Get the free Self Directed IRA - Self Directed IRA Services - New Direction ...

Show details

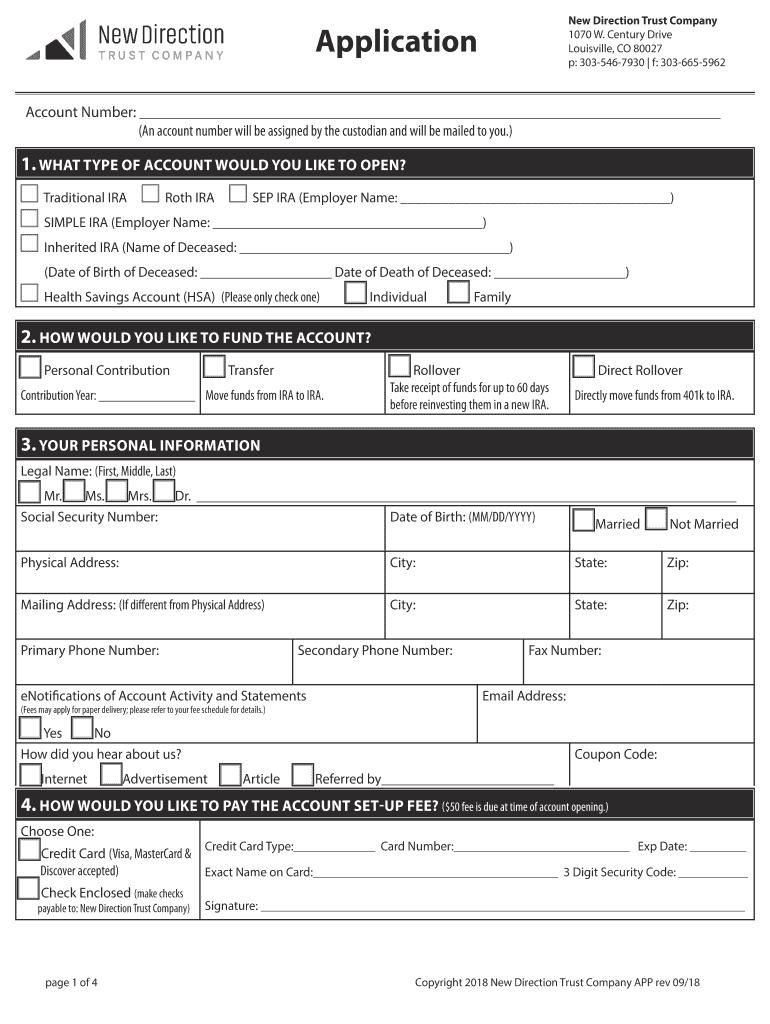

SelfDirectedIRA Application

For Precious Metals Accounts Direction Trust Company

www.NDTCO.com

1070 W Century Drive

Louisville, CO 80027

Email: PAT×ndtco.com

Toll Free: 8777421270, ext. 185

Phones:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign self directed ira

Edit your self directed ira form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your self directed ira form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit self directed ira online

Follow the guidelines below to use a professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit self directed ira. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out self directed ira

How to fill out self directed ira

01

Step 1: Determine your eligibility for a self-directed IRA. Not everyone is eligible to open a self-directed IRA. You must have earned income and meet certain eligibility requirements set by the IRS.

02

Step 2: Choose a custodian. A self-directed IRA must be held by a custodian or trustee that specializes in these types of accounts. Research and choose a reputable custodian that allows for self-directed investments.

03

Step 3: Open an account. Once you have chosen a custodian, you will need to complete the necessary paperwork to open a self-directed IRA account. This may include providing personal information, identifying your investment objectives, and signing any required agreements or disclosures.

04

Step 4: Fund your account. Transfer funds from an existing IRA or make a contribution to your self-directed IRA. The maximum annual contribution limits apply to self-directed IRAs as well.

05

Step 5: Identify your investment(s). Determine the types of investments you want to make with your self-directed IRA. This can include real estate, private equity, precious metals, or other alternative assets.

06

Step 6: Due diligence and research. Before making any investment, conduct thorough due diligence and research to ensure it aligns with your investment goals and risk tolerance.

07

Step 7: Make the investment. Once you have performed your due diligence, instruct your custodian to make the investment on behalf of your self-directed IRA.

08

Step 8: Monitor your investments. Regularly review the performance of your investments and make adjustments as necessary.

09

Step 9: Stay compliant. Ensure that you are aware of and follow all IRS rules and regulations regarding self-directed IRAs. This includes reporting requirements and prohibited transactions.

10

Step 10: Consult with professionals. Consider consulting with financial advisors, tax professionals, and legal experts to ensure you are making informed decisions and maximizing the benefits of your self-directed IRA.

Who needs self directed ira?

01

Individuals who want more control over their retirement investments

02

Those who have knowledge or interest in alternative investments such as real estate, private equity, precious metals, or other non-traditional assets

03

Investors who are looking to diversify their retirement portfolio beyond traditional stocks, bonds, and mutual funds

04

Entrepreneurs or small business owners who want to use their retirement funds to invest in their own businesses

05

Those who want to take advantage of potential tax benefits and potentially grow their retirement savings faster

06

Individuals who have a high tolerance for risk and are comfortable with the potential volatility of alternative investments

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my self directed ira directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your self directed ira as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How do I edit self directed ira straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit self directed ira.

How do I complete self directed ira on an Android device?

Complete self directed ira and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

Fill out your self directed ira online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Self Directed Ira is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.