Get the free net 30 terms credit account application - Shamrock Steel ...

Show details

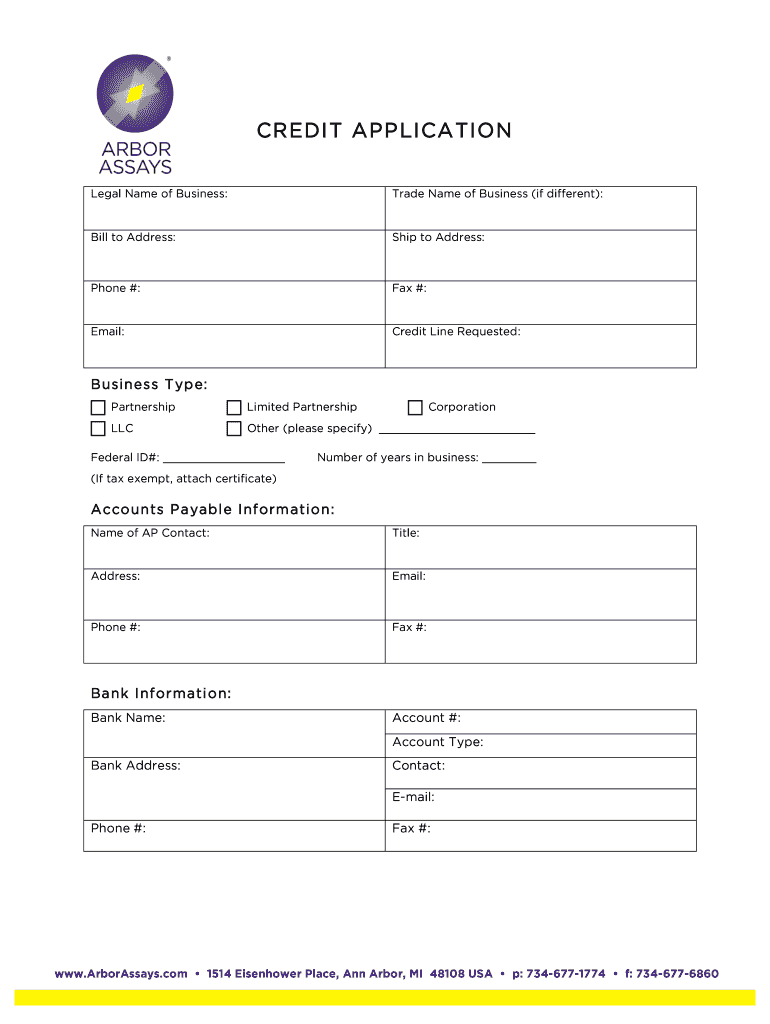

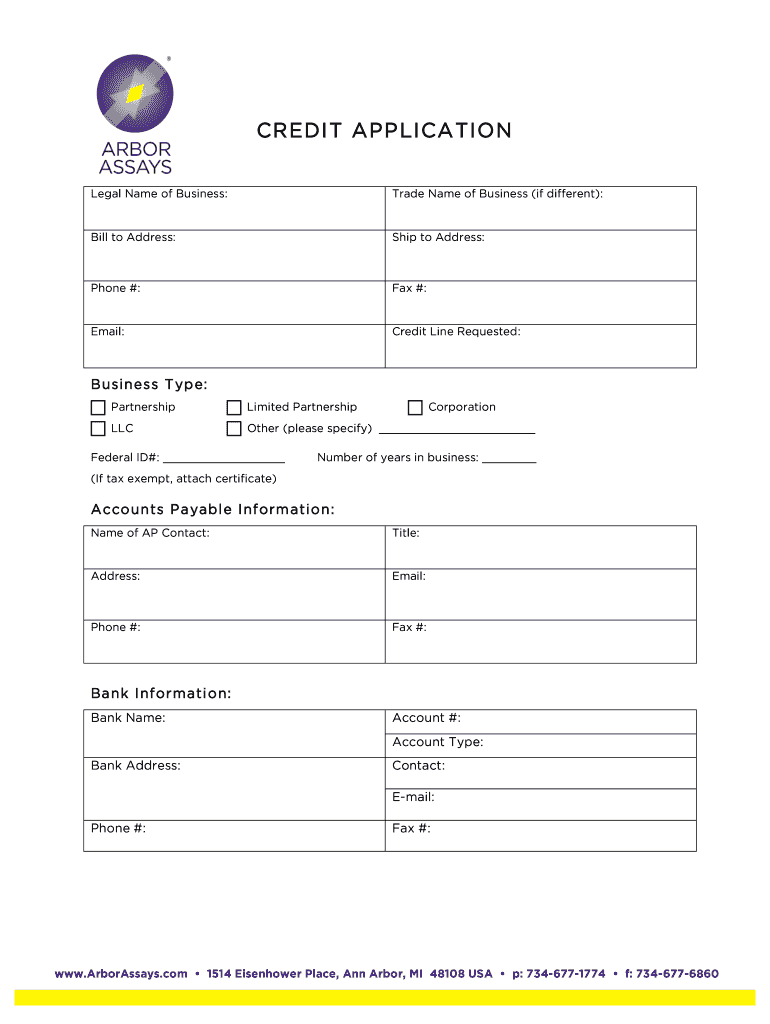

CREDIT T APP LISA TON Legal Name of Business:Trade Name of Business (if different):Bill to Address:Ship to Address:Phone #:Fax #:Email:Credit Line Requested:By sines s T YP e: Partnership Limited

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign net 30 terms credit

Edit your net 30 terms credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your net 30 terms credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit net 30 terms credit online

Follow the steps below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit net 30 terms credit. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out net 30 terms credit

How to fill out net 30 terms credit

01

Step 1: Obtain the net 30 terms credit application form from the creditor.

02

Step 2: Fill in your business information, including your legal business name, address, and contact details.

03

Step 3: Provide your business tax identification number or employer identification number (EIN).

04

Step 4: Include relevant financial information about your business, such as your annual revenue and number of employees.

05

Step 5: Specify the requested credit limit for your net 30 terms credit account.

06

Step 6: Attach any required supporting documents, such as financial statements or business licenses.

07

Step 7: Review the completed application form for accuracy and completeness before submission.

08

Step 8: Submit the filled-out application form to the creditor via mail, email, or online submission portal.

09

Step 9: Wait for the creditor's review and approval process. This may take several days to weeks.

10

Step 10: Once approved, you will receive your net 30 terms credit account information and can start using it for eligible purchases.

Who needs net 30 terms credit?

01

Small businesses that may not have immediate cash flow to pay for goods or services upfront.

02

Businesses looking to establish or build credit history for future financing opportunities.

03

Entrepreneurs or startups seeking to establish business relationships with suppliers or vendors.

04

Companies that desire a more sustainable cash flow management system by allowing payment within 30 days.

05

Organizations looking to streamline their accounts payable processes and consolidate vendor payments.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute net 30 terms credit online?

Easy online net 30 terms credit completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I make changes in net 30 terms credit?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your net 30 terms credit to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

Can I create an eSignature for the net 30 terms credit in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your net 30 terms credit and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

What is net 30 terms credit?

Net 30 terms credit refers to payment terms where the buyer is required to pay the invoice in full within 30 days of the invoice date.

Who is required to file net 30 terms credit?

Businesses and individuals who extend credit to their customers and clients are required to offer net 30 terms credit.

How to fill out net 30 terms credit?

To fill out net 30 terms credit, you need to include the payment terms on the invoice or contract, specifying that the payment is due within 30 days.

What is the purpose of net 30 terms credit?

The purpose of net 30 terms credit is to provide a set timeline for payment that allows businesses to manage cash flow and ensure timely payment from customers.

What information must be reported on net 30 terms credit?

The information that must be reported on net 30 terms credit includes the invoice amount, due date, payment terms, and any penalties for late payment.

Fill out your net 30 terms credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Net 30 Terms Credit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.