Get the free ACCOUNTS BANKING

Show details

INDIAS1NUMBERINSTITUTE ACCOUNTS BANKING FINANCE TAXATION USYOURCAREER MATTERSINDUSTRY ORIENTEDJOBGUARANTEEDwww.icajobguarantee.employer ENDORSED SAP ERP GST ENABLEDABOUT ICA History Inception in 1999

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign accounts banking

Edit your accounts banking form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your accounts banking form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit accounts banking online

Follow the steps below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit accounts banking. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

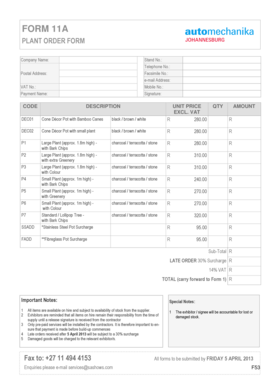

How to fill out accounts banking

How to fill out accounts banking

01

Gather all necessary documents like identification, proof of address, and income documents.

02

Research and choose a suitable bank that offers the type of accounts you require.

03

Visit the bank's branch or website and locate the account opening section or form.

04

Fill out the required personal information such as name, address, contact details, etc.

05

Provide identification details like passport number, social security number, or Aadhaar number.

06

Enter your employment and income details if applicable.

07

Select the type of account you want to open such as savings, current, or fixed deposit.

08

Choose any additional features or services you desire, like a debit card, online banking, or overdraft protection.

09

Review the terms and conditions, fees, and charges associated with the account.

10

Sign and submit your completed application along with the required documents to the bank.

11

Wait for the bank's approval and account activation. This may take a few days or weeks depending on the bank's process.

12

Once your account is activated, you will receive your account details and be able to access your funds and banking services.

Who needs accounts banking?

01

Anyone who wants to manage their finances, keep their money safe, and have easy access to banking services can benefit from opening accounts with a bank.

02

Individuals who receive regular income and need a convenient way to pay bills, make transactions, and save money can use banking accounts.

03

Businesses and organizations often require bank accounts to receive payments, make transactions, and keep their financial records organized.

04

Students and young adults starting to handle their own finances can open accounts to learn about banking and manage their money effectively.

05

Having a bank account is also important for individuals seeking loans, building credit history, or saving for specific goals like buying a house or retirement.

06

Overall, anyone looking for financial stability, security, and access to a wide range of banking services should consider opening accounts with a bank.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit accounts banking from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your accounts banking into a dynamic fillable form that you can manage and eSign from any internet-connected device.

Can I sign the accounts banking electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your accounts banking in minutes.

How do I fill out accounts banking on an Android device?

Use the pdfFiller mobile app and complete your accounts banking and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is accounts banking?

Accounts banking refers to the process of managing and recording financial transactions related to banking activities.

Who is required to file accounts banking?

Businesses and individuals who engage in banking activities are required to file accounts banking.

How to fill out accounts banking?

Accounts banking can be filled out by recording all financial transactions accurately and in accordance with accounting principles.

What is the purpose of accounts banking?

The purpose of accounts banking is to keep track of financial transactions, monitor cash flow, and assess the financial health of an entity.

What information must be reported on accounts banking?

Information such as income, expenses, assets, liabilities, and equity must be reported on accounts banking.

Fill out your accounts banking online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Accounts Banking is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.