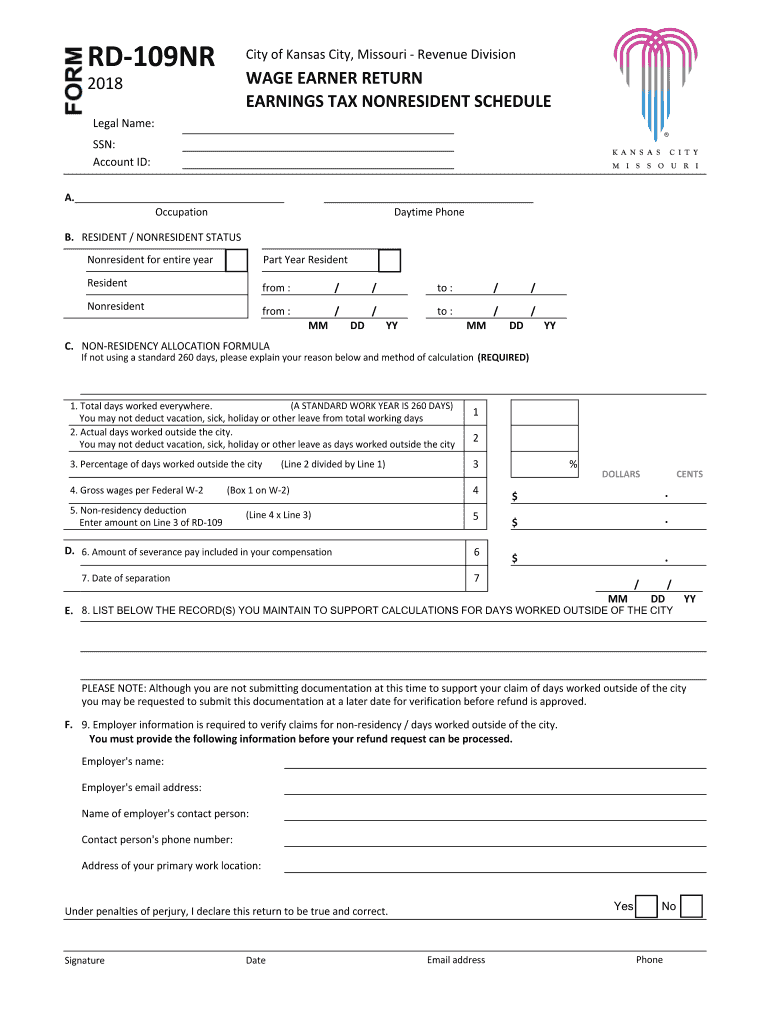

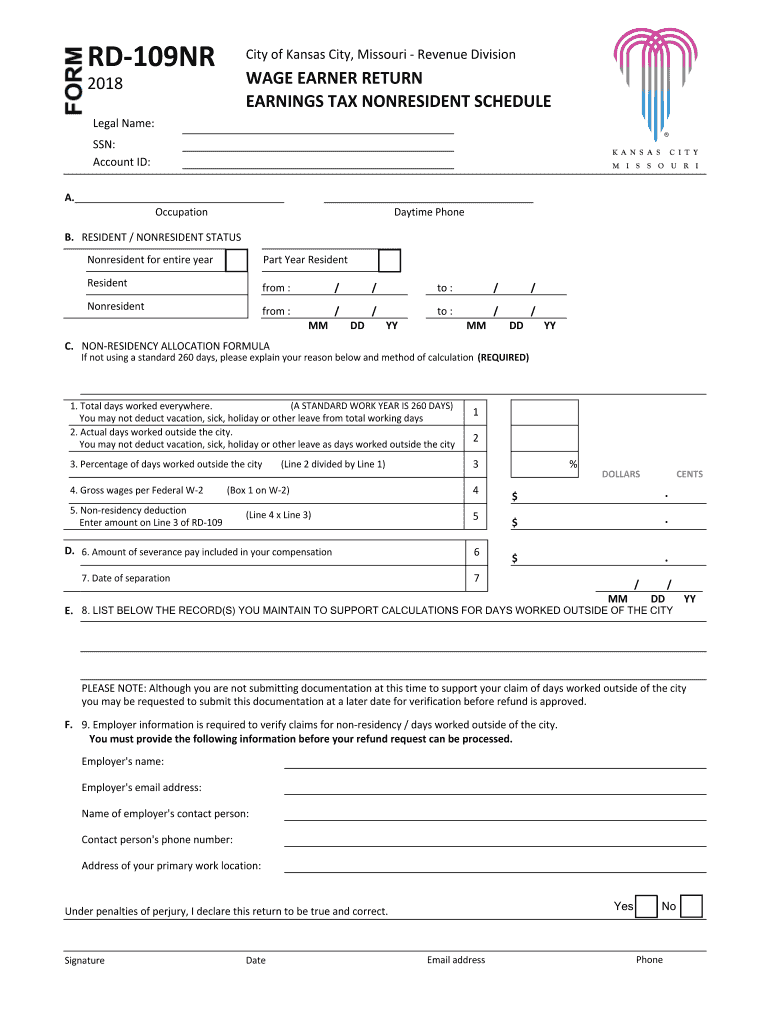

MO RD-109NR - Kansas City 2018 free printable template

Get, Create, Make and Sign MO RD-109NR - Kansas City

Editing MO RD-109NR - Kansas City online

Uncompromising security for your PDF editing and eSignature needs

MO RD-109NR - Kansas City Form Versions

How to fill out MO RD-109NR - Kansas City

How to fill out MO RD-109NR - Kansas City

Who needs MO RD-109NR - Kansas City?

Instructions and Help about MO RD-109NR - Kansas City

Welcome to another Rd Works Learning Lab as you can see Im in a slightly chilled mood and its been a long day in the garden my project engineer has had a whole list of jobs for me and I suppose its limbers me up for whats to come Im starting to join the dots in this session now the good news about gardening is my dad was a philosopher and he said to me son is it never have any more grass than your wife or mud I have none its all brew so its easy to keep clean pot plants but hey Ive got pot plants in so that somebody else could look after them it turns out that thats somebody elses needs yeah Im old Im not that wise obviously but anyway on to todays session weve done a lot of work dissecting all the details of how were going to produce clean sweet dots we understand everything about the makeup of how dots are formed now were going to have to put it all back together and see what sort of pictures we can make now Ive got a fairly good idea that the dotty pictures that Im going to try and produce aint going to be that good but the plan is to build and build and build to find out what it is that makes a good picture now I tend to use photoshop and Ive always used photoshop to distort my pictures over quick quite a long way actually to get half reasonable features down or to various media but that will be a separate issue that we should tackle during this building session so without any more ado Im just about to get involved in seven days worth of work to try and put this final session together so I suppose I better get up and do something right well here we are beside the machine ready to run what i pletely described is one of my ex-girlfriends peaches but before we do that theres a little bit of housekeeper that we really ought to do weve got to try and get this picture as clean as we possibly can and so we need the best dots that we can bearing in mind what were trying to find out as dots now I think this first picture is going to be not very good but we are trying to prove a point here more than anything else now knowing Im going to be running this picture at 400 millimeters a second I need to make sure that the scan lines line up properly so Ive already got a little program in the machine which is set to 30 power and 400 millimeters a second the first thing were going to look at is this offset between the lines as you can see the scan left and the scan right do not line I its not a huge amount because the peach in between those lines is 05 of a millimeter so I think we may well have to shift by only about point zero five to get the lines to line up so lets go and do that in the program now to find out where to do that we need to go up here to config and system settings and then under system settings youll find this box here which is called scanning reverse interval well you need a tick beside that and we need to set if you havent got one already you need to do ad and ad will bring you up this box now Ive already put one in here at 400 and its got...

People Also Ask about

What is a Kansas City RD-109 for taxpayer taxes?

What is 1% earnings tax Kansas City?

What is a Kansas City tax return?

What is Form RI 1040NR?

What is the 1% tax refund in Kansas City?

What is a Kansas City RD 109 for taxpayer taxes?

How do I get a copy of my tax return form?

Who pays KC earnings tax?

Do I have to file a Kansas City MO tax return?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in MO RD-109NR - Kansas City without leaving Chrome?

How can I edit MO RD-109NR - Kansas City on a smartphone?

Can I edit MO RD-109NR - Kansas City on an iOS device?

What is MO RD-109NR - Kansas City?

Who is required to file MO RD-109NR - Kansas City?

How to fill out MO RD-109NR - Kansas City?

What is the purpose of MO RD-109NR - Kansas City?

What information must be reported on MO RD-109NR - Kansas City?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.