Get the free Revenue Anticipation Note (RAN) - Investopedia

Show details

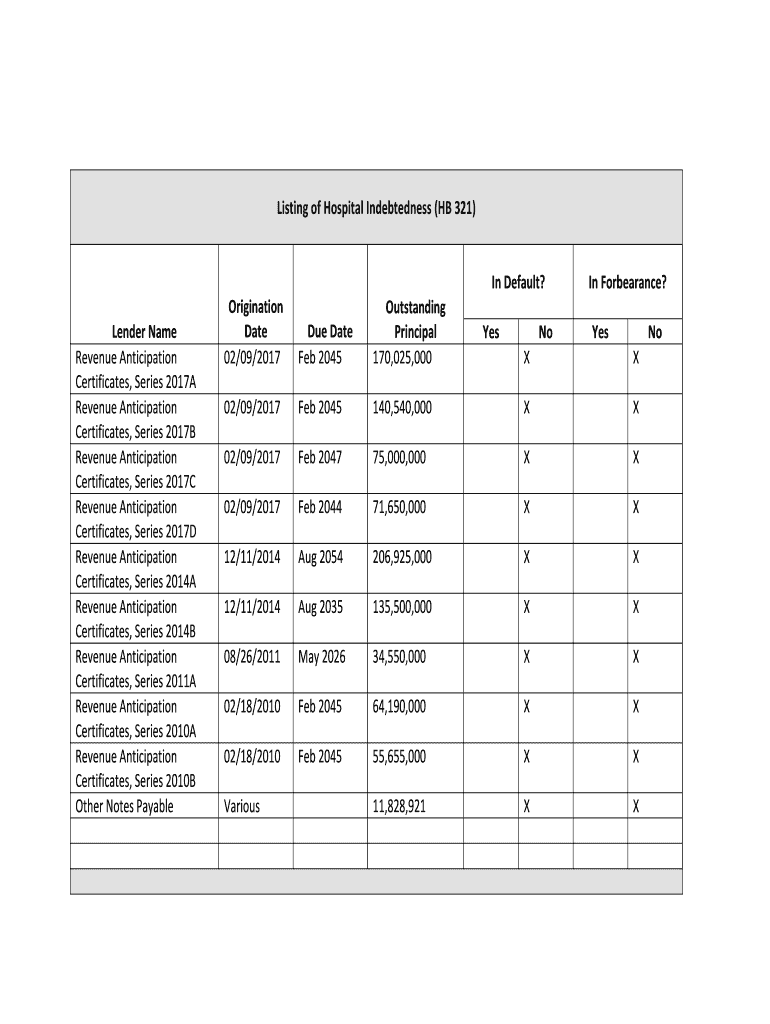

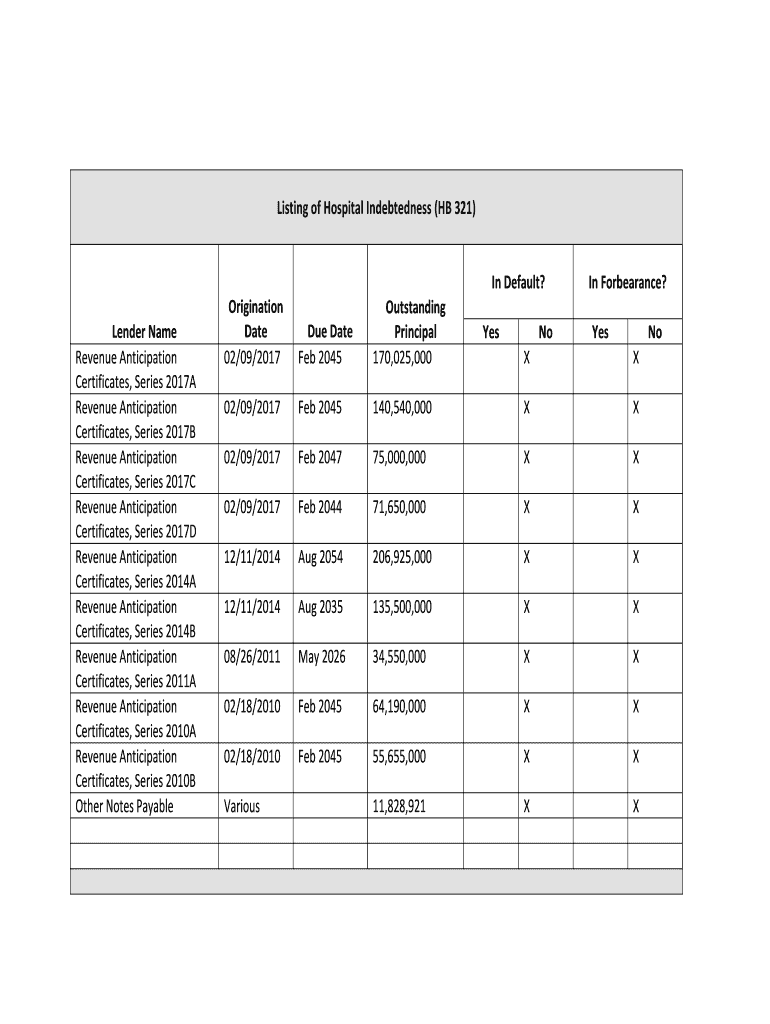

Listing of Hospital Indebtedness (HE 321)Lender Name

Revenue Anticipation

Certificates, Series 2017A

Revenue Anticipation

Certificates, Series 2017B

Revenue Anticipation

Certificates, Series 2017C

Revenue

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign revenue anticipation note ran

Edit your revenue anticipation note ran form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your revenue anticipation note ran form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing revenue anticipation note ran online

To use our professional PDF editor, follow these steps:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit revenue anticipation note ran. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out revenue anticipation note ran

How to fill out revenue anticipation note ran

01

To fill out a revenue anticipation note (RAN), follow these steps:

02

Start by obtaining a RAN application form from the relevant issuing authority or financial institution.

03

Provide the necessary information in the application form, such as the name of the issuer, principal amount, interest rate, maturity date, and any additional terms and conditions.

04

Attach any required supporting documents, such as financial statements or government approvals.

05

Review the completed application form to ensure accuracy and sign it.

06

Submit the filled out application form along with any supporting documents to the issuing authority or financial institution.

07

Pay any applicable fees or charges associated with the RAN application.

08

Wait for the application to be processed and approved by the issuing authority or financial institution.

09

Once approved, receive the RAN document and ensure to comply with any terms and conditions outlined.

10

Use the funds obtained from the RAN for the intended purpose.

11

Note: It is recommended to consult with a financial advisor or legal expert familiar with RANs to ensure compliance with all applicable regulations and procedures.

Who needs revenue anticipation note ran?

01

Revenue anticipation notes (RANs) are typically used by state or local governments or public entities.

02

These entities may require short-term financing to bridge a gap between anticipated revenue inflow and immediate funding needs.

03

RANs provide a means for these entities to access funds in advance based on expected future revenues, such as tax collections or grants.

04

By utilizing RANs, these entities can meet their immediate funding requirements, such as meeting payroll or funding public infrastructure projects, while waiting for the actual revenue to be received.

05

Since RANs are generally short-term in nature, they are suitable for entities with a reliable revenue stream and a clear repayment plan.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete revenue anticipation note ran online?

Completing and signing revenue anticipation note ran online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I make changes in revenue anticipation note ran?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your revenue anticipation note ran to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I edit revenue anticipation note ran on an Android device?

The pdfFiller app for Android allows you to edit PDF files like revenue anticipation note ran. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is revenue anticipation note ran?

A revenue anticipation note (RAN) is a short-term debt instrument issued by a municipality in anticipation of future revenue.

Who is required to file revenue anticipation note ran?

Municipalities or local governments may be required to file revenue anticipation notes (RANs) if they need to borrow money for short-term expenses.

How to fill out revenue anticipation note ran?

To fill out a revenue anticipation note (RAN), the issuer must provide information about the amount being borrowed, the anticipated revenue that will repay the note, and other relevant details.

What is the purpose of revenue anticipation note ran?

The purpose of a revenue anticipation note (RAN) is to provide municipalities with short-term financing to cover expenses until anticipated revenue is received.

What information must be reported on revenue anticipation note ran?

Information such as the amount borrowed, repayment terms, anticipated revenue sources, and other relevant financial details must be reported on a revenue anticipation note (RAN).

Fill out your revenue anticipation note ran online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Revenue Anticipation Note Ran is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.