Get the free Deed of Gift Fdn .doc

Show details

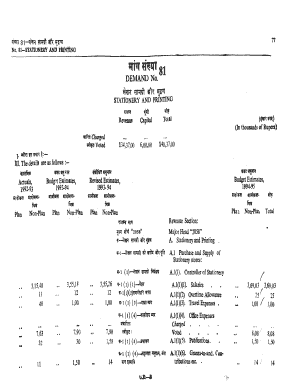

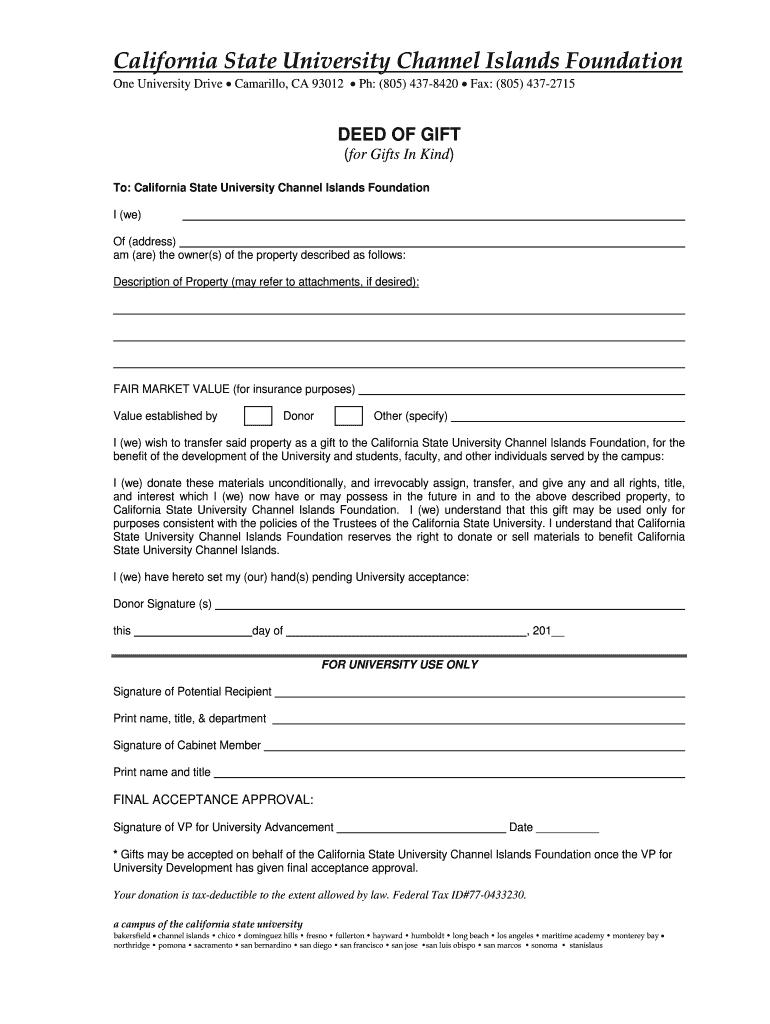

California State University Channel Islands Foundation One University Drive Camarillo, CA 93012 pH: (805) 4378420 Fax: (805) 4372715DEED OF GIFT (for Gifts In Kind) To: California State University

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign deed of gift fdn

Edit your deed of gift fdn form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your deed of gift fdn form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit deed of gift fdn online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit deed of gift fdn. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out deed of gift fdn

How to fill out deed of gift fdn

01

Here is a step-by-step guide on how to fill out a Deed of Gift for a foundation:

02

Begin by stating the names of the parties involved in the transaction - the donor and the recipient foundation.

03

Clearly describe the property or assets being donated. Include any identifying information such as serial numbers, addresses, or other relevant details.

04

Specify the purpose of the donation and any restrictions or conditions attached to it. This could include how the foundation can use the donated assets or any legal requirements for its utilization.

05

Include provisions for the transfer of ownership. This may involve signatures, notary acknowledgments, or other legal formalities.

06

Include any tax or financial implications of the gift. This can include information on potential tax deductions or requirements for reporting the donation.

07

Include an acknowledgment clause that states the donor's understanding of the consequences of the gift and their acceptance of the terms outlined in the Deed of Gift.

08

Make sure to review the completed Deed of Gift carefully for accuracy and completeness. Consider consulting with legal counsel or professionals experienced in foundation transactions to ensure all necessary elements are addressed.

09

Once you are satisfied with the content, both parties should sign and date the Deed of Gift.

10

Retain copies of the signed Deed of Gift for your records.

11

It is important to note that this is a general guide. Depending on the specific requirements of the foundation and jurisdiction, additional or specific steps may be necessary.

12

Always consult with legal professionals to ensure compliance with applicable laws and regulations.

Who needs deed of gift fdn?

01

A Deed of Gift for a foundation is typically needed by individuals or organizations who wish to make a charitable donation to a foundation.

02

This could include philanthropists, individuals looking to establish their own foundation, corporations wishing to donate assets, or anyone seeking to contribute to the mission and goals of a foundation.

03

Foundations themselves may also require a Deed of Gift for accepting donated assets and documenting the terms of the gift.

04

It is important to consult with legal professionals and the specific foundation to determine their requirements for executing a Deed of Gift.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send deed of gift fdn for eSignature?

deed of gift fdn is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How can I edit deed of gift fdn on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing deed of gift fdn.

How do I fill out deed of gift fdn on an Android device?

Use the pdfFiller app for Android to finish your deed of gift fdn. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is deed of gift fdn?

Deed of gift fdn is a legal document that transfers ownership of a gift to a foundation.

Who is required to file deed of gift fdn?

Individuals or entities transferring gifts to a foundation are required to file deed of gift fdn.

How to fill out deed of gift fdn?

Deed of gift fdn can be filled out by providing details of the gift, the donor, and the foundation in the document.

What is the purpose of deed of gift fdn?

The purpose of deed of gift fdn is to legally transfer ownership of a gift to a foundation.

What information must be reported on deed of gift fdn?

Deed of gift fdn must include details of the gift, donor, recipient foundation, and the date of transfer.

Fill out your deed of gift fdn online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Deed Of Gift Fdn is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.