Get the free January 2016 Credit Card Statement - Mountain Sage ...

Show details

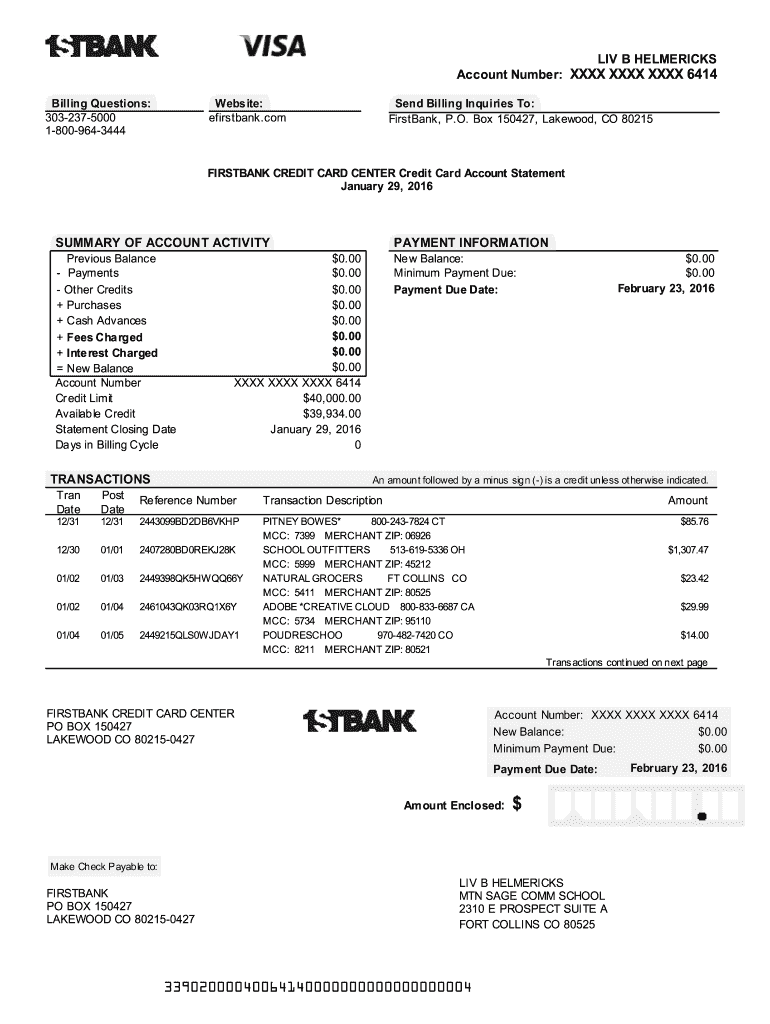

LIV B HENDRICKS Account Number: XXX XXX XXX 6414 Billing Questions: 3032375000 18009643444Webs ite: firsthand. Commend Billing Inquiries To: Firsthand, P.O. Box 150427, Lakewood, CO 80215FIRSTBANK

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign january 2016 credit card

Edit your january 2016 credit card form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your january 2016 credit card form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing january 2016 credit card online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Check your account. In case you're new, it's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit january 2016 credit card. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out january 2016 credit card

01

To fill out a January 2016 credit card, gather all the necessary documents and information such as your credit card statement, personal identification, and recent financial transactions.

02

Start by carefully reviewing the credit card statement for the month of January 2016. Check for any discrepancies or fraudulent charges.

03

Verify if all the transactions listed on the statement are accurate and if you recognize each charge. If you come across any unfamiliar transactions, contact the credit card company immediately.

04

Make sure to note the payment due date mentioned on the credit card statement. It is crucial to pay the outstanding balance on time to avoid late fees and negative impacts on your credit score.

05

Determine the minimum payment required for the January 2016 credit card bill. This information is typically provided on the statement.

06

Consider paying more than the minimum payment if your budget allows, as it helps reduce the outstanding balance and minimize interest charges.

07

If you have any inquiries or need clarification on the January 2016 credit card statement, contact the credit card company's customer service department for assistance.

08

Once you have reviewed and understood the statement, fill out the payment section of the credit card statement. Provide the necessary details such as your name, address, payment amount, and payment method.

09

Include any additional information or documentation required by the credit card company, such as a payment slip or identification number.

10

Finally, make the payment for the outstanding balance mentioned on the January 2016 credit card statement. You can choose to make the payment online, through mobile banking, or by sending a check.

Who needs a January 2016 credit card?

01

Individuals who require access to credit for personal expenses during the month of January 2016 may need a January 2016 credit card.

02

People who prefer using credit cards for convenience, security, and rewards may find a January 2016 credit card beneficial.

03

Those looking to manage their finances effectively and build a positive credit history may consider obtaining a January 2016 credit card.

04

Individuals with planned purchases or expenses in January 2016 may find it advantageous to have a credit card to spread out payments or take advantage of promotional offers.

05

Frequent travelers may prefer using a January 2016 credit card for travel-related expenses, such as booking flights, accommodations, and rental cars.

06

People who wish to track their expenses or have a record of their spending for personal budgeting purposes may find a January 2016 credit card useful.

07

Anyone who already holds a credit card and desires an additional card for backup or for specific purposes may choose to obtain a January 2016 credit card.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send january 2016 credit card for eSignature?

When you're ready to share your january 2016 credit card, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I fill out january 2016 credit card using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign january 2016 credit card and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I complete january 2016 credit card on an Android device?

Complete your january 2016 credit card and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is January credit card?

January credit card typically refers to the monthly billing cycle for credit cards where transactions made in January are summarized for billing purposes.

Who is required to file January credit card?

Individuals or businesses that use credit cards for transactions in January are typically required to file their credit card statements or reports for accurate financial record-keeping.

How to fill out January credit card?

To fill out January credit card information, you'll need to provide details such as your name, card number, transaction details for the month, and any other required personal information based on the credit card issuer's guidelines.

What is the purpose of January credit card?

The purpose of January credit card is to manage expenses incurred during the month of January, allowing cardholders to track spending and make timely payments.

What information must be reported on January credit card?

The information that must be reported includes the total expenditures for the month, payment history, outstanding balance, and any fees or interest charges applicable during January.

Fill out your january 2016 credit card online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

January 2016 Credit Card is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.