Get the free ITI Long Term equITy Fund - ITI Mutual Fund

Show details

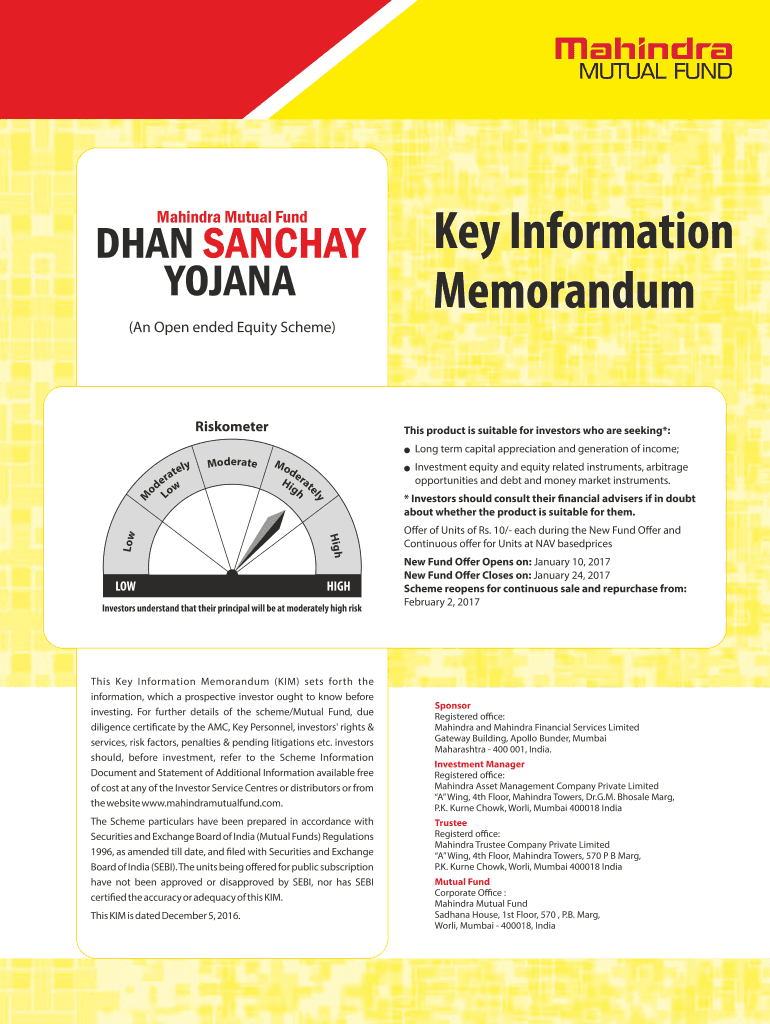

Key Information Memorandum(An Open ended Equity Scheme)RiskometerThis product is suitable for investors who are seeking*:Commode Hi rat ghlHIGHInvestors understand that their principal will be at

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign iti long term equity

Edit your iti long term equity form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your iti long term equity form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing iti long term equity online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit iti long term equity. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out iti long term equity

How to fill out iti long term equity

01

To fill out ITI Long Term Equity, follow these steps:

02

Open the application form for ITI Long Term Equity.

03

Fill in your personal details such as name, address, and contact information.

04

Provide your PAN (Permanent Account Number) and KYC (Know Your Customer) details.

05

Choose the investment amount and mode (lump sum or SIP) as per your preference.

06

Read and understand the terms and conditions of the scheme.

07

Sign the form and submit it along with the necessary supporting documents.

08

Ensure all the information provided is accurate and up-to-date.

09

Keep a copy of the filled form and acknowledgement for future reference.

Who needs iti long term equity?

01

ITI Long Term Equity is suitable for individuals who:

02

- Are looking for long-term investment opportunities

03

- Wish to invest in equity-oriented schemes

04

- Have a higher risk appetite

05

- Want to save taxes with the benefit of ELSS (Equity Linked Saving Scheme)

06

- Believe in the potential of the Indian equity market

07

- Are willing to stay invested for a considerable period of time

08

- Want to build wealth and achieve financial goals

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit iti long term equity from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your iti long term equity into a dynamic fillable form that you can manage and eSign from any internet-connected device.

Can I create an electronic signature for the iti long term equity in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your iti long term equity in seconds.

Can I edit iti long term equity on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign iti long term equity. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is iti long term equity?

iti long term equity refers to a type of investment strategy that involves holding onto investments for an extended period of time, usually more than one year.

Who is required to file iti long term equity?

Individuals or entities who hold long term equity investments are required to file iti long term equity.

How to fill out iti long term equity?

iti long term equity can be filled out by providing detailed information about the long term equity investments held, including the purchase date, purchase price, current value, and any dividends received.

What is the purpose of iti long term equity?

The purpose of iti long term equity is to provide transparency and accountability in reporting long term equity investments to regulatory authorities.

What information must be reported on iti long term equity?

Information such as the name of the investment, the quantity held, the date of purchase, the purchase price, the current value, and any dividends received must be reported on iti long term equity.

Fill out your iti long term equity online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Iti Long Term Equity is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.