Get the free Simplified Critical Illness Insurance

Show details

Toll Free: 18002767619, Ext. 4264

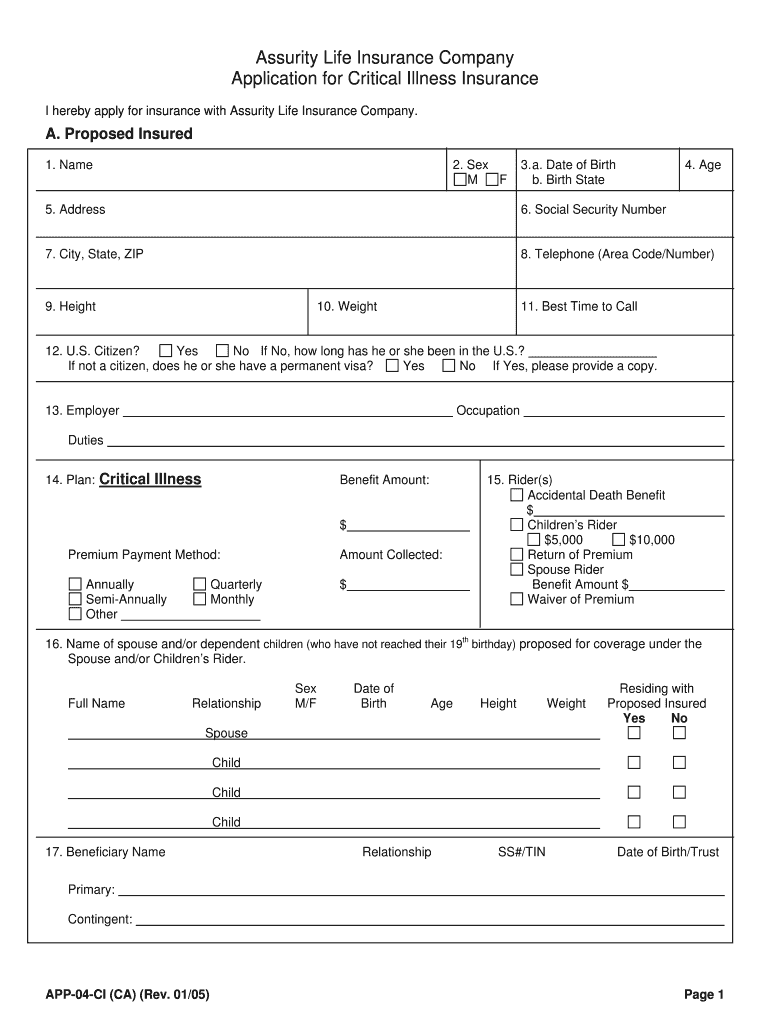

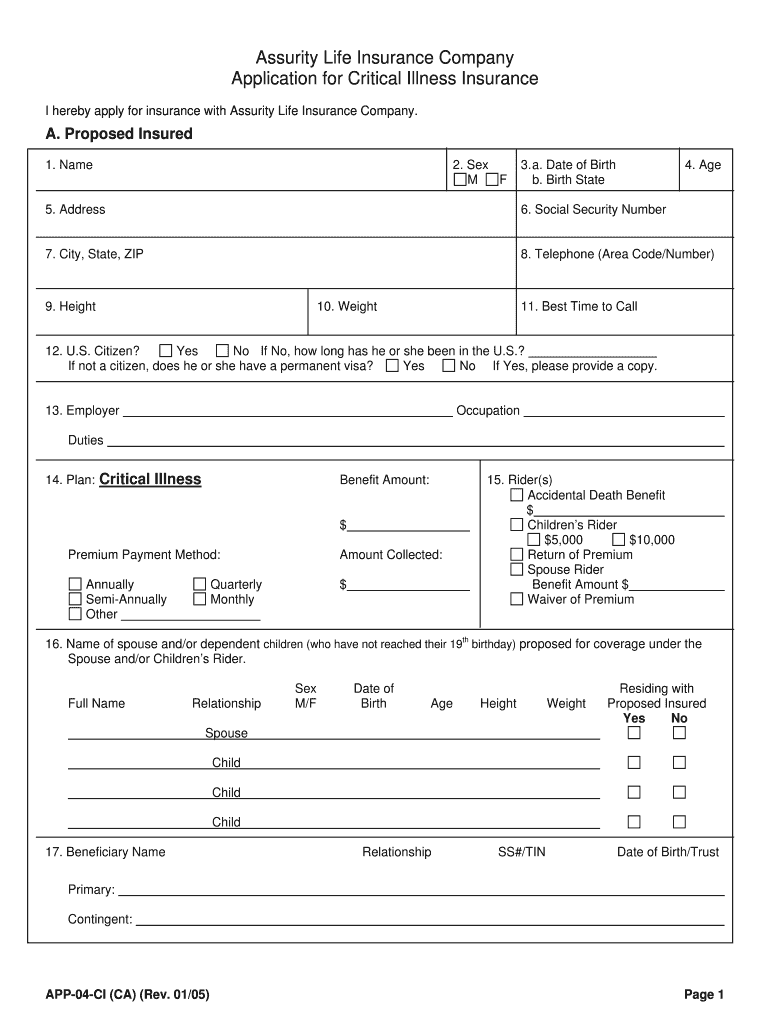

Assuring Address: http://assurelink.assurity.comCalifornia Application for

Simplified Critical Illness Insurance

This application includes all forms needed to apply

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign simplified critical illness insurance

Edit your simplified critical illness insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your simplified critical illness insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing simplified critical illness insurance online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit simplified critical illness insurance. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out simplified critical illness insurance

How to fill out simplified critical illness insurance

01

Step 1: Obtain a simplified critical illness insurance application form from a reputable insurance provider.

02

Step 2: Carefully read the application form and understand the terms and coverage offered by the insurance policy.

03

Step 3: Provide your personal information, such as name, address, contact details, and date of birth, in the designated sections of the application form.

04

Step 4: Declare any pre-existing medical conditions or previous critical illnesses that you may have had, as required by the application form.

05

Step 5: Select the coverage amount and duration that best suits your needs and affordability.

06

Step 6: Review the application form for completeness and accuracy before submitting it.

07

Step 7: Attach any required supporting documents, such as medical reports or certificates, as specified by the insurance provider.

08

Step 8: Submit the filled-out application form and supporting documents to the insurance provider through their specified channels, such as in-person submission or online submission.

09

Step 9: Await the processing and evaluation of your application by the insurance provider.

10

Step 10: Once your application is approved, carefully review the policy document and make the necessary premium payments to activate your simplified critical illness insurance coverage.

Who needs simplified critical illness insurance?

01

Anyone who wants financial protection against critical illnesses can consider simplified critical illness insurance.

02

Individuals who do not have extensive health insurance coverage or sufficient savings to cover potential medical expenses resulting from critical illnesses may benefit from this type of insurance.

03

People who have dependents or family members who rely on their income may choose to get simplified critical illness insurance to ensure financial stability in case of a critical illness diagnosis.

04

Self-employed individuals or those without employer-provided insurance may find simplified critical illness insurance valuable to cover medical expenses and maintain their income during recovery.

05

Individuals who have a higher risk of developing critical illnesses due to their medical history, family history, or occupation may also find this insurance beneficial.

06

It's essential to consult with an insurance professional or financial advisor to determine if simplified critical illness insurance is appropriate for your specific needs and circumstances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit simplified critical illness insurance from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your simplified critical illness insurance into a dynamic fillable form that you can manage and eSign from anywhere.

How can I send simplified critical illness insurance for eSignature?

When your simplified critical illness insurance is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How can I get simplified critical illness insurance?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the simplified critical illness insurance in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

What is simplified critical illness insurance?

Simplified critical illness insurance is a type of insurance policy that provides a lump sum payment if the policyholder is diagnosed with a covered critical illness.

Who is required to file simplified critical illness insurance?

Any individual who wishes to have coverage for critical illnesses and meets the eligibility requirements set by the insurance provider is required to file simplified critical illness insurance.

How to fill out simplified critical illness insurance?

To fill out simplified critical illness insurance, one must provide personal information, medical history, and select coverage options based on their needs and budget.

What is the purpose of simplified critical illness insurance?

The purpose of simplified critical illness insurance is to provide financial protection and peace of mind in the event of a critical illness diagnosis, helping cover medical expenses and loss of income.

What information must be reported on simplified critical illness insurance?

Information such as personal details, medical history, chosen coverage options, and beneficiary details must be reported on simplified critical illness insurance.

Fill out your simplified critical illness insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Simplified Critical Illness Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.