Get the free Financial Statement - Auditor's Report Form 4 - City of Hamilton

Show details

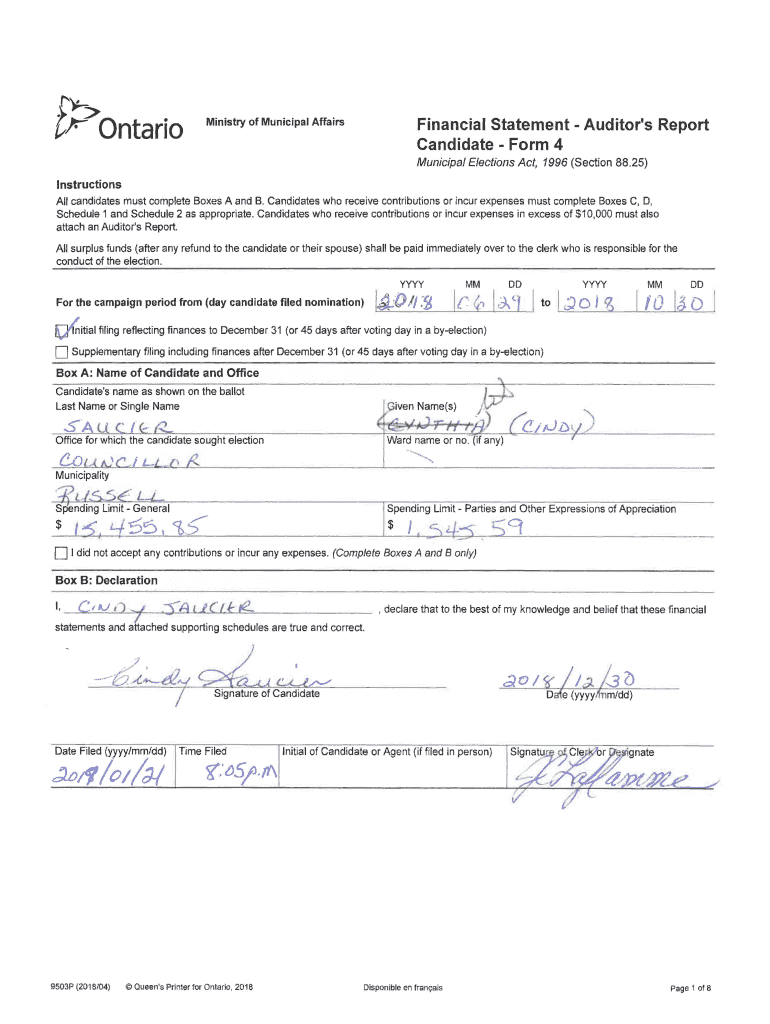

R ')ht?ontarioMinistry of Municipal AffairsFinancial Statement Auditor's Report Candidate Form 4 Municipal Elections Act, 1996 (Section 88.25)Instructions All candidates must complete Boxes A and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign financial statement - auditors

Edit your financial statement - auditors form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your financial statement - auditors form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit financial statement - auditors online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit financial statement - auditors. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out financial statement - auditors

How to fill out financial statement - auditors

01

Begin by gathering all relevant financial documents and records, such as balance sheets, income statements, and cash flow statements.

02

Review the financial statements and ensure they adhere to generally accepted accounting principles (GAAP) and any applicable auditing standards.

03

Analyze the financial data and identify any inconsistencies or abnormalities that may require further investigation.

04

Validate the accuracy of the financial statements by cross-checking the data with supporting documentation and conducting necessary tests and calculations.

05

Prepare detailed notes and schedules to provide additional explanations and disclosure for specific line items in the financial statements.

06

Obtain necessary supporting evidence and documentation to validate the statements, such as invoices, bank statements, and contracts.

07

Draft a comprehensive report summarizing the findings, observations, and recommendations based on the audit of the financial statements.

08

Review the completed financial statement and report with the client, addressing any questions or concerns they may have.

09

Obtain necessary approvals and signatures from relevant parties involved in the audit process.

10

Provide a final copy of the audited financial statement to the client and ensure proper filing and retention for future reference and compliance purposes.

Who needs financial statement - auditors?

01

Auditors typically require financial statements to perform various audit and assurance services for their clients.

02

These clients may include businesses, organizations, government agencies, non-profit entities, and other entities that require independent verification of their financial performance and position.

03

Financial statements are necessary to assess the accuracy and completeness of an entity's financial records and disclosures, determine compliance with accounting standards and regulatory requirements, and provide stakeholders with reliable and transparent financial information.

04

Additionally, auditors may also use financial statements to evaluate an entity's internal controls, identify potential fraud or irregularities, and provide recommendations for improvement in financial management and reporting processes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send financial statement - auditors for eSignature?

When your financial statement - auditors is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I make changes in financial statement - auditors?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your financial statement - auditors to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I edit financial statement - auditors in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing financial statement - auditors and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

What is financial statement - auditors?

Financial statements audited by auditors are documents that show the financial position of a company at a specific point in time and are issued along with an audit report.

Who is required to file financial statement - auditors?

Auditors are required to file financial statements for the companies they audit.

How to fill out financial statement - auditors?

Auditors must fill out financial statements by examining the company's financial records and ensuring compliance with accounting standards and regulations.

What is the purpose of financial statement - auditors?

The purpose of financial statements audited by auditors is to provide a true and fair view of a company's financial position and performance to stakeholders, such as investors, creditors, and regulators.

What information must be reported on financial statement - auditors?

Financial statements audited by auditors must include balance sheet, income statement, cash flow statement, and notes to the financial statements.

Fill out your financial statement - auditors online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Financial Statement - Auditors is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.