Get the free Simplified issue term life insurance: Learn the basics

Show details

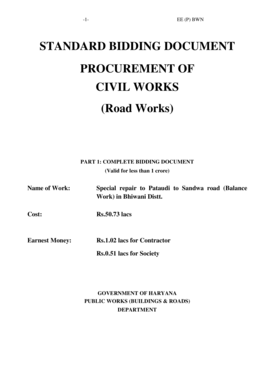

Simplified Issue Term Life Insurance Agent Guidebook No. 6147CL (Rev. 4/17)BASE PLANS Safetied Initial Term Periods Benefits15, 20, or 30 years20 or 30 Yaroslavl death benefit all reissue Ages (age

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign simplified issue term life

Edit your simplified issue term life form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your simplified issue term life form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit simplified issue term life online

Follow the steps below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit simplified issue term life. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out simplified issue term life

How to fill out simplified issue term life

01

Start by gathering all the necessary personal information such as your name, address, contact details, and social security number.

02

Determine the coverage amount you need and the length of the term life policy you want to purchase.

03

Research different insurance companies that offer simplified issue term life policies and compare their rates and benefits.

04

Once you have chosen an insurance company, contact their customer service or visit their website to start the application process.

05

Fill out the application form with accurate and complete information about your health, lifestyle habits, and any pre-existing conditions you may have.

06

Provide any required documents such as medical records or a medical exam, if necessary.

07

Review the application form and make sure all the information is correct before submitting it.

08

Pay the necessary premiums for the policy either online or through other available payment methods.

09

Wait for the insurance company to review your application and underwrite the policy.

10

Once approved, sign the policy documents and keep a copy for your records.

11

Make sure to continue paying your premiums on time to keep the policy in force.

12

In case of any changes to your personal information or if you need to make a claim, contact your insurance company's customer service.

Who needs simplified issue term life?

01

Individuals who want a simple and quick process of getting life insurance coverage without the need for a medical exam.

02

People who have a good overall health condition and do not have any major pre-existing medical conditions.

03

Those who are looking for a temporary life insurance policy to cover specific financial obligations such as mortgage payments or education expenses.

04

Individuals who want to provide financial protection for their loved ones in case of their untimely death.

05

People who prefer a hassle-free application and underwriting process compared to traditional life insurance policies.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit simplified issue term life online?

With pdfFiller, the editing process is straightforward. Open your simplified issue term life in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

Can I create an electronic signature for the simplified issue term life in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your simplified issue term life in seconds.

How do I edit simplified issue term life on an iOS device?

You certainly can. You can quickly edit, distribute, and sign simplified issue term life on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

What is simplified issue term life?

Simplified issue term life insurance is a type of life insurance policy that offers coverage without the need for a medical exam. Instead of extensive underwriting, applicants are asked a few simple health questions to determine eligibility.

Who is required to file simplified issue term life?

Individuals who are looking for a quick and easy way to secure life insurance coverage without the hassle of a medical exam may choose to file for a simplified issue term life policy.

How to fill out simplified issue term life?

To fill out a simplified issue term life insurance application, individuals typically need to answer a few health-related questions honestly and accurately. The process is designed to be quick and easy compared to traditional life insurance applications.

What is the purpose of simplified issue term life?

The purpose of simplified issue term life insurance is to provide individuals with a straightforward way to obtain life insurance coverage without the need for a medical exam or extensive underwriting. This type of policy is often chosen by those who are looking for quick and easy coverage options.

What information must be reported on simplified issue term life?

On a simplified issue term life insurance application, individuals are typically asked to provide basic personal information, details about their health history, and answer a few health-related questions. The exact information required may vary depending on the insurance company and policy.

Fill out your simplified issue term life online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Simplified Issue Term Life is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.