Get the free Car insurance - I Will Teach You To Be Rich

Show details

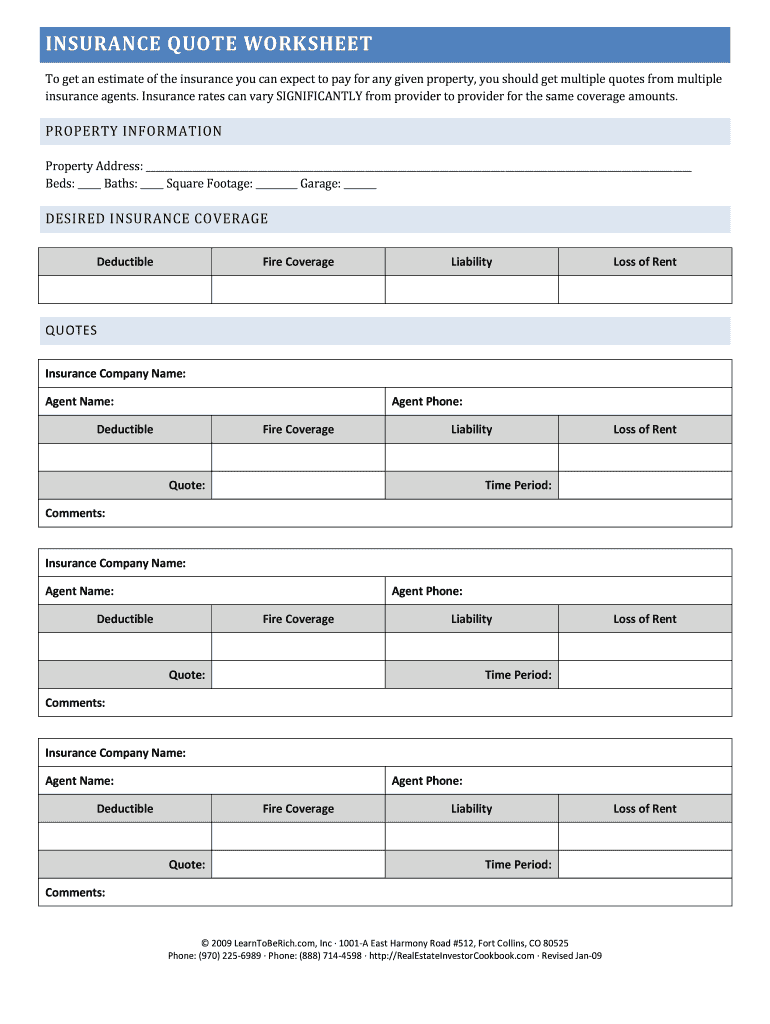

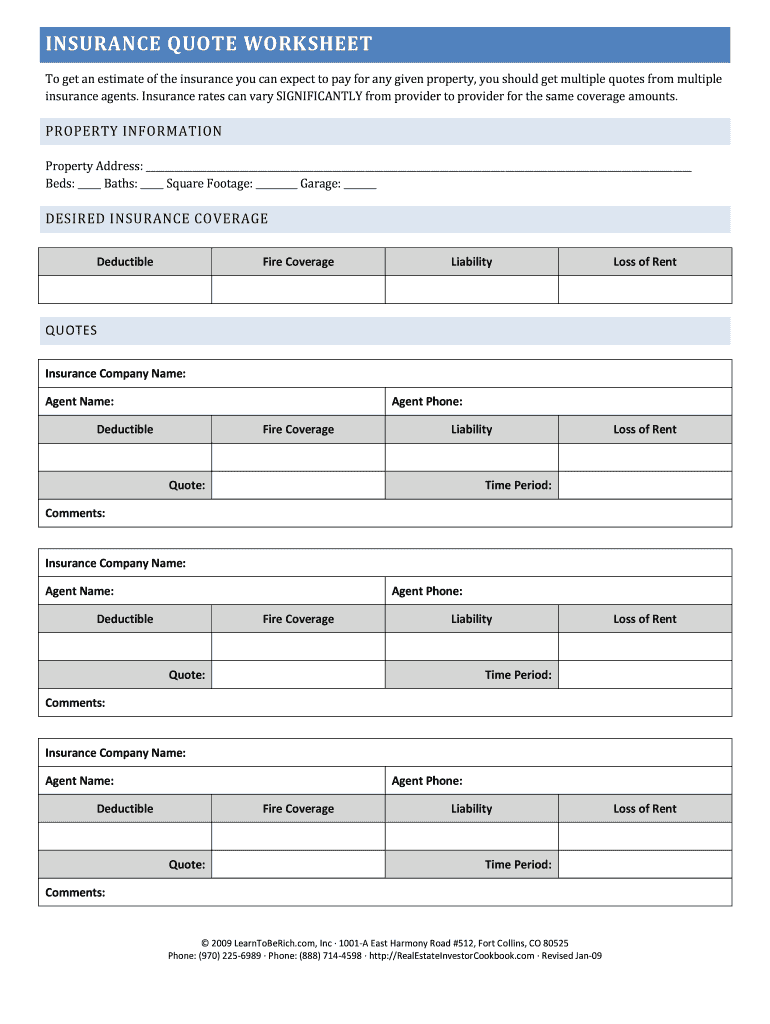

INSURANCE QUOTE WORKSHEET To get an estimate of the insurance you can expect to pay for any given property, you should get multiple quotes from multiple insurance agents. Insurance rates can vary

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign car insurance - i

Edit your car insurance - i form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your car insurance - i form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit car insurance - i online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit car insurance - i. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out car insurance - i

How to fill out car insurance - i

01

To fill out car insurance, follow these steps:

02

Gather necessary information: Start by collecting all relevant information, including your contact details, vehicle information, driving history, and insurance requirements.

03

Choose an insurance provider: Research different car insurance companies and compare their coverage options, premiums, and customer reviews. Select a provider that suits your needs and budget.

04

Determine the coverage type: Understand the different types of car insurance coverage available, such as liability, collision, and comprehensive. Assess your needs and choose the appropriate coverage.

05

Fill out the application form: Obtain the application form from the insurance provider and carefully complete all the required fields. Double-check the accuracy of the information provided.

06

Provide necessary documents: Along with the application form, you may need to provide documents like your driver's license, vehicle registration, and previous insurance policy (if applicable). Make sure to submit all required paperwork.

07

Review and understand the policy: Read the car insurance policy thoroughly to understand the coverage details, exclusions, deductibles, and terms. Seek clarification from the insurance provider if needed.

08

Pay the premium: Calculate the premium amount based on the coverage and payment frequency selected. Make the payment to activate the policy. Consider setting up automatic payments for future premiums.

09

Keep a copy of the policy: After successfully filling out the car insurance, keep a copy of the policy document for future reference. Store it in a secure place.

10

Review and update regularly: Periodically review your car insurance policy to ensure it meets your current needs. Update any changes in your personal or vehicle information as necessary.

11

Renew the policy on time: Stay aware of the policy renewal date and make sure to renew it before it expires to avoid any lapse in coverage.

Who needs car insurance - i?

01

Anyone who owns or drives a car needs car insurance.

02

Car insurance is legally mandatory in most countries to protect drivers, passengers, and third parties from financial losses in case of accidents or damages caused by their vehicles.

03

New car owners: Car insurance is particularly crucial for new car owners who want to protect their investment from potential accidents, theft, or damage.

04

Experienced drivers: Even experienced drivers may need car insurance to cover damages caused by accidents, natural disasters, theft, or vandalism.

05

Commuters and daily drivers: People who use their cars for daily commuting or long-distance travel should have car insurance to protect themselves and their vehicles from unforeseen events.

06

Frequent travelers: If you travel frequently by car, the risk of accidents or damage increases. Car insurance provides financial protection during such travels.

07

Businesses with company vehicles: Companies that own or lease vehicles for business purposes must have car insurance to safeguard their assets and protect employees.

08

Financial institutions: Lenders who provide vehicle loans often require borrowers to have car insurance as a condition for the loan.

09

Drivers with loans or leases: Individuals who have borrowed money to purchase a car or have leased a vehicle are typically required to have car insurance by the lenders or leasing companies.

10

Parents with teenage drivers: Parents of teenage drivers should have car insurance to cover their child's actions on the road and protect themselves from potential liabilities.

11

Even if car insurance is not legally mandatory in some situations or locations, it is still highly recommended to protect oneself from unexpected financial burdens.

12

Consult with local authorities or insurance professionals to understand the specific car insurance requirements in your area.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send car insurance - i for eSignature?

To distribute your car insurance - i, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I make changes in car insurance - i?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your car insurance - i to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I edit car insurance - i straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing car insurance - i.

What is car insurance - i?

Car insurance - i is a type of insurance that provides financial protection to the owner of the vehicle in case of accidents or damages.

Who is required to file car insurance - i?

All vehicle owners are required to have car insurance - i in order to legally drive on the roads.

How to fill out car insurance - i?

To fill out car insurance - i, you will need to provide personal information, vehicle details, and choose the coverage options that best suit your needs.

What is the purpose of car insurance - i?

The purpose of car insurance - i is to protect the vehicle owner from financial loss in case of accidents, theft, or other damages.

What information must be reported on car insurance - i?

The information that must be reported on car insurance - i includes the make and model of the vehicle, the driver's license number, and any previous accidents or claims.

Fill out your car insurance - i online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Car Insurance - I is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.