Get the free Other Post-Retirement Considerations - psrs/peers

Show details

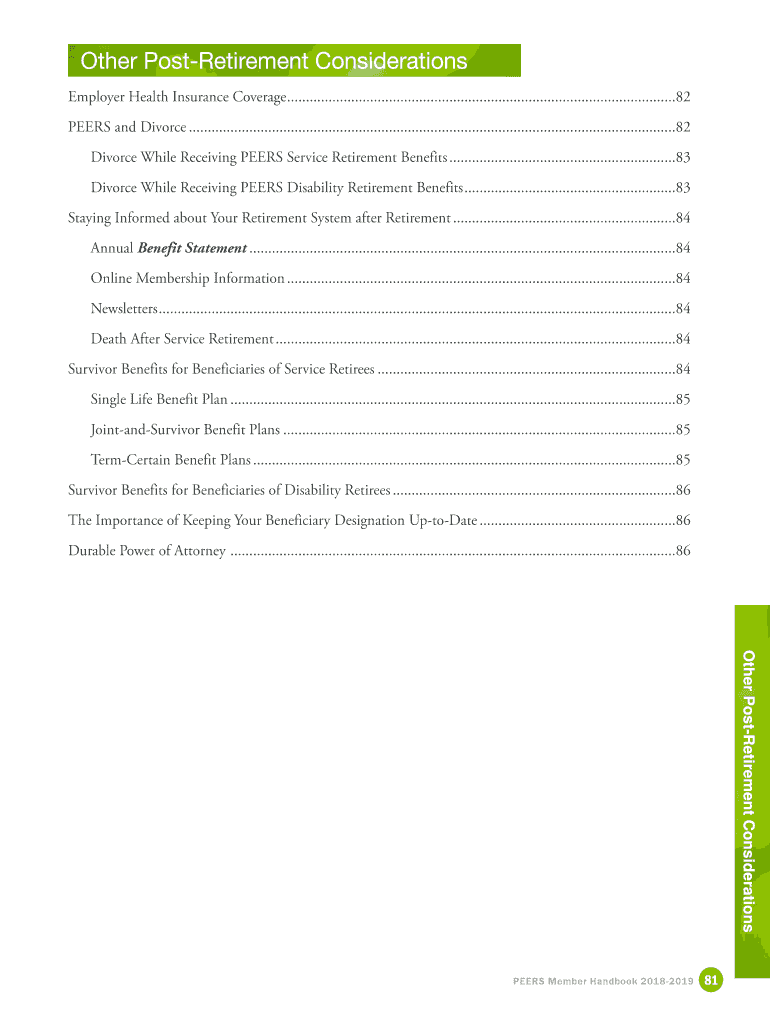

Other PostRetirement Considerations

Employer Health Insurance Coverage........................................................................................................82

PEERS and Divorce..................................................................................................................................82Divorce

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign oformr post-retirement considerations

Edit your oformr post-retirement considerations form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your oformr post-retirement considerations form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit oformr post-retirement considerations online

To use the services of a skilled PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit oformr post-retirement considerations. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out oformr post-retirement considerations

How to fill out oformr post-retirement considerations

01

Start by gathering all relevant information such as your retirement savings, Social Security benefits, and any other pension or investment accounts you may have.

02

Review your current expenses and determine what your post-retirement budget will look like. Consider any changes in healthcare costs, housing, and other expenses that may arise.

03

Consider your long-term goals and aspirations for retirement. This could include travel plans, pursuing hobbies, or starting a new business. Take these goals into account when planning your post-retirement considerations.

04

Evaluate your risk tolerance and determine how much risk you are willing to take with your investments. This will help you decide how to allocate your retirement savings among different investment options.

05

Seek professional advice from a financial planner or retirement specialist. They can guide you through the process and provide valuable insights tailored to your specific needs and goals.

06

Stay informed about changes in tax laws and regulations that may affect your retirement plans. Consult with a tax professional to ensure you are maximizing your tax benefits.

07

Regularly review and update your post-retirement considerations as your circumstances and goals change over time. It's important to regularly assess your financial situation and make adjustments as needed.

Who needs oformr post-retirement considerations?

01

Anyone who is approaching or has already reached retirement age should consider filling out oformr post-retirement considerations. This includes individuals who want to ensure financial security and stability during their retirement years.

02

People who want to make informed decisions about their retirement savings, investments, and post-retirement budget should also consider filling out oformr post-retirement considerations.

03

Individuals who are unsure about how to manage their retirement funds and need professional guidance can benefit from filling out oformr post-retirement considerations.

04

Whether you have a substantial retirement savings or limited resources, filling out oformr post-retirement considerations can help you create a comprehensive plan that aligns with your financial goals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit oformr post-retirement considerations from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your oformr post-retirement considerations into a dynamic fillable form that you can manage and eSign from anywhere.

How do I make edits in oformr post-retirement considerations without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit oformr post-retirement considerations and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

How can I fill out oformr post-retirement considerations on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your oformr post-retirement considerations. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

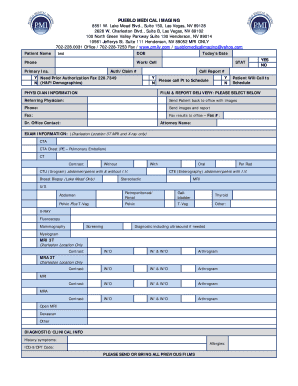

What is oformr post-retirement considerations?

Oformr post-retirement considerations are the forms that need to be filled out and submitted by individuals who have retired from a company or organization.

Who is required to file oformr post-retirement considerations?

Individuals who have retired from a company or organization are required to file oformr post-retirement considerations.

How to fill out oformr post-retirement considerations?

Oformr post-retirement considerations can be filled out online or on paper, following the instructions provided on the form.

What is the purpose of oformr post-retirement considerations?

The purpose of oformr post-retirement considerations is to report any post-retirement income, assets, or changes in financial status to the relevant authorities.

What information must be reported on oformr post-retirement considerations?

Information such as income, assets, investments, and other financial details must be reported on oformr post-retirement considerations.

Fill out your oformr post-retirement considerations online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Oformr Post-Retirement Considerations is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.