Get the free Wrongful Death Trust to Beneficiaries Under 25 Years of Age

Show details

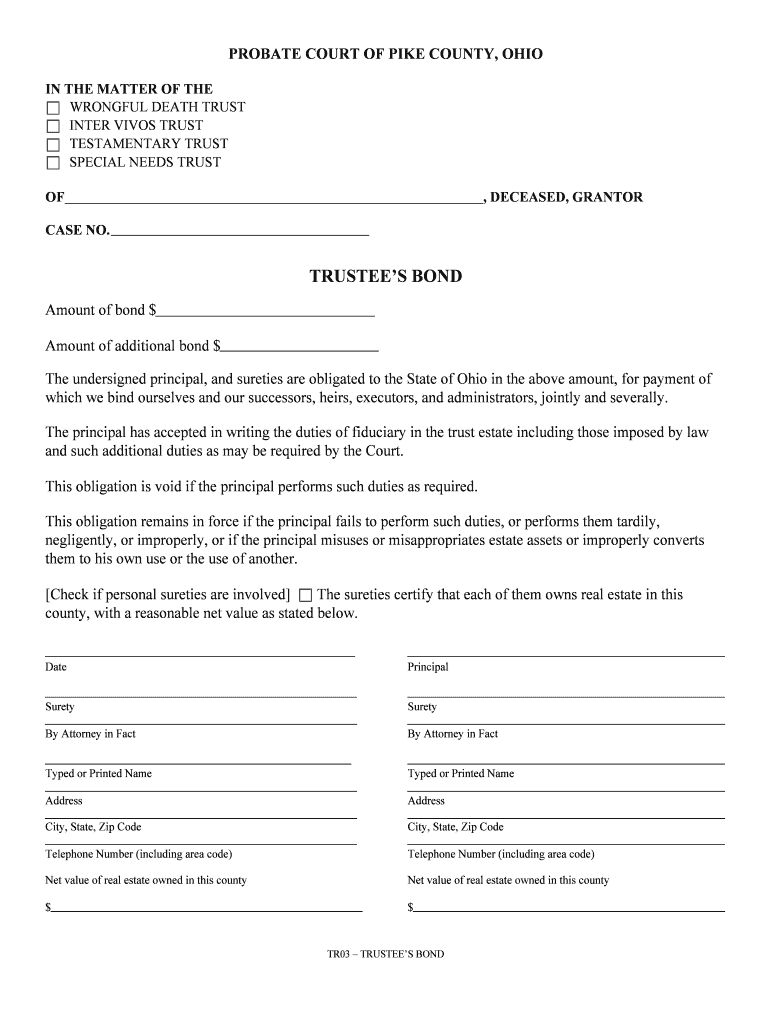

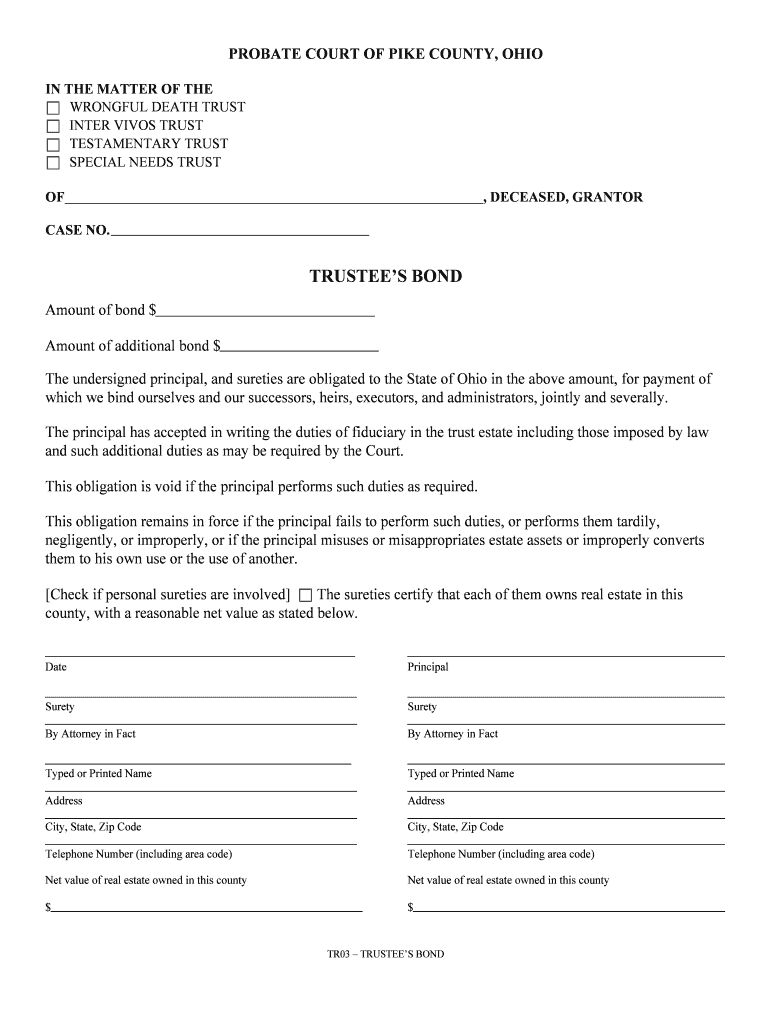

PROBATE COURT OF PIKE COUNTY, OHIO

IN THE MATTER OF THE

WRONGFUL DEATH TRUST

INTER VIVOS TRUST

TESTAMENTARY TRUST

SPECIAL NEEDS TRUST

OF, DECEASED, GRANTORCASE NO.TRUSTEES BOND

Amount of bond $

Amount

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign wrongful death trust to

Edit your wrongful death trust to form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your wrongful death trust to form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing wrongful death trust to online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

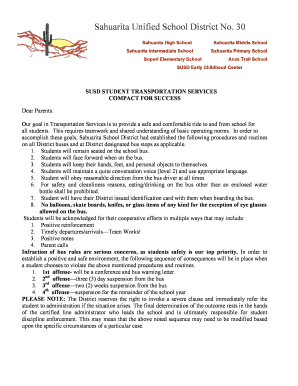

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit wrongful death trust to. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out wrongful death trust to

How to fill out wrongful death trust to

01

To fill out a wrongful death trust, follow these steps:

02

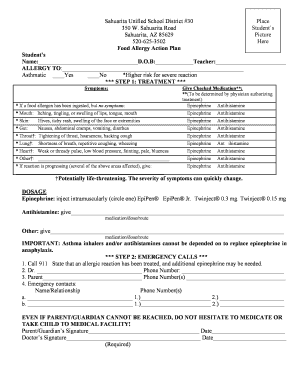

Gather the necessary documents, such as the death certificate and any legal documents related to the wrongful death claim.

03

Identify the beneficiaries of the trust, which are typically the surviving family members of the deceased.

04

Consult with an attorney specializing in trusts to ensure that you understand the legal requirements and options available to you.

05

Complete the necessary paperwork, including drafting the trust agreement and naming a trustee to oversee the trust.

06

Fund the trust by transferring assets into it, such as insurance proceeds or settlements received from the wrongful death claim.

07

Review the trust documents with all beneficiaries and obtain their consent and understanding.

08

Execute the trust agreement by signing it in the presence of witnesses, as required by law.

09

Keep a copy of the completed trust documents in a safe place, and provide copies to all beneficiaries and the designated trustee.

10

Regularly review and update the trust as needed to ensure it reflects any changes in circumstances or preferences.

11

Seek legal advice if you have any questions or concerns during the process.

Who needs wrongful death trust to?

01

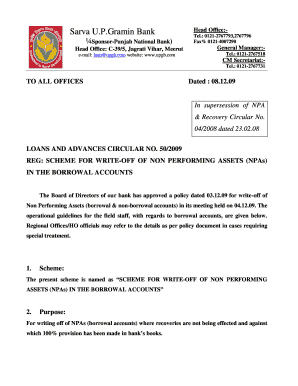

Wrongful death trust may be needed by individuals who have lost a loved one due to someone else's negligence or wrongful act.

02

The trust is designed to protect and manage the financial assets and benefits received as a result of the wrongful death claim.

03

Beneficiaries of the trust are typically the surviving family members, such as spouses, children, parents, or other dependents.

04

By creating a wrongful death trust, these individuals can ensure that the received compensation is properly managed, distributed, and used for the benefit of the beneficiaries.

05

Having a trust in place can provide financial security and peace of mind, especially when dealing with the aftermath of a wrongful death.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get wrongful death trust to?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the wrongful death trust to. Open it immediately and start altering it with sophisticated capabilities.

How do I execute wrongful death trust to online?

Completing and signing wrongful death trust to online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I make edits in wrongful death trust to without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your wrongful death trust to, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

What is wrongful death trust to?

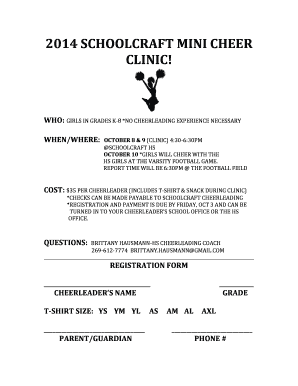

Wrongful death trust is a legal arrangement that holds assets on behalf of beneficiaries who are entitled to damages resulting from a wrongful death lawsuit.

Who is required to file wrongful death trust to?

The personal representative or executor of the deceased's estate is typically required to file the wrongful death trust.

How to fill out wrongful death trust to?

To fill out a wrongful death trust, the personal representative must gather information about the deceased, the beneficiaries, and the assets being held in the trust.

What is the purpose of wrongful death trust to?

The purpose of a wrongful death trust is to ensure that the damages awarded in a wrongful death lawsuit are properly managed and distributed to the designated beneficiaries.

What information must be reported on wrongful death trust to?

Information that must be reported on a wrongful death trust typically includes details about the deceased, the beneficiaries, the assets held in the trust, and any distributions made to the beneficiaries.

Fill out your wrongful death trust to online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Wrongful Death Trust To is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.