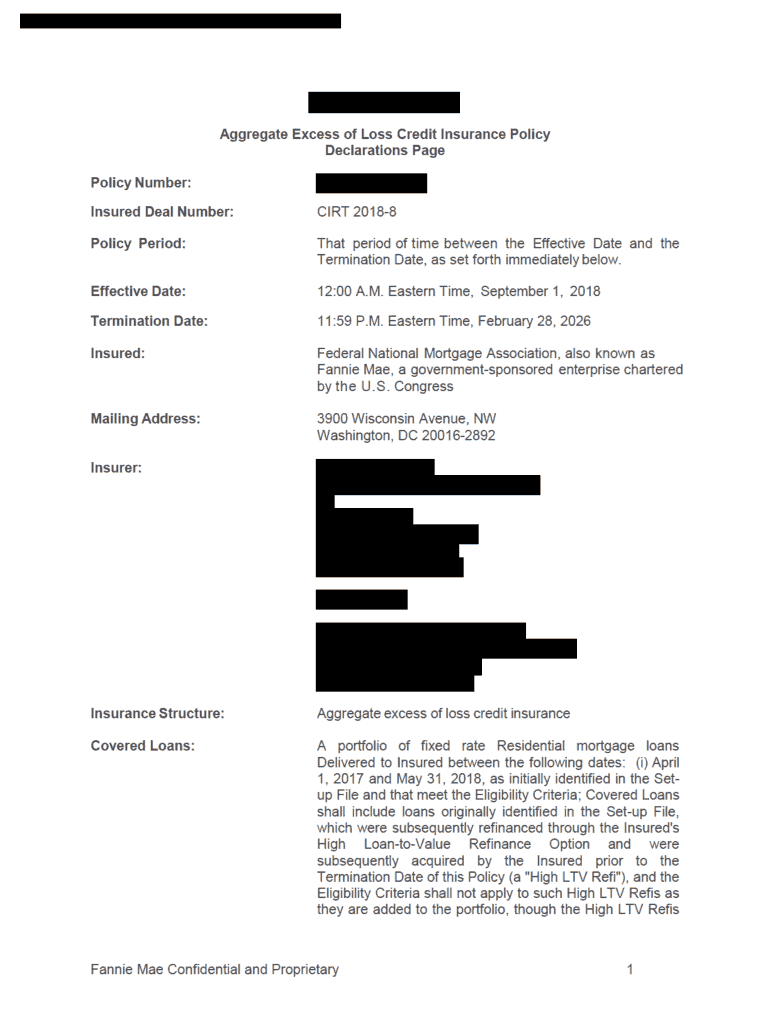

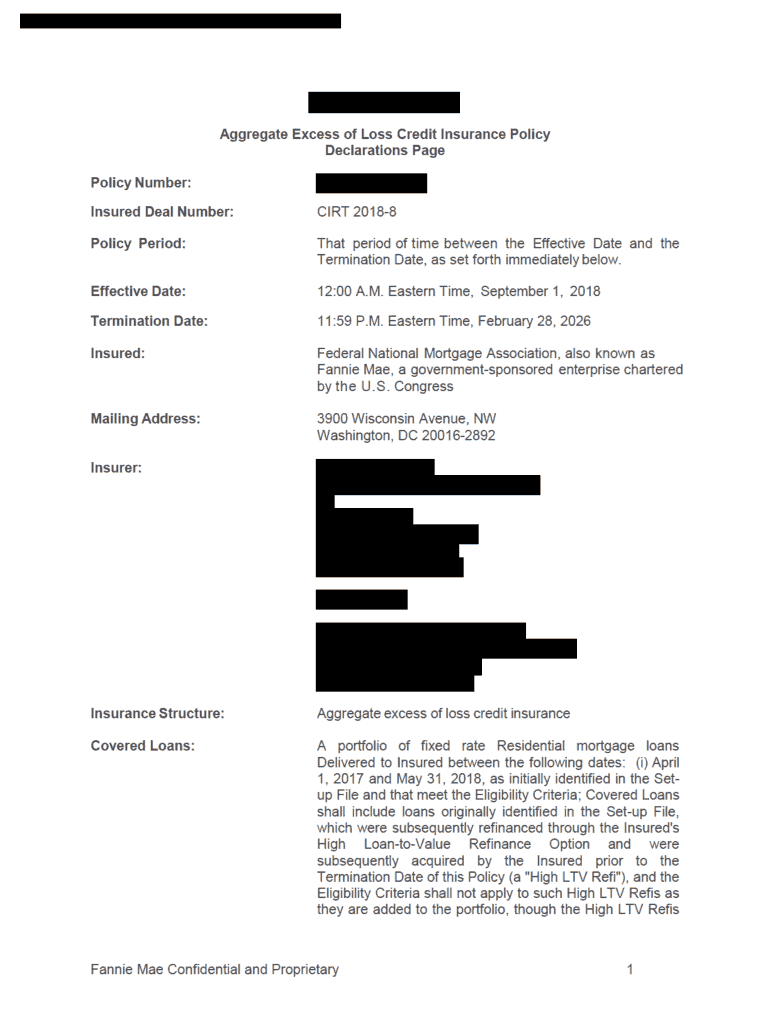

Get the free Credit Insurance Risk Transfer Insurance Policy 2018-08. Credit Insurance Risk Trans...

Show details

Will conform with any guidelines or criteria applicable to the Insureds High LoantoValue Refinance Option. Total Initial Principal Balance:$12,784,981,984.05Number of Loans:65,574Limit of Liability:$191,774,729.76Limit

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit insurance risk transfer

Edit your credit insurance risk transfer form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit insurance risk transfer form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit credit insurance risk transfer online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit credit insurance risk transfer. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit insurance risk transfer

How to fill out credit insurance risk transfer

01

To fill out a credit insurance risk transfer, follow these steps:

02

Gather all required information about the credit insurance policy, including the policy number, insurer's contact details, and coverage details.

03

Identify the specific risk you want to transfer and assess its potential impact on your business.

04

Determine the appropriate amount of risk transfer needed and calculate the associated costs.

05

Contact the insurance company or broker who is handling the credit insurance policy to initiate the risk transfer process.

06

Provide all necessary documentation and complete the required forms, which may include a risk transfer agreement.

07

Review and sign the risk transfer agreement, ensuring that all terms and conditions are understood and agreed upon.

08

Pay any applicable premiums or fees associated with the risk transfer.

09

Keep a copy of the completed risk transfer documentation for your records.

10

Monitor the effectiveness of the risk transfer and communicate with the insurance company regarding any changes or updates that may affect the coverage.

Who needs credit insurance risk transfer?

01

Credit insurance risk transfer is primarily needed by businesses that want to mitigate the financial impact of credit-related risks.

02

Specifically, it is useful for businesses that:

03

- Provide goods or services on credit and want to protect themselves against non-payment or default by their customers.

04

- Deal with high-risk industries or sectors where the chances of default are relatively higher.

05

- Have a large volume of credit transactions and need to manage their credit risk exposure effectively.

06

- Depend heavily on a few key customers or clients and want to safeguard their financial stability in case of default.

07

- Have significant outstanding debts and want to transfer the risk of potential non-payment to an insurer.

08

- Need to comply with financing agreements, investor requirements, or regulatory obligations that mandate credit insurance risk transfer.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get credit insurance risk transfer?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific credit insurance risk transfer and other forms. Find the template you want and tweak it with powerful editing tools.

How do I edit credit insurance risk transfer straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit credit insurance risk transfer.

How can I fill out credit insurance risk transfer on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your credit insurance risk transfer. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is credit insurance risk transfer?

Credit Insurance Risk Transfer is a strategy used by financial institutions to transfer the risk of credit default to a third party, typically an insurance company.

Who is required to file credit insurance risk transfer?

Financial institutions such as banks, credit unions, and other lenders are required to file credit insurance risk transfer.

How to fill out credit insurance risk transfer?

Credit insurance risk transfer can be filled out online through the designated reporting platform provided by regulatory authorities.

What is the purpose of credit insurance risk transfer?

The purpose of credit insurance risk transfer is to mitigate the financial impact of credit default on the balance sheet of financial institutions.

What information must be reported on credit insurance risk transfer?

Information such as details of the credit insurance policy, exposure amount, premium paid, and the name of the insurance company must be reported on credit insurance risk transfer.

Fill out your credit insurance risk transfer online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Insurance Risk Transfer is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.