Get the free Strategically managing indirect taxes in Latin America - EY

Show details

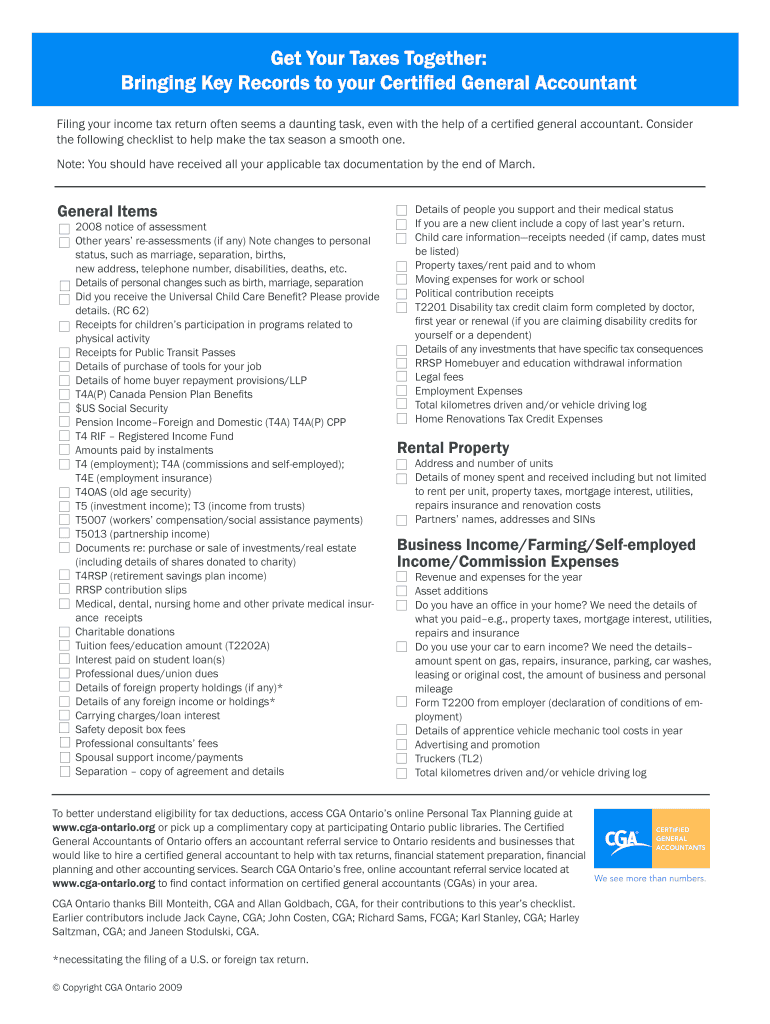

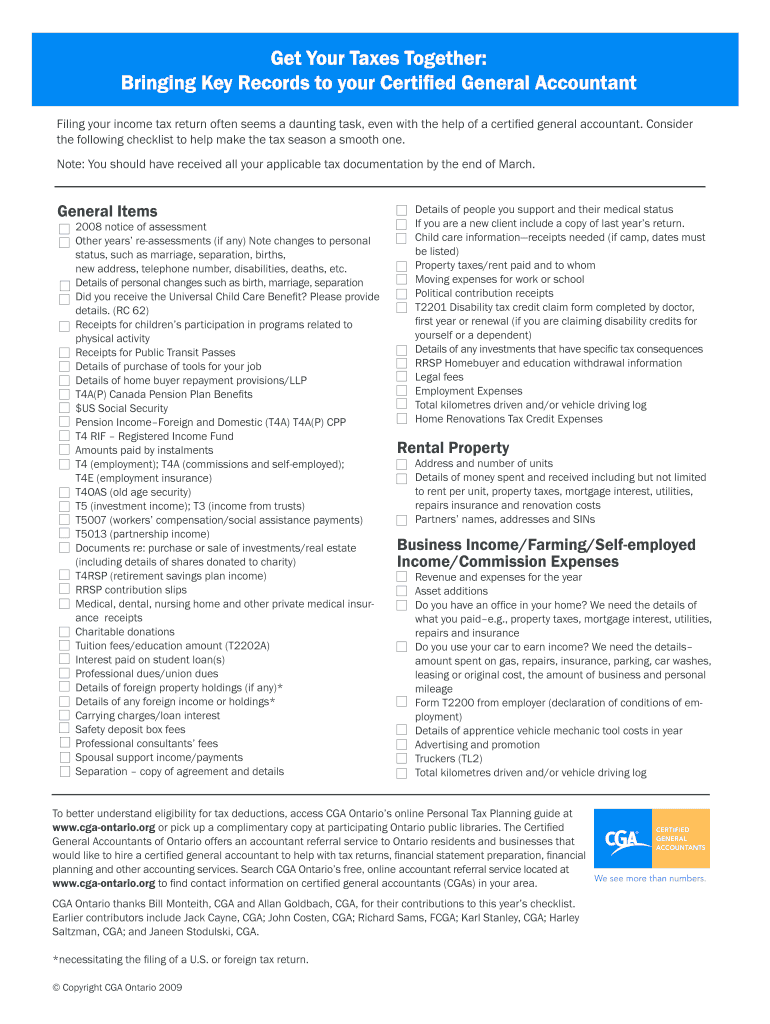

Get Your Taxes Together:

Bringing Key Records to your Certified General Accountant

Filing your income tax return often seems a daunting task, even with the help of a certified general accountant.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign strategically managing indirect taxes

Edit your strategically managing indirect taxes form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your strategically managing indirect taxes form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing strategically managing indirect taxes online

To use the professional PDF editor, follow these steps below:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit strategically managing indirect taxes. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out strategically managing indirect taxes

How to fill out strategically managing indirect taxes

01

Understand the different types of indirect taxes, such as sales tax, value-added tax (VAT), and excise tax.

02

Identify the applicable indirect taxes based on the jurisdiction and nature of your business operations.

03

Create a comprehensive register of all your indirect tax obligations, including filing deadlines and tax rates.

04

Implement automated tax compliance software to streamline the indirect tax management process.

05

Regularly update your tax compliance software with the latest tax regulations and changes.

06

Conduct periodic reviews of your indirect tax processes to identify any areas of improvement or potential errors.

07

Train your finance and accounting team on the proper handling of indirect taxes, including accurate record-keeping and reporting.

08

Monitor changes in tax legislation and stay informed about developments in indirect tax regulations.

09

Seek professional advice from tax consultants or advisors to ensure compliance with complex indirect tax laws.

10

Develop a proactive approach to managing indirect taxes by analyzing the impact of tax changes on your business and incorporating tax planning strategies.

Who needs strategically managing indirect taxes?

01

Businesses of all sizes and industries that engage in taxable activities and transactions where indirect taxes are levied.

02

Companies operating in multiple jurisdictions with varying indirect tax laws that require strategic management to maximize compliance and minimize tax liabilities.

03

Finance and accounting professionals responsible for ensuring accurate and timely indirect tax reporting and compliance.

04

Tax departments or tax consultants who specialize in indirect taxes and help businesses navigate complex tax regulations and optimize tax planning strategies.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my strategically managing indirect taxes in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your strategically managing indirect taxes and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I make edits in strategically managing indirect taxes without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing strategically managing indirect taxes and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

Can I edit strategically managing indirect taxes on an Android device?

With the pdfFiller Android app, you can edit, sign, and share strategically managing indirect taxes on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is strategically managing indirect taxes?

Strategically managing indirect taxes involves planning and optimizing a company's indirect tax obligations to minimize tax risks and liabilities while maximizing tax savings.

Who is required to file strategically managing indirect taxes?

Any business that is subject to indirect taxes, such as value added tax (VAT) or sales tax, may be required to file strategically managing indirect taxes.

How to fill out strategically managing indirect taxes?

To fill out strategically managing indirect taxes, businesses need to review their indirect tax obligations, assess the impact on their operations, and develop a tax strategy to manage them effectively.

What is the purpose of strategically managing indirect taxes?

The purpose of strategically managing indirect taxes is to ensure compliance with tax laws, minimize tax risks, and maximize tax savings for the business.

What information must be reported on strategically managing indirect taxes?

Businesses must report information related to their indirect tax obligations, tax planning strategies, and any transactions that may impact their indirect tax liabilities.

Fill out your strategically managing indirect taxes online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Strategically Managing Indirect Taxes is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.