Get the free Federal Direct Loan Program Parent Data Form - Purdue ...

Show details

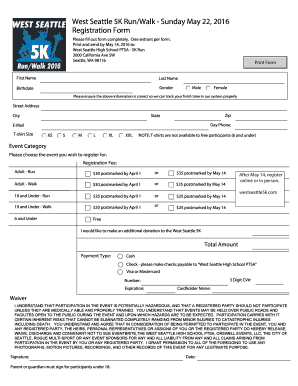

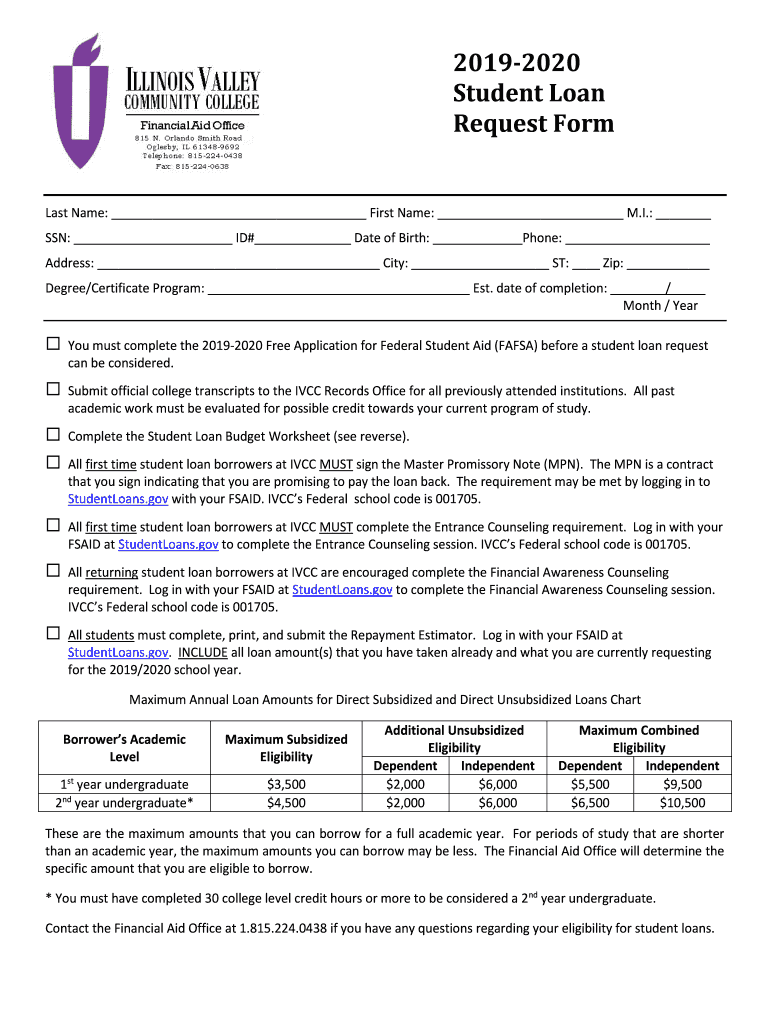

20192020 Student Loan Request Format Names: First Name: M.I.: SSN: ID# Date of Birth: Phone: Address: City: ST: Zip: Degree/Certificate Program: Est. Date of completion: / Month / Year must complete

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign federal direct loan program

Edit your federal direct loan program form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your federal direct loan program form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit federal direct loan program online

To use the professional PDF editor, follow these steps:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit federal direct loan program. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out federal direct loan program

How to fill out federal direct loan program

01

Check your eligibility: Make sure you meet the basic eligibility requirements for the federal direct loan program, such as being a U.S. citizen or eligible non-citizen, having a valid Social Security number, and being enrolled at least half-time in an eligible degree or certificate program.

02

Complete the Free Application for Federal Student Aid (FAFSA): The first step in applying for federal direct loans is to fill out the FAFSA form. Provide accurate information about your financial situation, including income and assets.

03

Review your financial aid package: After submitting the FAFSA, you will receive a Student Aid Report (SAR) that summarizes your financial aid eligibility. Review this document to see if you have been awarded any federal direct loans.

04

Accept the loan offer: If you have been offered a federal direct loan, you can choose to accept all or a portion of the loan amount. Consider your needs and only borrow what is necessary.

05

Complete entrance counseling: First-time federal direct loan borrowers must complete entrance counseling to understand their rights and responsibilities as a loan borrower. This can usually be done online.

06

Sign the Master Promissory Note (MPN): The MPN is a legal document that outlines the terms and conditions of your federal direct loan. Read it carefully and sign electronically or on paper.

07

Receive loan funds: Once all the necessary steps have been completed, your school will disburse the federal direct loan funds to you. This usually happens at the beginning of each semester.

08

Manage loan repayment: After graduation or when you drop below half-time enrollment, you will need to start repaying your federal direct loan. Explore repayment options and make timely payments to avoid default.

Who needs federal direct loan program?

01

Students pursuing higher education: The federal direct loan program is designed to help students finance their education at colleges, universities, and career schools. It is a popular option for undergraduates and graduate students alike.

02

Parents of dependent students: The federal direct PLUS loan, which is part of the federal direct loan program, allows parents to borrow money to help pay for their child's education expenses.

03

Individuals seeking financial assistance for education: If you need financial assistance to cover the cost of tuition, fees, books, and other educational expenses, the federal direct loan program can be a valuable resource.

04

Students with limited credit history or low income: Federal direct loans do not require a credit check or a cosigner. This makes them accessible to students with limited credit history or low income.

05

Borrowers looking for flexible repayment options: The federal direct loan program offers various repayment plans, including income-driven options. This flexibility can be beneficial for borrowers who may have difficulty making standard loan payments.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify federal direct loan program without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including federal direct loan program. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I execute federal direct loan program online?

pdfFiller makes it easy to finish and sign federal direct loan program online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

Can I create an electronic signature for signing my federal direct loan program in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your federal direct loan program and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

What is federal direct loan program?

The Federal Direct Loan Program is a program that provides low-interest loans to students and parents to help pay for the cost of higher education.

Who is required to file federal direct loan program?

Students and parents who are interested in applying for federal direct loans are required to file the program.

How to fill out federal direct loan program?

To fill out the federal direct loan program, students and parents must complete the Free Application for Federal Student Aid (FAFSA) form.

What is the purpose of federal direct loan program?

The purpose of the federal direct loan program is to help students and parents finance the cost of higher education.

What information must be reported on federal direct loan program?

Information such as income, family size, and financial assets must be reported on the federal direct loan program.

Fill out your federal direct loan program online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Federal Direct Loan Program is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.