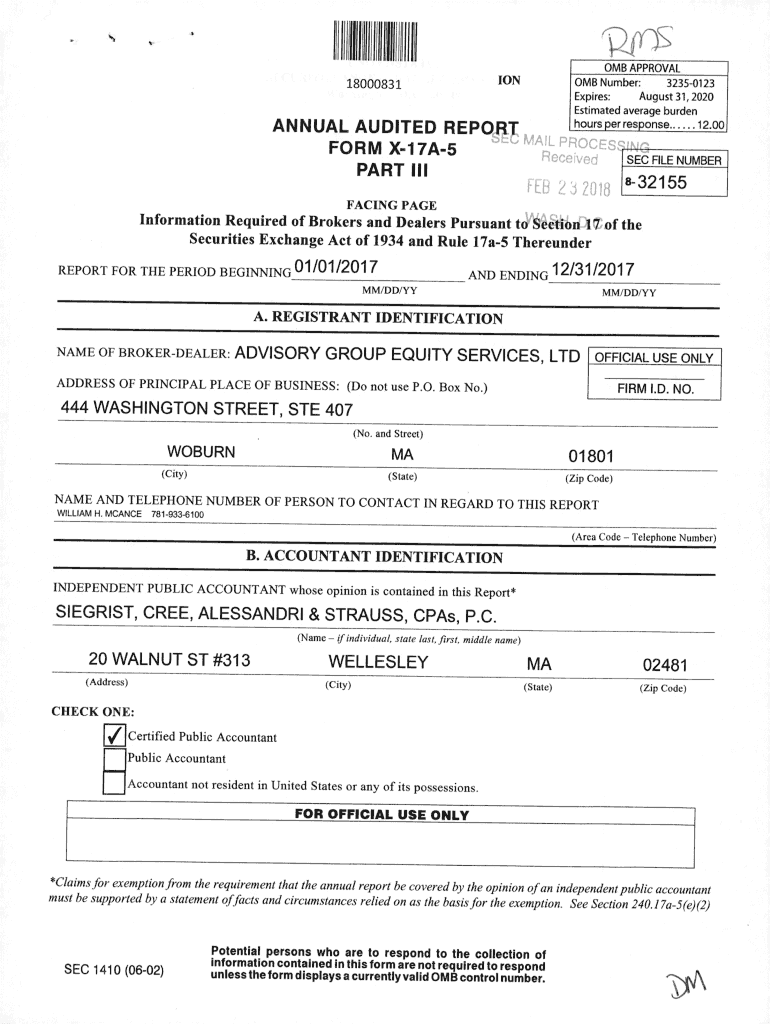

18000831IONANNUAL AUDITED REPO

FORM X17A5

PART limb Number:

32350123

Expires:

August 31, 2020,

Estimated average burdenhoursperresponse......12.00

MAIL Process

Received

SEC FILE NUMBERFEB2

We are not affiliated with any brand or entity on this form

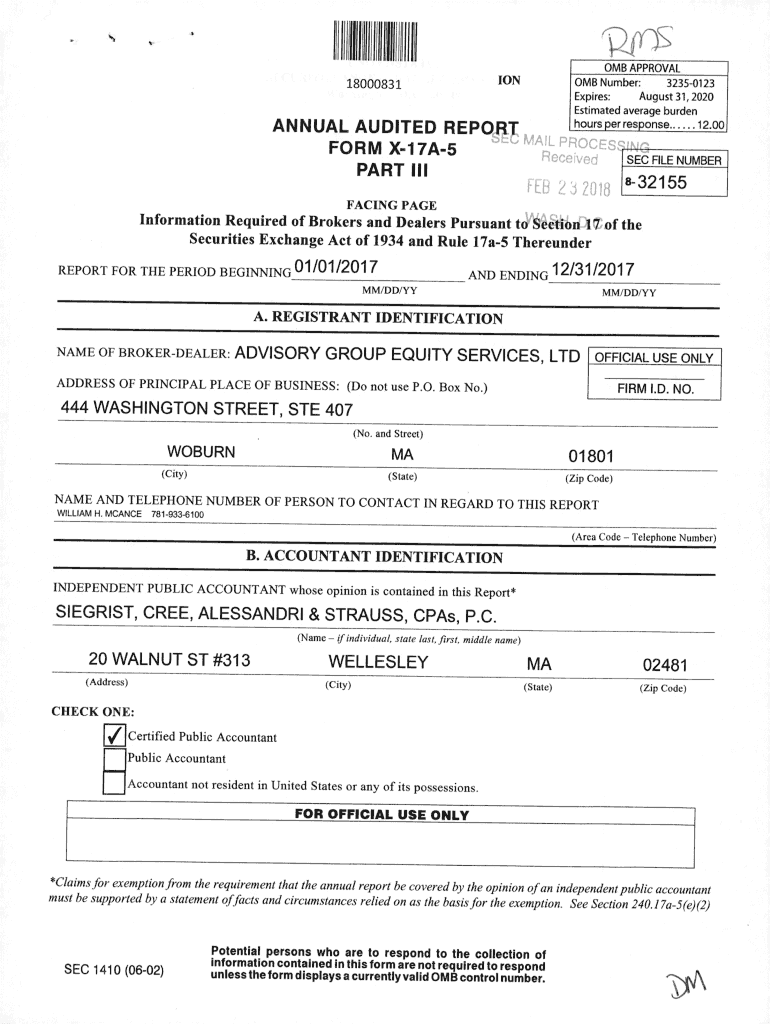

Get, Create, Make and Sign annual audited repo part

Edit your annual audited repo part form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your annual audited repo part form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing annual audited repo part online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit annual audited repo part. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out annual audited repo part

How to fill out annual audited repo part

01

To fill out the annual audited report part, follow these steps:

02

Begin by gathering all the necessary financial documents, such as income statements, balance sheets, and cash flow statements.

03

Review the reporting requirements set by the relevant regulatory body or accounting standards board.

04

Start by providing general information about the audited entity, including its name, address, and contact details.

05

Proceed to summarize the financial results for the reporting period, including revenue, expenses, and net income or loss.

06

Provide detailed explanations of any significant changes or anomalies in the financial statements, such as unusual transactions or events.

07

Include any additional disclosures required by applicable laws or regulations, such as related party transactions or contingent liabilities.

08

Make sure to properly reference all supporting documentation and include any necessary attachments, such as auditors' reports or management letters.

09

Review the completed report for accuracy and compliance with the reporting standards.

10

Submit the audited report to the appropriate regulatory body or stakeholders within the specified deadline.

11

Retain a copy of the audited report for future reference and potential audits or reviews.

Who needs annual audited repo part?

01

The annual audited report part is needed by various stakeholders, such as:

02

- Regulatory bodies: They require audited financial reports to ensure compliance with financial regulations and to assess the financial health and stability of entities under their supervision.

03

- Shareholders and Investors: They rely on audited reports to make informed investment decisions and assess the performance and profitability of companies.

04

- Creditors and Lenders: They use audited financial reports to evaluate the creditworthiness and repayment capacity of borrowers before providing loans or credit facilities.

05

- Management and Board of Directors: They require audited reports to monitor the financial performance and effectiveness of the entity's internal controls.

06

- Tax Authorities: They may request audited reports as part of tax audits or to verify the accuracy and completeness of reported financial information.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in annual audited repo part without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your annual audited repo part, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How do I edit annual audited repo part straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing annual audited repo part.

How do I edit annual audited repo part on an iOS device?

Use the pdfFiller mobile app to create, edit, and share annual audited repo part from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is annual audited repo part?

The annual audited repo part is a report that reflects the financial statements of a company that have been audited by a third-party accounting firm.

Who is required to file annual audited repo part?

Companies that are publicly traded or have a certain level of revenue are typically required to file an annual audited repo part.

How to fill out annual audited repo part?

The annual audited repo part is typically filled out by a company's finance or accounting department with the assistance of an external auditing firm.

What is the purpose of annual audited repo part?

The purpose of the annual audited repo part is to provide investors and stakeholders with a fair and accurate representation of a company's financial health and performance.

What information must be reported on annual audited repo part?

The annual audited repo part typically includes a company's balance sheet, income statement, cash flow statement, and accompanying notes.

Fill out your annual audited repo part online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Annual Audited Repo Part is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.