Get the free Guaranteed Lifetime Withdrawal Benefit Request to Exercise ...

Show details

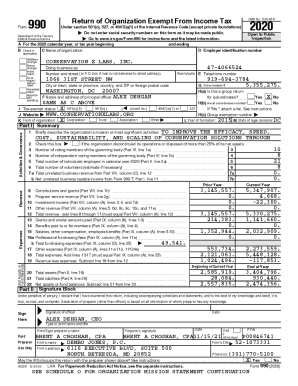

Nassau Life and Annuity Company (the Company)

Nassau Life Insurance Company (the Company)

PHL Variable Insurance Company (the Company)Request for

Maturity Date Postponement PO Box 219361, Kansas City,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign guaranteed lifetime withdrawal benefit

Edit your guaranteed lifetime withdrawal benefit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your guaranteed lifetime withdrawal benefit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit guaranteed lifetime withdrawal benefit online

To use the services of a skilled PDF editor, follow these steps:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit guaranteed lifetime withdrawal benefit. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out guaranteed lifetime withdrawal benefit

How to fill out guaranteed lifetime withdrawal benefit

01

Step 1: Gather all the required documents such as your investment portfolio, personal identification, and relevant financial information.

02

Step 2: Contact your insurance company or financial advisor to inquire about the guaranteed lifetime withdrawal benefit (GLWB) option.

03

Step 3: Discuss your financial goals and retirement plans with your advisor to determine if GLWB is suitable for you.

04

Step 4: Review the terms and conditions of the GLWB policy, including the withdrawal limits, fees, and any potential penalties.

05

Step 5: Fill out the necessary application forms provided by the insurance company or financial institution accurately and completely.

06

Step 6: Submit the filled-out application along with the required documents to the insurance company or financial institution.

07

Step 7: Wait for the approval and processing of your GLWB application.

08

Step 8: Once approved, familiarize yourself with the options and rules associated with the GLWB, such as the withdrawal frequency and amount.

09

Step 9: Monitor your investment portfolio regularly and make informed decisions on when and how much to withdraw.

10

Step 10: Consult with your financial advisor periodically to review the performance of your GLWB and make any necessary adjustments.

11

Step 11: Enjoy the benefits of guaranteed lifetime withdrawal with the reassurance of a steady income stream in retirement.

Who needs guaranteed lifetime withdrawal benefit?

01

Individuals who want a guaranteed stream of income throughout their retirement years.

02

People who are concerned about outliving their savings or facing financial risks in retirement.

03

Those who prefer a predictable and secure source of income rather than relying solely on investment returns.

04

Retirees who want flexibility in withdrawing funds while still maintaining a certain level of financial stability.

05

Individuals who value the option to continue withdrawing money from their investment portfolio even if the account balance is depleted.

06

People who want to protect their retirement assets from market fluctuations or unexpected events.

07

Those who want to leave a legacy for their beneficiaries while still having a reliable income source.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find guaranteed lifetime withdrawal benefit?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the guaranteed lifetime withdrawal benefit in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I edit guaranteed lifetime withdrawal benefit in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing guaranteed lifetime withdrawal benefit and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

Can I create an electronic signature for the guaranteed lifetime withdrawal benefit in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your guaranteed lifetime withdrawal benefit in seconds.

What is guaranteed lifetime withdrawal benefit?

Guaranteed lifetime withdrawal benefit is a feature of certain retirement investment products that guarantees a minimum level of income for the life of the annuitant.

Who is required to file guaranteed lifetime withdrawal benefit?

The annuitant or policyholder is typically required to file for the guaranteed lifetime withdrawal benefit.

How to fill out guaranteed lifetime withdrawal benefit?

The guaranteed lifetime withdrawal benefit form should be completed with accurate information regarding the annuitant's details and desired withdrawal options.

What is the purpose of guaranteed lifetime withdrawal benefit?

The purpose of guaranteed lifetime withdrawal benefit is to provide a steady stream of income during retirement, regardless of market fluctuations.

What information must be reported on guaranteed lifetime withdrawal benefit?

Information such as annuitant's name, policy number, withdrawal amount, and beneficiary details must be reported on the guaranteed lifetime withdrawal benefit form.

Fill out your guaranteed lifetime withdrawal benefit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Guaranteed Lifetime Withdrawal Benefit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.