Get the free Wharton County Tax Sale Information - McCreary, Veselka ...

Show details

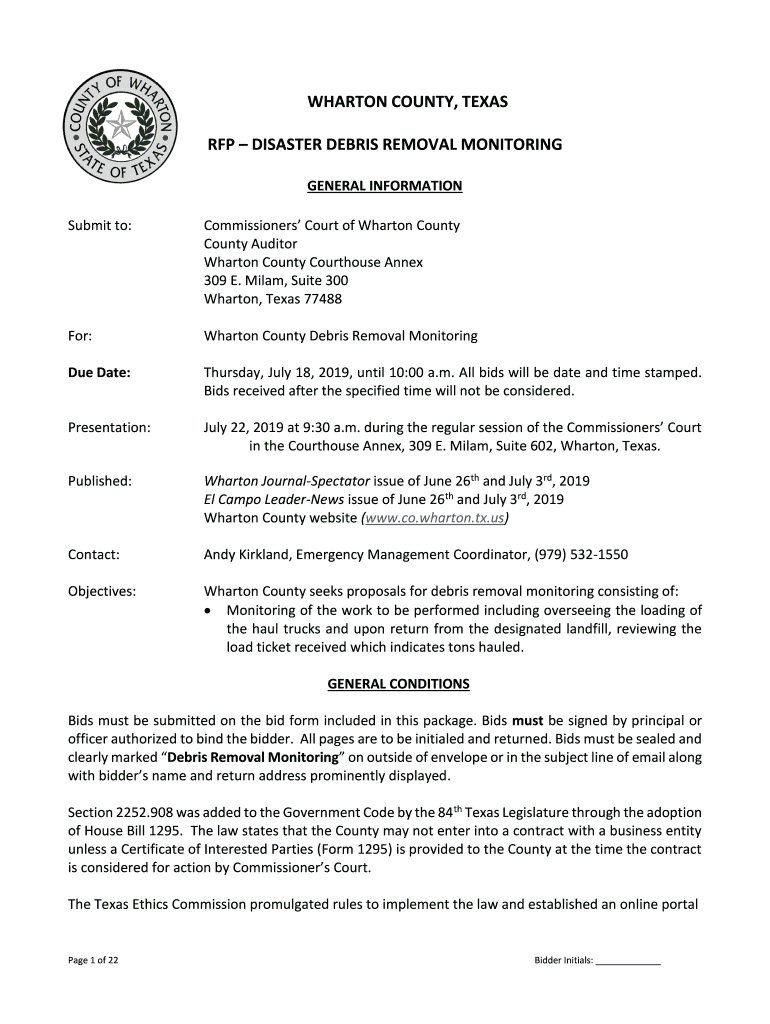

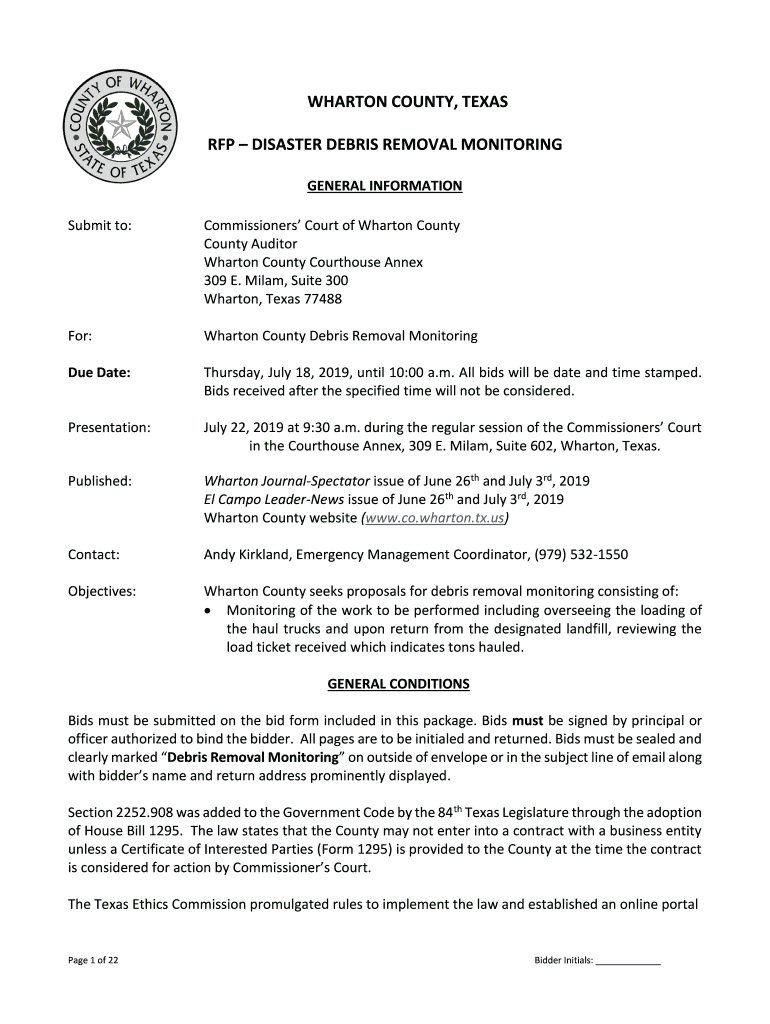

WHARTON COUNTY, TEXAS RFP DISASTER DEBRIS REMOVAL MONITORING GENERAL INFORMATION Submit to:Commissioners Court of Wharton County Auditor Wharton County Courthouse Annex 309 E. Milan, Suite 300 Wharton,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign wharton county tax sale

Edit your wharton county tax sale form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your wharton county tax sale form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing wharton county tax sale online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit wharton county tax sale. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out wharton county tax sale

How to fill out wharton county tax sale

01

To fill out the Wharton County tax sale, follow these steps:

02

Obtain the necessary tax sale forms from the Wharton County Tax Office.

03

Fill out the forms with accurate information regarding the property you wish to purchase at the tax sale.

04

Provide any required supporting documentation, such as proof of identification and proof of funds.

05

Submit the completed forms and documentation to the Wharton County Tax Office before the specified deadline.

06

Pay any applicable fees or deposits required for participating in the tax sale.

07

Attend the tax sale auction, if required, and follow the instructions provided by the tax office.

08

If your bid is successful, complete the necessary paperwork and payment to finalize the purchase.

09

Comply with any additional requirements or procedures outlined by the tax office to complete the acquisition of the property.

10

It is advisable to consult with the Wharton County Tax Office or seek professional guidance to ensure proper completion of the tax sale process.

Who needs wharton county tax sale?

01

Wharton County tax sale is typically sought after by individuals or investors who are interested in acquiring properties at a discounted rate or for investment purposes.

02

This may include real estate buyers looking for potential residential or commercial properties to purchase, developers seeking land or properties for development projects, or investors aiming to capitalize on the potential appreciation or rental income of acquired properties.

03

Additionally, those interested in tax sales may include individuals looking to acquire properties with specific criteria or in specific locations, as well as individuals interested in participating in the tax sale process as a means of acquiring alternative investment opportunities.

04

It is important for potential buyers to thoroughly research and understand the tax sale process and any associated risks before participating.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get wharton county tax sale?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific wharton county tax sale and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I edit wharton county tax sale in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing wharton county tax sale and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

How do I edit wharton county tax sale on an Android device?

With the pdfFiller Android app, you can edit, sign, and share wharton county tax sale on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is wharton county tax sale?

The Wharton County tax sale is an auction where the county sells off properties with unpaid taxes to recoup the lost revenue.

Who is required to file wharton county tax sale?

Property owners who have failed to pay their property taxes are required to file for the Wharton County tax sale.

How to fill out wharton county tax sale?

To fill out the Wharton County tax sale, property owners must submit a completed form listing the property details and the amount of unpaid taxes.

What is the purpose of wharton county tax sale?

The purpose of the Wharton County tax sale is to collect unpaid property taxes and transfer ownership of the property to the highest bidder at the auction.

What information must be reported on wharton county tax sale?

Property owners must report details of the property, including its location, size, and any outstanding tax amounts to be included in the Wharton County tax sale.

Fill out your wharton county tax sale online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Wharton County Tax Sale is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.