Get the free Exenciones de impuestos para personas de la tercera edad y ...

Show details

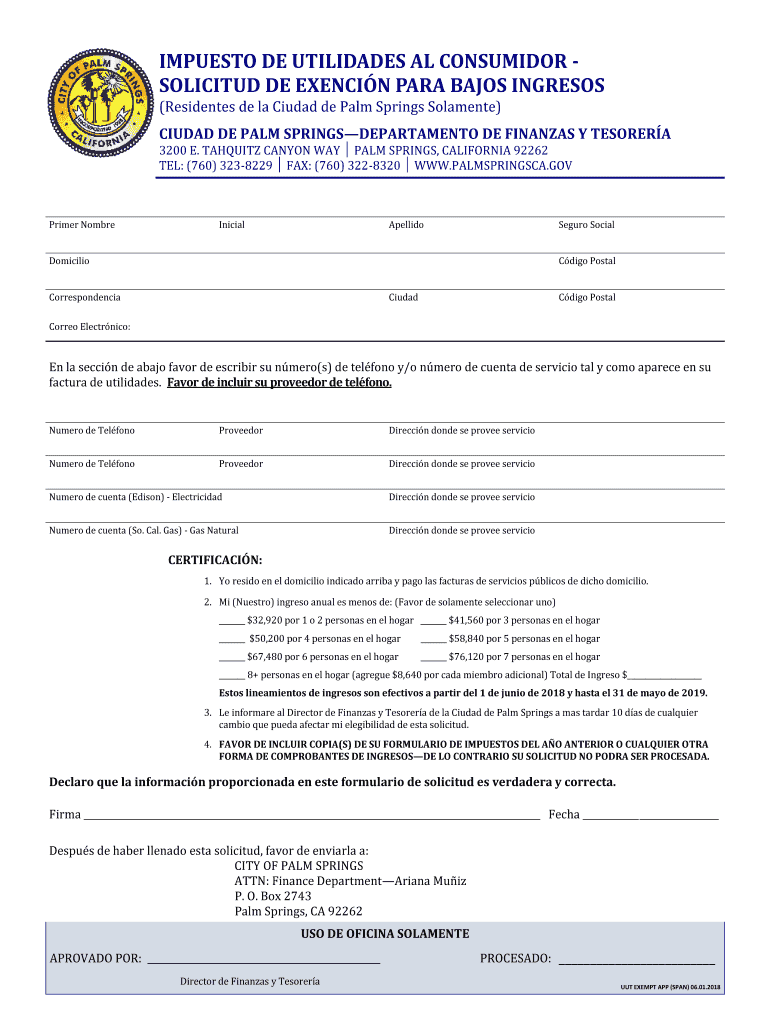

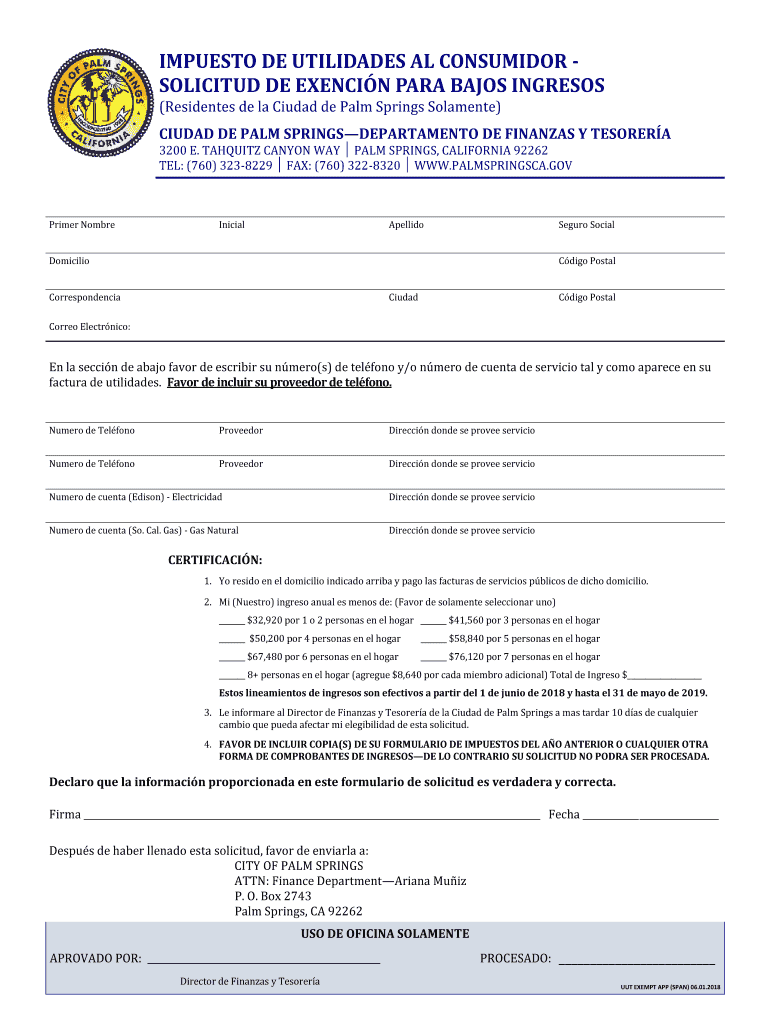

IMPASTO DE UTILITIES AL CONSIDER SOLICITED DE EVENING PARA BANJOS INGRESS (Residents de la Ciudad de Palm Springs Solvent) CIUDAD DE PALM SPRINGSDEPARTAMENTO DE FINANCES Y TERESA 3200 E. TAHITI CANYON

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign exenciones de impuestos para

Edit your exenciones de impuestos para form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your exenciones de impuestos para form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit exenciones de impuestos para online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit exenciones de impuestos para. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out exenciones de impuestos para

How to fill out exenciones de impuestos para

01

To fill out exenciones de impuestos para, follow these steps:

02

Obtain the necessary forms for exenciones de impuestos para. These can usually be found on the website of the tax authority or can be obtained in person at a tax office.

03

Carefully read the instructions provided with the forms to understand the eligibility criteria and the specific information required.

04

Gather all the necessary documents and information needed to complete the forms. This may include personal identification, proof of income, and any relevant receipts or documentation.

05

Fill out the forms accurately and completely. Make sure to provide all the required information and double-check for any errors or missing details.

06

Submit the completed forms to the appropriate tax authority. This can usually be done online, by mail, or in person at a tax office.

07

Keep copies of all the submitted documents for your records.

08

Wait for a response from the tax authority regarding your application for exenciones de impuestos para. This may involve further verification or request for additional information.

09

If approved, make sure to follow any instructions provided on how to claim the tax exemption or benefits.

10

If your application is denied, carefully review the reasons for rejection and consider seeking professional assistance or reapplying with the necessary corrections.

11

Keep track of any deadlines or renewal requirements related to the exenciones de impuestos para to ensure continued eligibility.

12

Remember, it is always recommended to consult with a tax professional or seek guidance from the relevant tax authority for specific and up-to-date instructions.

Who needs exenciones de impuestos para?

01

Exenciones de impuestos para is needed by individuals or organizations who qualify for certain tax benefits or exemptions.

02

The specific eligibility criteria may vary depending on the country or jurisdiction, but generally, it may be needed by:

03

- Low-income individuals or families who qualify for income-based tax credits or deductions.

04

- Students or educational institutions eligible for education-related tax benefits.

05

- Charitable organizations or non-profit entities eligible for tax exemptions.

06

- Business owners or entrepreneurs eligible for small business tax incentives or deductions.

07

- Individuals with disabilities eligible for disability-related tax benefits.

08

- Homeowners eligible for property tax exemptions or deductions.

09

- Certain individuals or industries eligible for specific tax relief or exemptions as per government regulations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit exenciones de impuestos para online?

The editing procedure is simple with pdfFiller. Open your exenciones de impuestos para in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I edit exenciones de impuestos para in Chrome?

exenciones de impuestos para can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

Can I create an electronic signature for signing my exenciones de impuestos para in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your exenciones de impuestos para right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

What is exenciones de impuestos para?

Exenciones de impuestos para se refiere a las exenciones fiscales para ciertos contribuyentes.

Who is required to file exenciones de impuestos para?

Certain individuals or organizations may be required to file exenciones de impuestos para depending on their tax status.

How to fill out exenciones de impuestos para?

Exenciones de impuestos para deben ser completadas con la información fiscal correspondiente y presentadas a la autoridad fiscal competente.

What is the purpose of exenciones de impuestos para?

The purpose of exenciones de impuestos para is to report and claim tax exemptions for eligible individuals or organizations.

What information must be reported on exenciones de impuestos para?

Information such as income, deductions, credits, and tax-exempt status must be reported on exenciones de impuestos para.

Fill out your exenciones de impuestos para online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Exenciones De Impuestos Para is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.