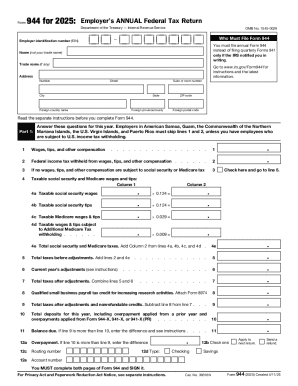

IRS 944 2019 free printable template

Instructions and Help about IRS 944

How to edit IRS 944

How to fill out IRS 944

About IRS previous version

What is IRS 944?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 944

What should I do if I need to correct an error on my IRS 944 after filing?

To correct mistakes on your IRS 944, you need to file an amended return using Form 944-X. This form allows you to make corrections and should be submitted to the same address where you originally sent your IRS 944. Ensure that you clearly indicate the errors and provide the correct information to facilitate processing.

How can I verify the status of my filed IRS 944?

To verify the status of your IRS 944, you can use the IRS online tools or contact their support for assistance. They can provide information on whether your form has been received and processed. Keep your confirmation number handy for quicker assistance during your inquiry.

What should I keep in mind regarding privacy and data security while filing my IRS 944?

When filing your IRS 944, ensure that you use secure methods, especially when e-filing. It’s important to choose trusted software that encrypts your data. Additionally, retain a copy of your filed form and any related documentation securely for at least four years to safeguard your personal and business information.

What are common errors to avoid when filing IRS 944?

Common errors in filing IRS 944 include incorrectly calculating taxes owed, omitting required information, or using the wrong year on the form. To prevent these issues, double-check your entries, ensure correct tax rates are applied, and review the form for completeness before submission.

How do I respond if I receive a notice regarding my IRS 944?

If you receive an IRS notice related to your IRS 944, read it carefully to understand the issue. Respond promptly with the required documentation or explanations, ensuring you follow the instructions provided in the notice. Maintaining records of your correspondence with the IRS is important for future reference.

See what our users say