IRS 990 or 990-EZ - Schedule L 2019 free printable template

Show details

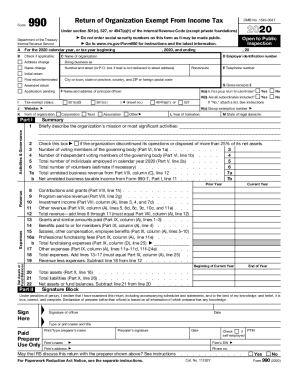

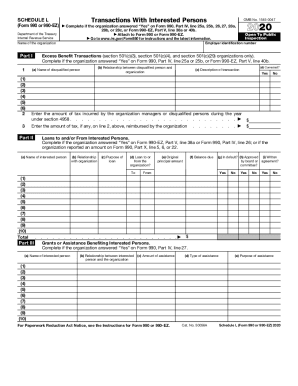

SCHEDULE L

(Form 990 or 990EZ) CompleteDepartment of the Treasury

Internal Revenue ServiceTransactions With Interested Persons13Open To Public

InspectionEmployer identification numberless Benefit

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 990 or 990-EZ - Schedule

How to edit IRS 990 or 990-EZ - Schedule

How to fill out IRS 990 or 990-EZ - Schedule

Instructions and Help about IRS 990 or 990-EZ - Schedule

How to edit IRS 990 or 990-EZ - Schedule

To edit the IRS 990 or 990-EZ - Schedule, you need to access a digital version of the form. You can use tools such as pdfFiller, which allows for easy editing, signing, and storage of your tax documents. Start by uploading the form to the platform, where you can fill in or modify existing entries as necessary. Make sure to save your changes regularly to avoid data loss.

How to fill out IRS 990 or 990-EZ - Schedule

Filling out the IRS 990 or 990-EZ - Schedule requires accurate information regarding your organization's finances. Begin by entering your organization’s name and Employer Identification Number (EIN) at the top of the form. Subsequently, complete each section diligently, providing details on revenue, expenses, and assets. Be sure to consult the form instructions to avoid common errors and ensure each line is accurately filled out.

About IRS 990 or 990-EZ - Schedule 2019 previous version

What is IRS 990 or 990-EZ - Schedule?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 990 or 990-EZ - Schedule 2019 previous version

What is IRS 990 or 990-EZ - Schedule?

IRS 990 or 990-EZ - Schedule is a tax form used by tax-exempt organizations to report financial information. It provides the IRS with a comprehensive overview of the organization’s activities, including income, expenditures, and program services. Understanding and accurately completing this form is essential for compliance with federal tax laws.

What is the purpose of this form?

The purpose of the IRS 990 or 990-EZ - Schedule is to maintain transparency among tax-exempt organizations by requiring them to disclose financial and operational information. This accountability is vital for public trust and ensures that organizations are adhering to tax-exempt regulations. The data reported can also help inform donors and stakeholders about the organization’s financial health.

Who needs the form?

Organizations that are exempt from federal income tax, such as charities and non-profits, need to file an IRS 990 or 990-EZ - Schedule as part of their annual reporting requirements. This form is necessary for organizations with gross receipts above a certain threshold, which was typically $200,000 for 2019, ensuring adequate disclosure of financial activities.

When am I exempt from filling out this form?

Certain organizations may be exempt from filing the IRS 990 or 990-EZ - Schedule if their gross receipts are below a specified limit, or if they fall into specific categories such as churches or certain governmental units. Additionally, organizations classified as private foundations generally have different reporting requirements and might not need to file this form.

Components of the form

The IRS 990 or 990-EZ - Schedule comprises several sections to capture detailed information about the organization's financial status. Key components include income statements, balance sheets, and governance information. Each section must be completed with accuracy, following IRS guidelines to ensure proper reporting.

What are the penalties for not issuing the form?

Failure to file the IRS 990 or 990-EZ - Schedule can result in significant penalties for organizations. The IRS imposes fines for late submissions, and repeated failures to file can lead to automatic revocation of tax-exempt status. It is critical for organizations to adhere to filing deadlines to avoid these repercussions.

What information do you need when you file the form?

When filing the IRS 990 or 990-EZ - Schedule, you will need comprehensive financial data, including income sources, expense reports, and asset details. Additionally, the organization’s legal name, address, and Employer Identification Number (EIN) are required for proper identification and processing of the form. Accurate records of the board of directors and key personnel may also be necessary.

Is the form accompanied by other forms?

The IRS 990 or 990-EZ - Schedule may be accompanied by additional forms, depending on the organization’s activities. For instance, organizations may need to submit Form 990-T if unrelated business income is present. It's essential to review IRS guidelines to determine any supplementary forms required for comprehensive reporting.

Where do I send the form?

The completed IRS 990 or 990-EZ - Schedule should be mailed to the IRS address specified in the form instructions based on the organization's principal location. Alternatively, organizations may file electronically through approved e-filing services. Ensuring the form reaches the correct address is crucial for timely processing and compliance.

See what our users say