Get the free Recognizing Employee Expenses on an Accrual Basis : Abacus - fbs admin utah

Show details

Expense

August 2019

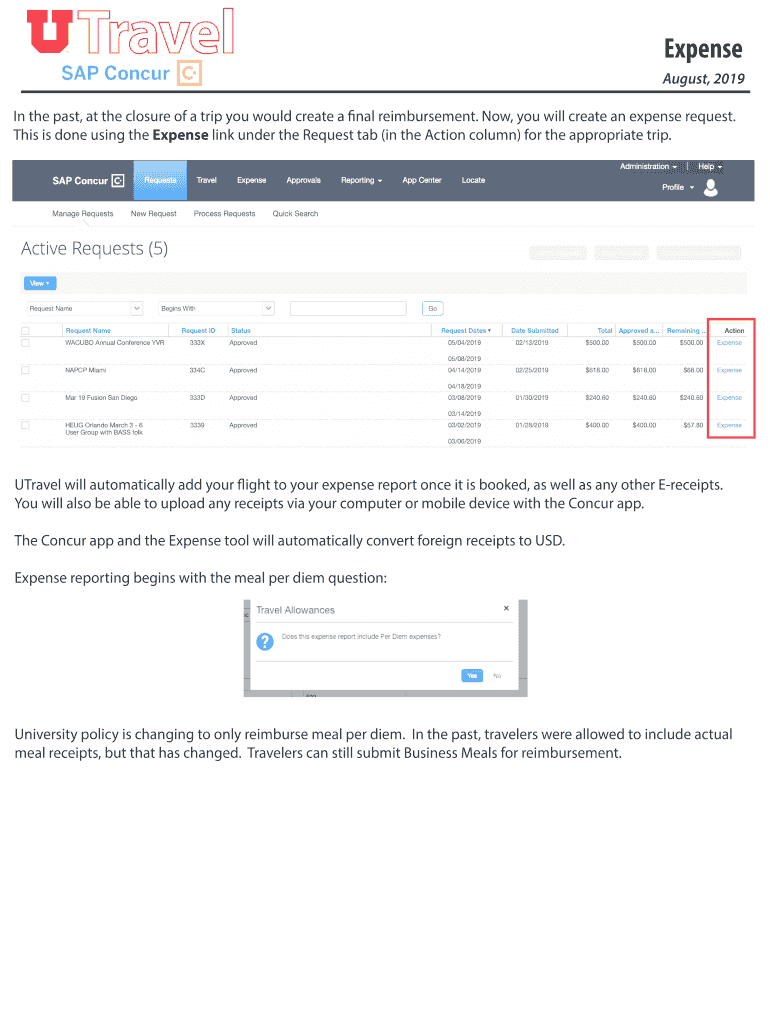

In the past, at the closure of a trip you would create a final reimbursement. Now, you will create an expense request.

This is done using the Expense link under the Request tab

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign recognizing employee expenses on

Edit your recognizing employee expenses on form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your recognizing employee expenses on form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing recognizing employee expenses on online

To use the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit recognizing employee expenses on. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out recognizing employee expenses on

How to fill out recognizing employee expenses on

01

Gather all the necessary information and documentation related to employee expenses.

02

Determine the appropriate expense recognition method to use. This may depend on accounting policies and regulations.

03

Identify the expense categories and allocate the expenses to the respective categories.

04

Calculate the total expenses for each category and verify the accuracy of the calculations.

05

Prepare the appropriate journal entries to record the recognized employee expenses.

06

Review and reconcile the recorded expenses with supporting documentation to ensure accuracy.

07

Close the recognition process by updating the financial records and reports with the recognized employee expenses.

Who needs recognizing employee expenses on?

01

Companies and organizations that have employees who incur expenses as part of their job responsibilities.

02

Accounting and finance departments that need to accurately record and track employee expenses for reporting and analysis purposes.

03

Auditors and regulators who require transparent and compliant recognition of employee expenses.

04

Tax authorities who need to ensure proper deduction and reporting of employee expenses for tax purposes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete recognizing employee expenses on online?

pdfFiller has made it easy to fill out and sign recognizing employee expenses on. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

Can I create an eSignature for the recognizing employee expenses on in Gmail?

Create your eSignature using pdfFiller and then eSign your recognizing employee expenses on immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How can I edit recognizing employee expenses on on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing recognizing employee expenses on, you can start right away.

What is recognizing employee expenses on?

Recognizing employee expenses is based on the accrual accounting principle, where expenses are recognized in the period they are incurred, regardless of when they are actually paid.

Who is required to file recognizing employee expenses on?

Employers and businesses that have employees and incur expenses related to their compensation are required to file recognizing employee expenses on.

How to fill out recognizing employee expenses on?

Recognizing employee expenses can be filled out by keeping accurate records of employee expenses, including salaries, benefits, bonuses, and other related costs, and reporting them in the appropriate income statement accounts.

What is the purpose of recognizing employee expenses on?

The purpose of recognizing employee expenses is to accurately reflect the true cost of employing individuals and to provide a clear picture of the financial health of a company.

What information must be reported on recognizing employee expenses on?

Information that must be reported on recognizing employee expenses includes salaries, benefits, payroll taxes, retirement contributions, and any other costs related to employee compensation.

Fill out your recognizing employee expenses on online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Recognizing Employee Expenses On is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.