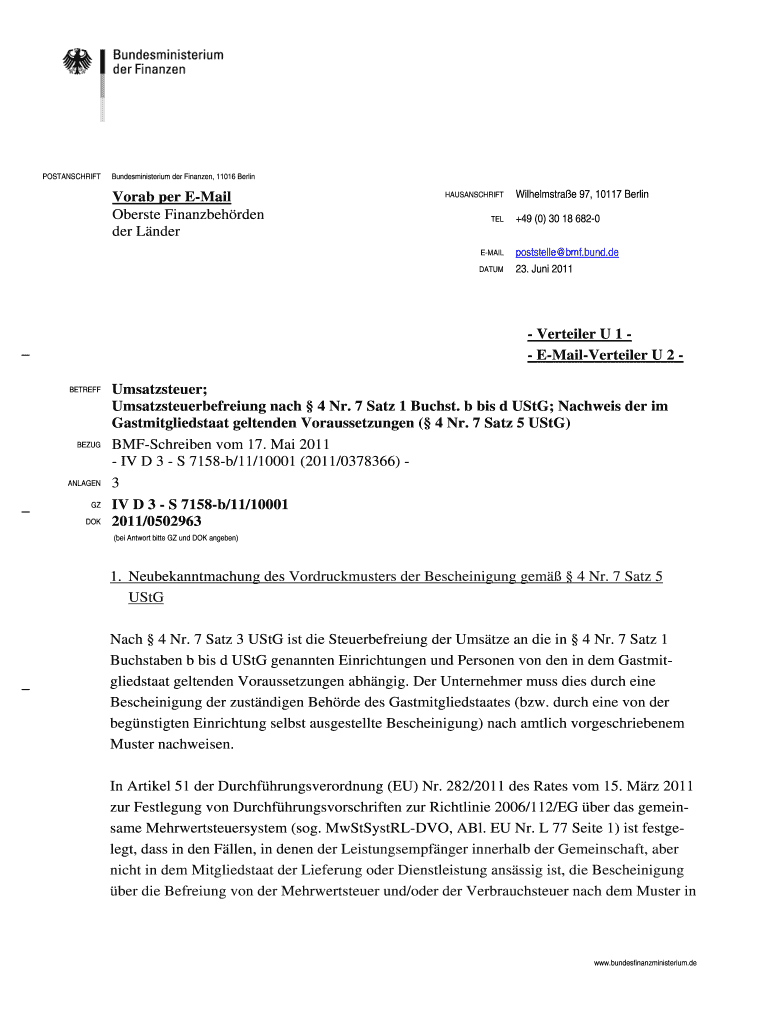

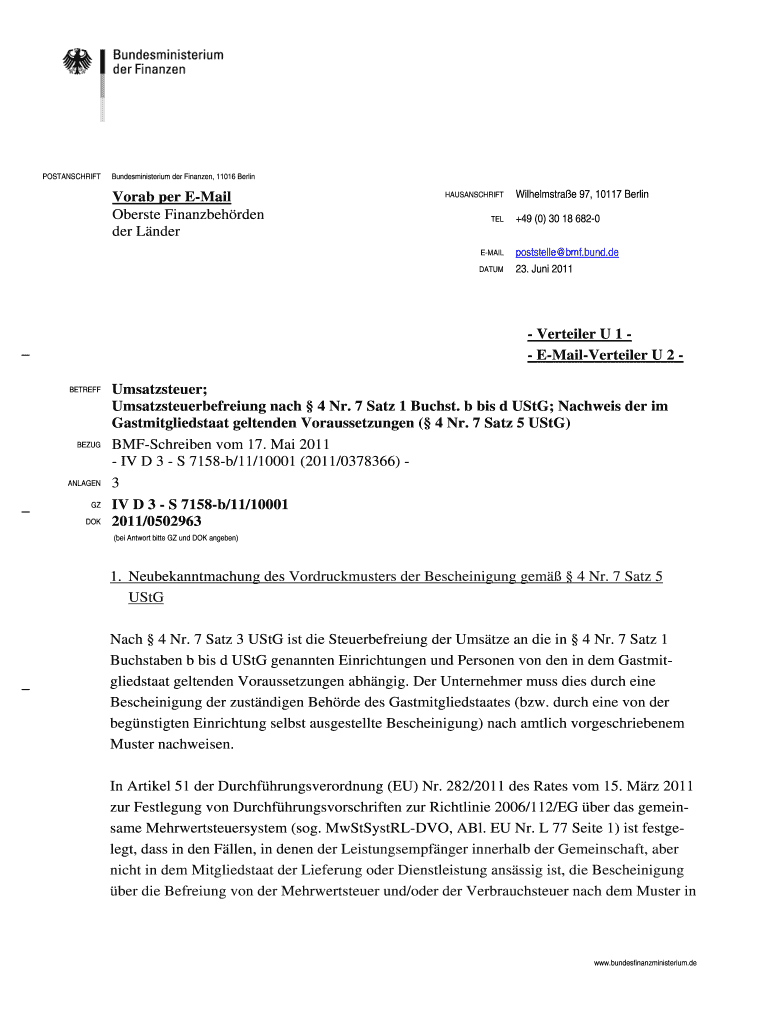

Get the free Umsatzsteuerbefreiung nach4 Nr. 7 Satz 1 Buchst. b bis d UStG; Nachweis der im Gastm...

Show details

POSTANSCHRIFTBundesministerium her Finance, 11016 BerlinVorab per EMailOberste Finanzbehrden her LnderHAUSANSCHRIFT TELWilhelmstrae 97, 10117 Berlin +49 (0) 30 18 6820EMAILpoststelle BMF.band.deDATUM23.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign umsatzsteuerbefreiung nach4 nr 7

Edit your umsatzsteuerbefreiung nach4 nr 7 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your umsatzsteuerbefreiung nach4 nr 7 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit umsatzsteuerbefreiung nach4 nr 7 online

To use the professional PDF editor, follow these steps below:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit umsatzsteuerbefreiung nach4 nr 7. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out umsatzsteuerbefreiung nach4 nr 7

How to fill out umsatzsteuerbefreiung nach4 nr 7

01

To fill out the Umsatzsteuerbefreiung nach 4 Nr. 7, follow these steps:

02

Begin by entering your personal details such as name, address, and tax number in the designated fields.

03

Specify the relevant time period for which you are claiming the exemption.

04

Provide details of your business activities and indicate that they fall within the scope of Umsatzsteuerbefreiung nach 4 Nr. 7.

05

Attach any necessary supporting documents or evidence to substantiate your claim.

06

Review the form for accuracy and completeness.

07

Sign and date the form.

08

Submit the completed form to the appropriate tax authority.

Who needs umsatzsteuerbefreiung nach4 nr 7?

01

Umsatzsteuerbefreiung nach 4 Nr. 7 is needed by individuals or businesses that engage in specific activities that are exempt from value-added tax (Umsatzsteuer) as per Section 4, Number 7 of the German VAT Act (Umsatzsteuergesetz). This includes activities such as healthcare services, educational services, cultural services, and certain social services.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit umsatzsteuerbefreiung nach4 nr 7 from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your umsatzsteuerbefreiung nach4 nr 7 into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How can I get umsatzsteuerbefreiung nach4 nr 7?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the umsatzsteuerbefreiung nach4 nr 7. Open it immediately and start altering it with sophisticated capabilities.

How do I complete umsatzsteuerbefreiung nach4 nr 7 online?

pdfFiller makes it easy to finish and sign umsatzsteuerbefreiung nach4 nr 7 online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

What is umsatzsteuerbefreiung nach4 nr 7?

Umsatzsteuerbefreiung nach § 4 Nr. 7 is a value-added tax exemption in Germany for certain goods and services.

Who is required to file umsatzsteuerbefreiung nach4 nr 7?

Businesses or individuals who meet the criteria for the exemption outlined in § 4 Nr. 7 of the German VAT law are required to file for umsatzsteuerbefreiung nach § 4 Nr. 7.

How to fill out umsatzsteuerbefreiung nach4 nr 7?

To fill out umsatzsteuerbefreiung nach § 4 Nr. 7, you need to provide the necessary information requested in the form or document specific to the exemption.

What is the purpose of umsatzsteuerbefreiung nach4 nr 7?

The purpose of umsatzsteuerbefreiung nach § 4 Nr. 7 is to exempt certain transactions from value-added tax in order to promote specific social, cultural, or economic activities.

What information must be reported on umsatzsteuerbefreiung nach4 nr 7?

The information required to be reported on umsatzsteuerbefreiung nach § 4 Nr. 7 may include details about the nature of the goods or services, the parties involved, and the reason for the exemption.

Fill out your umsatzsteuerbefreiung nach4 nr 7 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Umsatzsteuerbefreiung nach4 Nr 7 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.