Get the free ADDITIONAL PREMISES LIABILITY COVERAGE

Show details

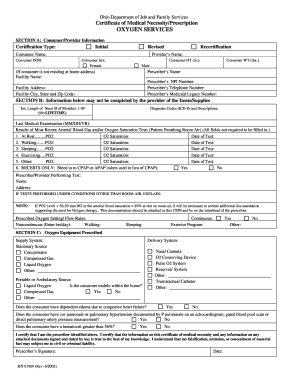

ADDITIONAL PREMISES LIABILITY COVERAGE For an included additional premium, the definition of insured location is expanded to include the premises designated below: DESIGNATION OF PREMISES: Medical

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign additional premises liability coverage

Edit your additional premises liability coverage form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your additional premises liability coverage form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing additional premises liability coverage online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit additional premises liability coverage. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out additional premises liability coverage

How to fill out additional premises liability coverage

01

To fill out additional premises liability coverage, follow these steps:

02

Review your existing liability coverage: Start by understanding your current premises liability coverage and the limits it provides.

03

Assess your risk: Evaluate the specific risks and exposures your premises face. Consider hazards like slippery floors, broken steps, inadequate lighting, and more.

04

Determine coverage needs: Based on your risk assessment, determine the additional coverage limits and types of coverage you require.

05

Consult with an insurance agent: Speak with an experienced insurance agent specializing in premises liability coverage. They can guide you through the process and help you select the most appropriate coverage options.

06

Provide necessary information: Gather and provide the necessary information requested by the insurance agent. This may include details about your premises, your business operations, prior claims history, and more.

07

Evaluate different insurance policies: Compare multiple insurance policies from different providers. Consider factors such as coverage limits, deductibles, exclusions, and pricing.

08

Select the right policy: Choose the policy that best meets your coverage needs and fits within your budget.

09

Fill out the required forms: Complete the necessary application forms provided by the insurance company. Provide accurate and detailed information to ensure proper underwriting of your premises liability coverage.

10

Review and sign the policy: Carefully review the terms and conditions of the policy before signing it. Make sure you understand the coverage, exclusions, and any endorsements or additional provisions.

11

Pay the premium: Arrange for the payment of the insurance premium as per the agreed terms.

12

Maintain proper documentation: Keep copies of your insurance policy, premium payment receipts, and any correspondence related to your premises liability coverage.

13

Periodic review: Regularly review and reassess your liability coverage to ensure it remains adequate for your changing business needs and any regulatory requirements.

14

Remember to consult with legal and risk management experts to ensure comprehensive protection for your premises.

Who needs additional premises liability coverage?

01

Anyone who owns or operates a premises where there is a potential risk of liability should consider obtaining additional premises liability coverage.

02

This includes, but is not limited to:

03

- Business owners: Whether you own a retail store, restaurant, office building, or any other type of business premises, additional premises liability coverage can help protect you from legal claims arising from accidents, injuries, or property damage that occur on your premises.

04

- Landlords: If you own rental properties, you can benefit from additional premises liability coverage to protect against claims made by tenants, visitors, or third parties who suffer injuries or property damage while on your property.

05

- Homeowners: Homeowners should also consider additional premises liability coverage in case someone is injured on their property, especially if they frequently host social gatherings or have potential hazards on their premises.

06

- Non-profit organizations: Non-profits that operate premises open to the public, such as community centers, museums, or event venues, have a higher risk of liability and can benefit from additional premises liability coverage.

07

- Contractors and construction companies: Those involved in construction, renovation, or maintenance of premises can face significant liability risks. Additional premises liability coverage can protect them from potential claims arising during their activities.

08

The specific need for additional premises liability coverage may vary depending on factors such as the nature of the premises, the type of business or activities conducted, the number of visitors or occupants, and the jurisdiction's legal requirements.

09

Consult with an insurance professional to assess your specific needs and determine the appropriate coverage for your premises.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute additional premises liability coverage online?

pdfFiller makes it easy to finish and sign additional premises liability coverage online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I edit additional premises liability coverage on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign additional premises liability coverage right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

How do I complete additional premises liability coverage on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your additional premises liability coverage by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is additional premises liability coverage?

Additional premises liability coverage provides extra protection for property owners in case someone is injured on their property.

Who is required to file additional premises liability coverage?

Property owners or business owners who want to protect themselves from liability claims related to injuries on their premises.

How to fill out additional premises liability coverage?

To fill out additional premises liability coverage, one must provide information about the property, any existing liability coverage, and any previous claims.

What is the purpose of additional premises liability coverage?

The purpose of additional premises liability coverage is to protect property owners from financial losses due to liability claims for injuries that occur on their premises.

What information must be reported on additional premises liability coverage?

Information such as the property address, coverage limits, previous claims history, and any additional insured parties must be reported on additional premises liability coverage.

Fill out your additional premises liability coverage online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Additional Premises Liability Coverage is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.