Get the free Easy IFTA Fuel Tax Reports, Fleet Fuel Card Integration

Show details

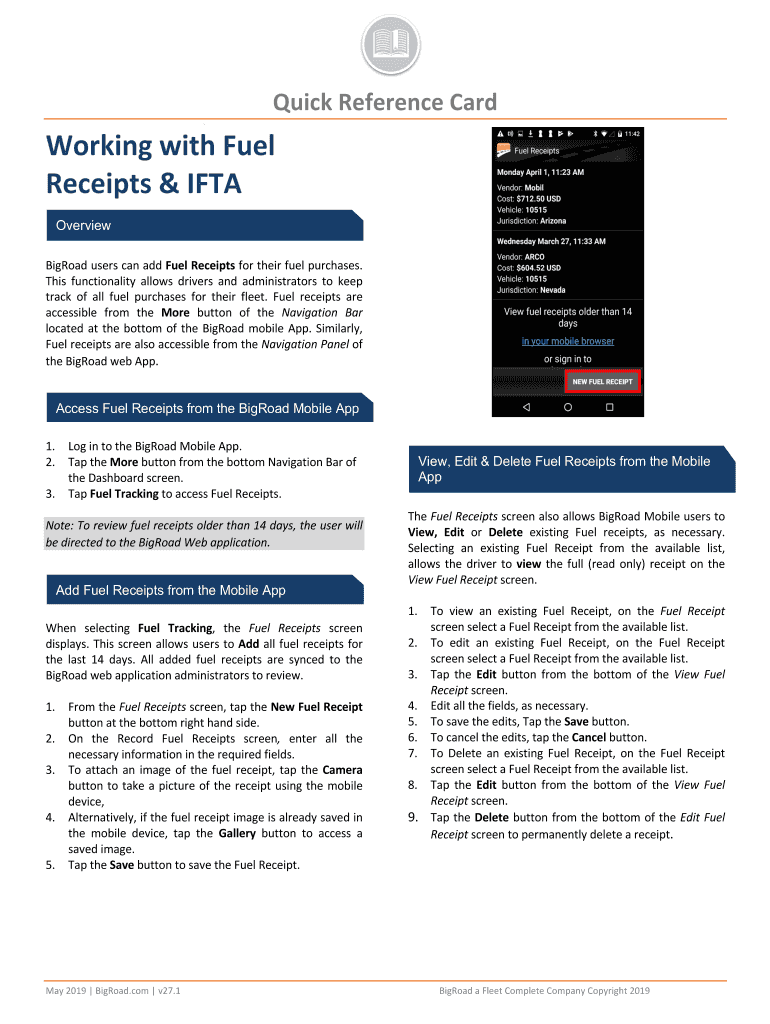

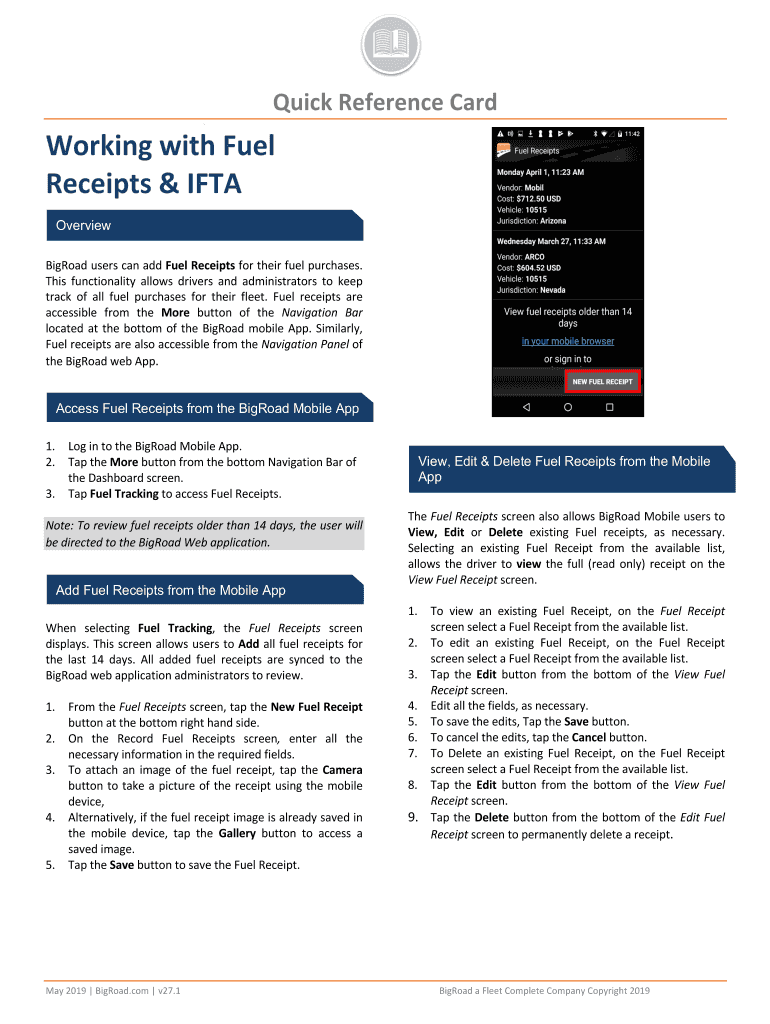

Quick Reference Card Working with Fuel Receipts & IFTA Overview Broad users can add Fuel Receipts for their fuel purchases. This functionality allows drivers and administrators to keep track of all

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign easy ifta fuel tax

Edit your easy ifta fuel tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your easy ifta fuel tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing easy ifta fuel tax online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit easy ifta fuel tax. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out easy ifta fuel tax

How to fill out easy ifta fuel tax

01

To fill out easy ifta fuel tax, follow these steps:

02

Gather all the necessary information, including the total miles driven in each jurisdiction, the total gallons of fuel purchased in each jurisdiction, and any fuel receipts or invoices.

03

Calculate the number of miles traveled in each jurisdiction by using a mileage tracking system or by recording the starting and ending odometer readings for each trip.

04

Calculate the total fuel purchased in each jurisdiction by adding up the gallons of fuel purchased from each fuel receipt or invoice.

05

Determine the fuel tax rate for each jurisdiction, which can be found on the IFTA website or by contacting the respective jurisdiction's motor fuel tax authority.

06

Multiply the total miles traveled in each jurisdiction by the fuel tax rate to calculate the amount of fuel tax owed for that jurisdiction.

07

Multiply the total fuel purchased in each jurisdiction by the fuel tax rate to calculate the amount of fuel tax owed for that jurisdiction.

08

Add up the total amount of fuel tax owed for each jurisdiction to determine the total ifta fuel tax amount that needs to be paid.

09

Complete the ifta fuel tax return form, including all the required information such as company details, vehicle information, and the calculated fuel tax amounts for each jurisdiction.

10

Submit the ifta fuel tax return form along with the payment for the calculated fuel tax amount to the respective motor fuel tax authority.

11

Keep copies of all documentation, including fuel receipts, invoices, and the completed ifta fuel tax return form, for future reference and auditing purposes.

Who needs easy ifta fuel tax?

01

Easy ifta fuel tax is needed by commercial motor carriers and operators who operate qualifying vehicles across two or more jurisdictions that participate in the International Fuel Tax Agreement (IFTA).

02

Qualifying vehicles include those that have a gross vehicle weight rating (GVWR) of over 26,000 pounds, or have three or more axles regardless of weight, and are used for transporting goods or passengers.

03

By using easy ifta fuel tax, these motor carriers and operators can accurately calculate and pay the appropriate fuel tax owed to each jurisdiction in which they operate, ensuring compliance with the IFTA regulations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit easy ifta fuel tax from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your easy ifta fuel tax into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I complete easy ifta fuel tax online?

pdfFiller has made it simple to fill out and eSign easy ifta fuel tax. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

Can I edit easy ifta fuel tax on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share easy ifta fuel tax from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is easy ifta fuel tax?

Easy IFTA fuel tax is a simplified way for interstate motor carriers to report and pay their fuel taxes in multiple states.

Who is required to file easy ifta fuel tax?

Interstate motor carriers who operate qualifying vehicles are required to file easy IFTA fuel tax.

How to fill out easy ifta fuel tax?

You can fill out easy IFTA fuel tax by entering your fuel purchase and mileage information for each jurisdiction.

What is the purpose of easy ifta fuel tax?

The purpose of easy IFTA fuel tax is to simplify the reporting and payment of fuel taxes for interstate motor carriers.

What information must be reported on easy ifta fuel tax?

On easy IFTA fuel tax, you must report your fuel purchase and mileage information for each jurisdiction you operated in.

Fill out your easy ifta fuel tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Easy Ifta Fuel Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.