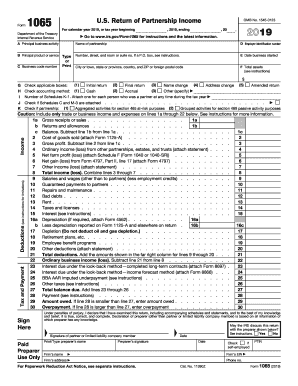

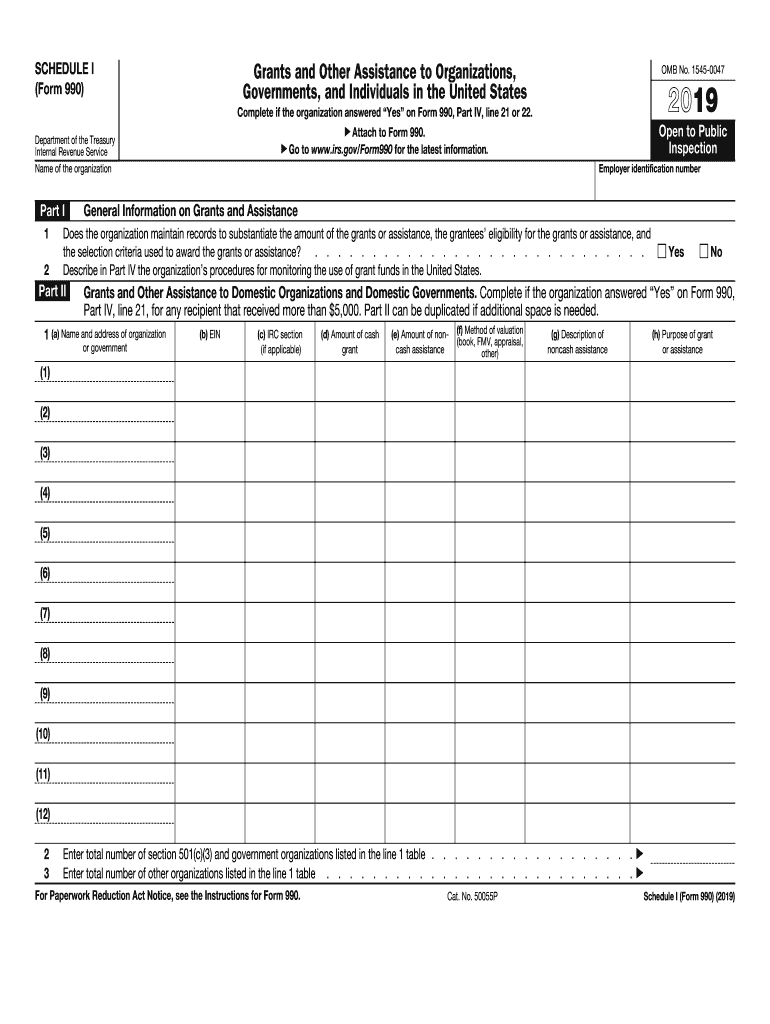

IRS 990 - Schedule I 2019 free printable template

Instructions and Help about IRS 990 - Schedule I

How to edit IRS 990 - Schedule I

How to fill out IRS 990 - Schedule I

About IRS 990 - Schedule I 2019 previous version

What is IRS 990 - Schedule I?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 990 - Schedule I

What should I do if I need to correct a mistake on my IRS 990 - Schedule I?

If you realize there are errors on your submitted IRS 990 - Schedule I, you should file an amended return using the same form. Ensure that you check the box indicating that it's an amended return and provide the corrected information. Double-check all entries to avoid repeated mistakes in future submissions.

How can I verify the status of my IRS 990 - Schedule I submission?

You can verify the receipt and processing status of your IRS 990 - Schedule I submission through the IRS online portal. Keep an eye out for common e-file rejection codes, and address them promptly to ensure your filing is accepted without delay.

What should I know about e-signatures for the IRS 990 - Schedule I?

E-signatures are acceptable for the IRS 990 - Schedule I, but ensure that your electronic signature complies with IRS guidelines. Retain a printed copy of the signed document for your records, as it is important for your filing history and documentation.

What fees should I anticipate when e-filing my IRS 990 - Schedule I?

When e-filing your IRS 990 - Schedule I, be aware that service fees may apply, depending on the platform you choose for submission. Additionally, if your submission is rejected, inquire if a refund or credit for fees incurred can be obtained.

What documentation should I prepare if I receive an IRS notice after filing my Schedule I?

In case you receive an IRS notice regarding your IRS 990 - Schedule I, gather all relevant documentation, including your filed form and correspondence. Review the notice carefully, and prepare a response addressing the concerns raised to ensure you fulfill any required actions promptly.