Get the free Salaried Pension Plan Actuarial Services

Show details

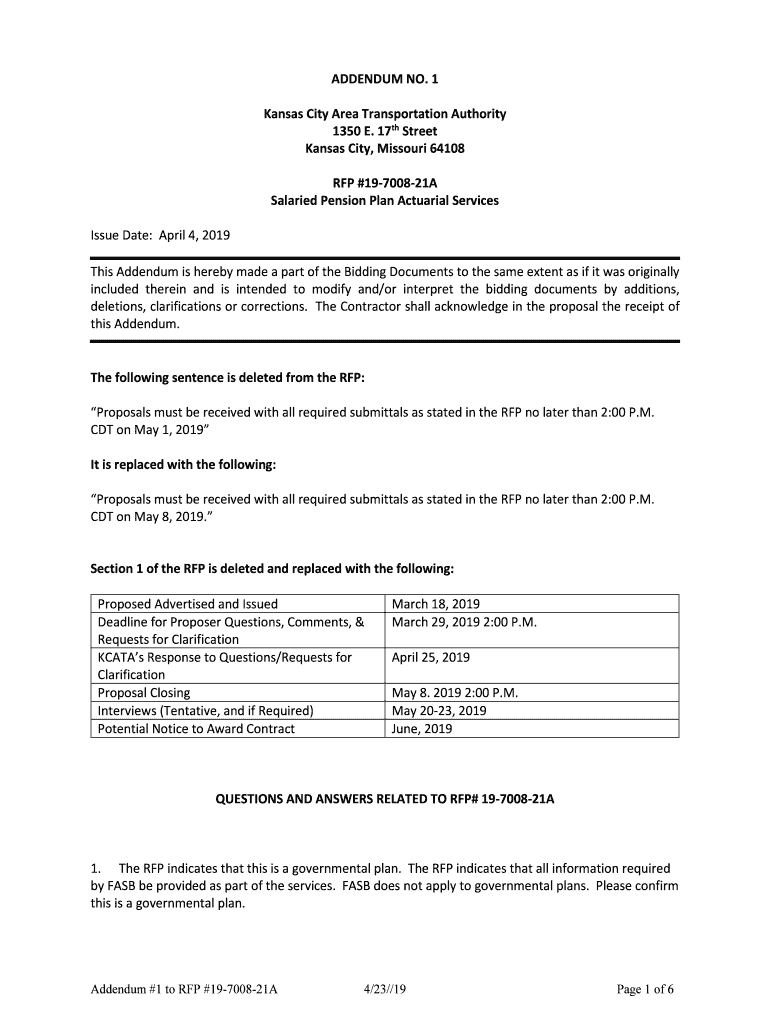

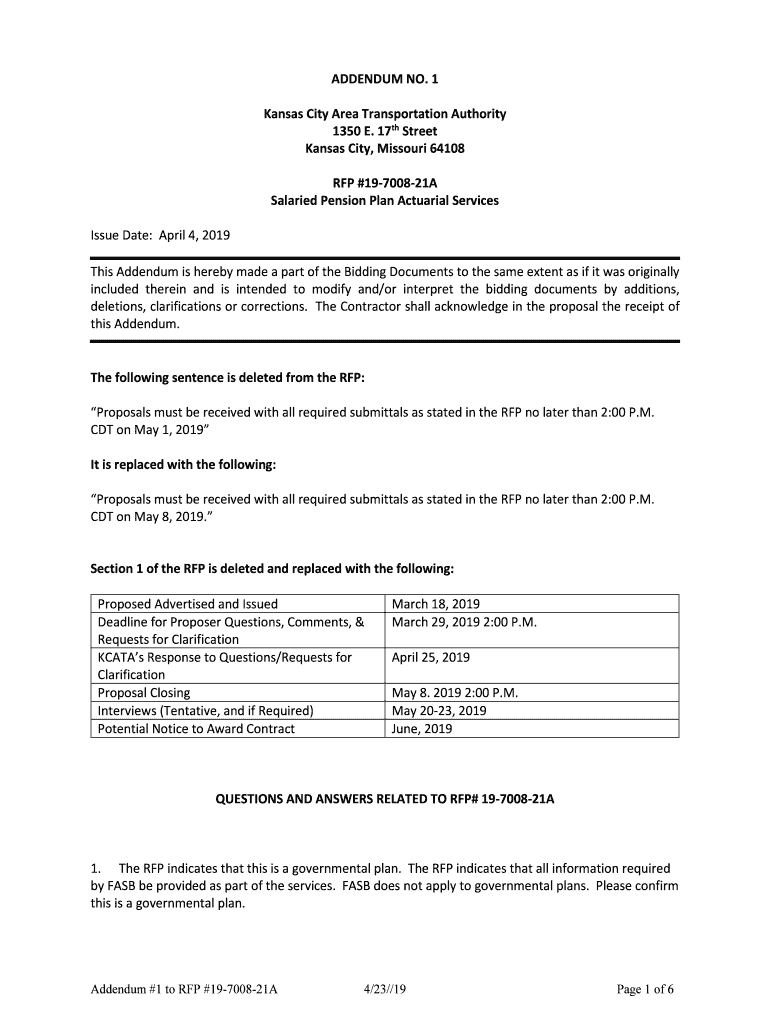

ADDENDUM NO. 1

Kansas City Area Transportation Authority

1350 E. 17th Street

Kansas City, Missouri 64108

RFP #19700821A

Salaried Pension Plan Actuarial Services

Issue Date: April 4, 2019,

This Addendum

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign salaried pension plan actuarial

Edit your salaried pension plan actuarial form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your salaried pension plan actuarial form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit salaried pension plan actuarial online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit salaried pension plan actuarial. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out salaried pension plan actuarial

How to fill out salaried pension plan actuarial

01

To fill out a salaried pension plan actuarial, follow these steps:

02

Gather all relevant information about the pension plan, including the employee's salary, years of service, retirement age, and any additional contributions.

03

Calculate the present value of each employee's pension benefit using actuarial formulas. This involves discounting future cash flows to their present value based on assumptions about interest rates and mortality rates.

04

Determine the funding status of the pension plan by comparing the present value of all accrued benefits to the plan's assets. This helps assess whether the plan is adequately funded to meet its obligations.

05

Analyze the impact of different factors on the pension plan, such as changes in interest rates, salary growth rates, and mortality assumptions. This helps assess the plan's sensitivity to different scenarios.

06

Prepare a summary report of the actuarial calculations and analysis, including key findings and recommendations for the pension plan's management and stakeholders.

07

Review and update the actuarial study periodically to stay informed about changes in the plan's funding status and reassess its financial health and sustainability.

Who needs salaried pension plan actuarial?

01

Salaried pension plan actuarial is needed by:

02

- Companies and organizations that offer salaried pension plans to their employees. It helps them assess the financial health and sustainability of the plan, make funding decisions, and manage their pension liabilities.

03

- Pension fund trustees, administrators, and actuaries responsible for managing the investment and payment of pension benefits.

04

- Regulatory bodies and government agencies overseeing pension plans to ensure compliance with regulations, protect plan participants, and monitor the overall stability of the pension system.

05

- Financial analysts, researchers, and consultants who analyze and provide insights into pension plan performance and trends.

06

- Individuals participating in the pension plan who want to understand the actuarial calculations and implications for their retirement benefits.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute salaried pension plan actuarial online?

Easy online salaried pension plan actuarial completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

Can I sign the salaried pension plan actuarial electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your salaried pension plan actuarial and you'll be done in minutes.

Can I create an eSignature for the salaried pension plan actuarial in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your salaried pension plan actuarial and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

What is salaried pension plan actuarial?

Salaried pension plan actuarial is a calculation and analysis of the financial costs and risks associated with providing pension benefits to employees.

Who is required to file salaried pension plan actuarial?

Employers who offer salaried pension plans are required to file the actuarial report.

How to fill out salaried pension plan actuarial?

The actuarial report for a salaried pension plan must be filled out by a qualified actuary who will analyze the plan's liabilities, assets, and funding requirements.

What is the purpose of salaried pension plan actuarial?

The purpose of salaried pension plan actuarial is to ensure that pension plans are properly funded and able to meet the future benefit obligations to employees.

What information must be reported on salaried pension plan actuarial?

The actuarial report must include information about the plan's demographics, funding status, investment performance, and assumptions used in the calculations.

Fill out your salaried pension plan actuarial online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Salaried Pension Plan Actuarial is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.