Get the free Term Life - ME Andrews Portal

Show details

ASSURING LIFE INSURANCE COMPANY Toll free Number: (800) 2767619, Extension 4264 Assuring Address: http://assurelink.assurity.comUniversal Lifehack you for your interest in writing business with Assuring

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign term life - me

Edit your term life - me form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your term life - me form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing term life - me online

Follow the steps down below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit term life - me. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out term life - me

How to fill out term life - me

01

To fill out a term life insurance policy, follow these steps:

02

Determine the coverage amount you need: Calculate how much financial protection your loved ones would require if you were to pass away.

03

Choose the term length: Decide how long you want the policy to be in effect, commonly ranging from 10 to 30 years.

04

Shop around and compare quotes: Research different insurance providers and obtain quotes to find the best coverage at an affordable price.

05

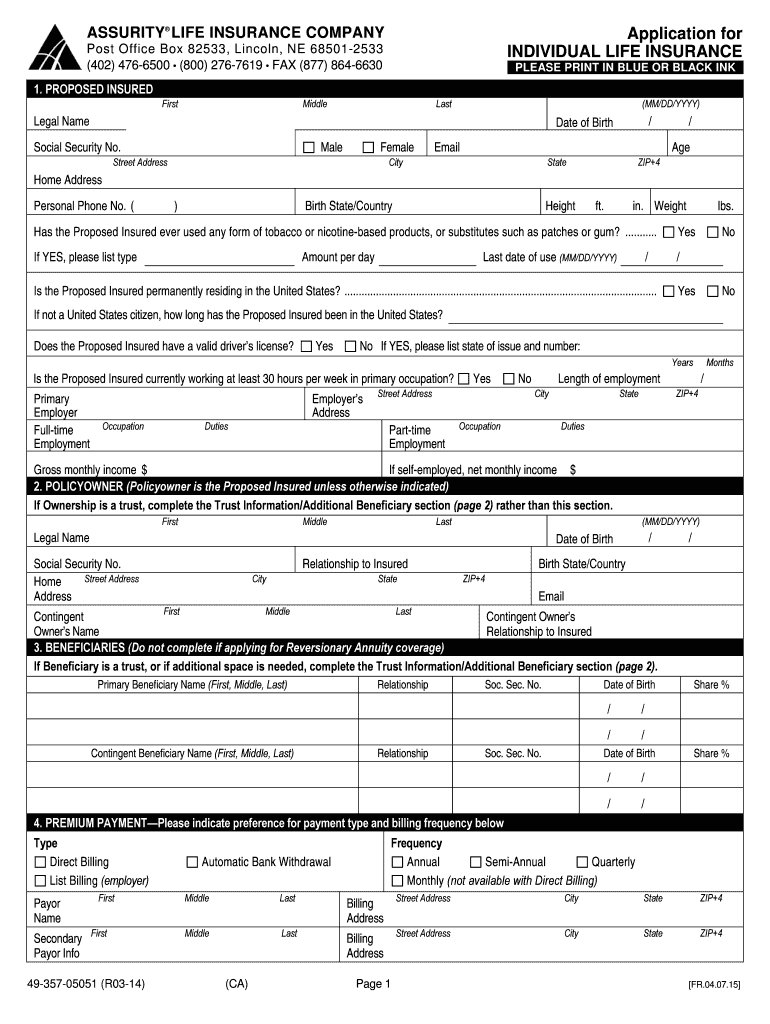

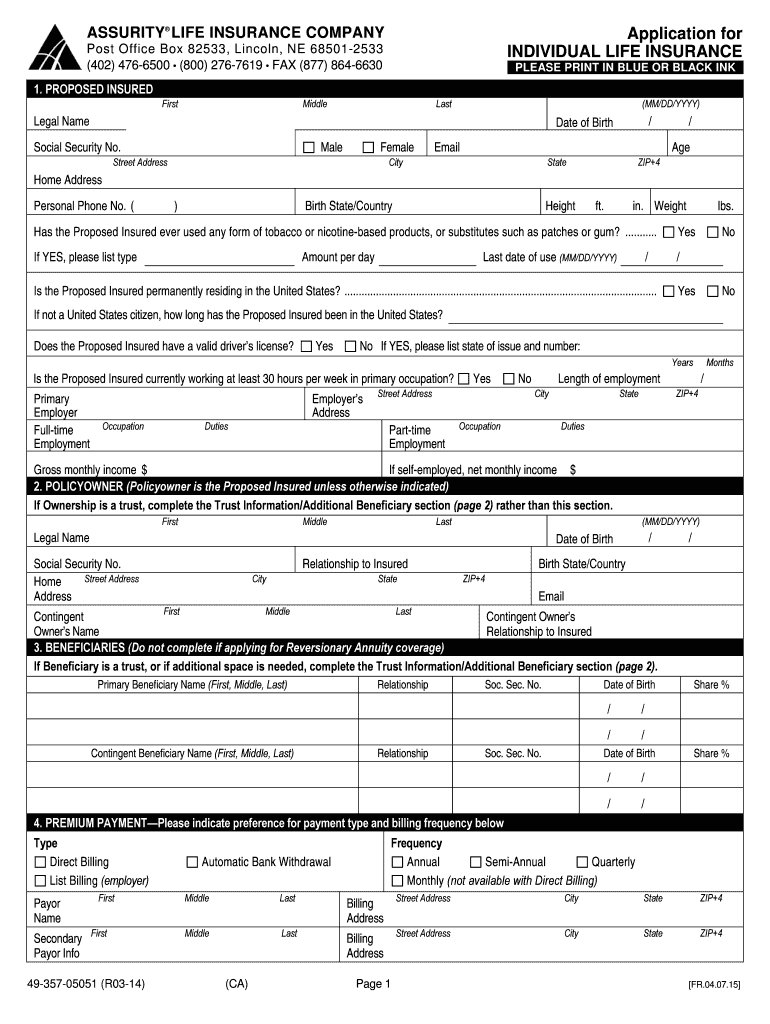

Fill out the application: Provide personal information such as your name, address, date of birth, occupation, health history, and lifestyle habits.

06

Undergo a medical exam (if required): Some insurers may require a medical examination to assess your overall health and determine the premium.

07

Review the policy details: Carefully read the terms and conditions, including coverage, exclusions, premiums, and policy riders.

08

Sign the policy documents: If you agree with the terms, sign the necessary documents to finalize the policy.

09

Make premium payments: Pay the premiums on time to keep the policy in force and ensure the coverage remains active.

10

Inform beneficiaries: Let your beneficiaries know about the policy and provide them with the necessary information to file a claim if needed.

11

Review and update the policy as needed: Periodically reassess your coverage requirements and make any necessary adjustments to your term life insurance.

Who needs term life - me?

01

Term life insurance can be beneficial for various individuals and situations, including:

02

- Breadwinners: Those who provide the primary source of income for their families can use term life insurance to replace their lost income if they were to pass away.

03

- Parents: Parents can safeguard their children's future by ensuring there is enough financial support for their education, living expenses, and other needs.

04

- Homeowners: Homeowners with mortgage or other debts can use term life insurance to cover those obligations in case of their untimely death.

05

- Business owners: Business owners can use term life insurance to protect their business by providing funds for succession planning, covering debts, or compensating partners.

06

- Individuals with dependents: Anyone with dependents, such as elderly parents or disabled siblings, can secure their financial well-being with term life insurance.

07

- Those with temporary financial responsibilities: People with temporary financial responsibilities, such as co-signed loans or short-term debts, can benefit from term life insurance.

08

However, the need for term life insurance varies for each person, and it's essential to evaluate your specific circumstances and consult with an insurance professional to determine if it's suitable for you.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my term life - me directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your term life - me and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I edit term life - me on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign term life - me. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

How do I edit term life - me on an Android device?

You can edit, sign, and distribute term life - me on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is term life - me?

Term life insurance is a type of life insurance that provides coverage for a specific period of time or term.

Who is required to file term life - me?

Individuals who wish to protect their loved ones financially in case of their death.

How to fill out term life - me?

To fill out term life insurance, you will need to provide information about yourself, beneficiaries, coverage amount, and policy term.

What is the purpose of term life - me?

The purpose of term life insurance is to provide financial protection for your loved ones in case of your death during the term of the policy.

What information must be reported on term life - me?

The information that must be reported on term life insurance includes personal details, beneficiaries, coverage amount, premiums, and policy terms.

Fill out your term life - me online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Term Life - Me is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.