Get the free certified payroll and compliance manual - Nevada Department ...

Show details

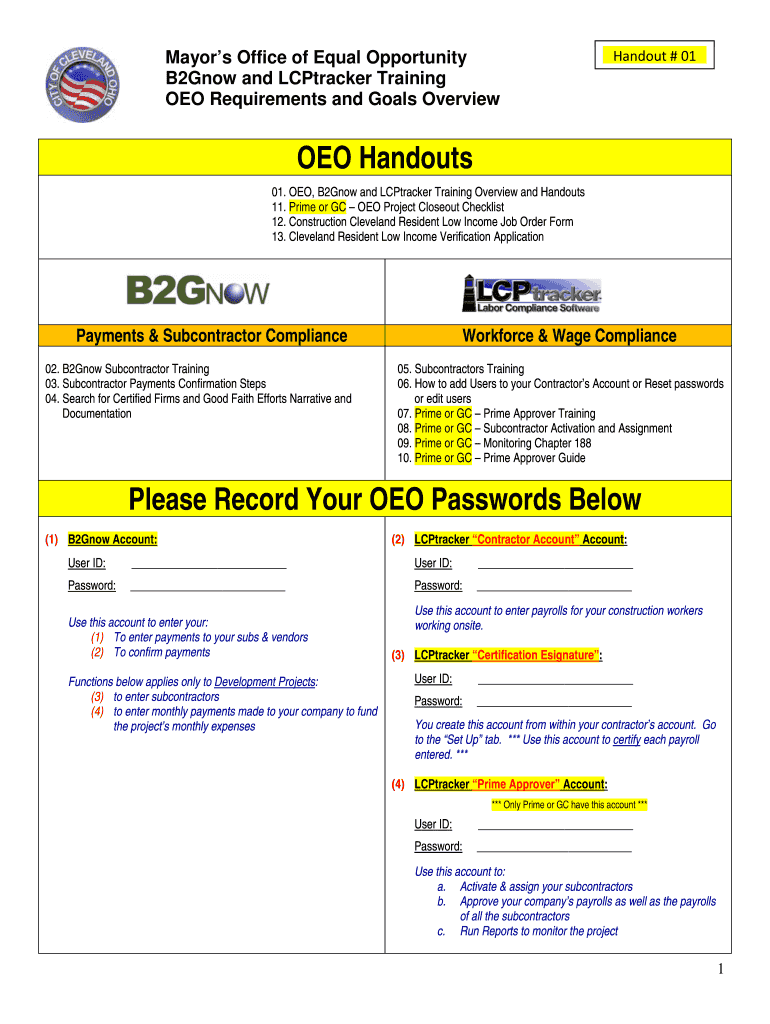

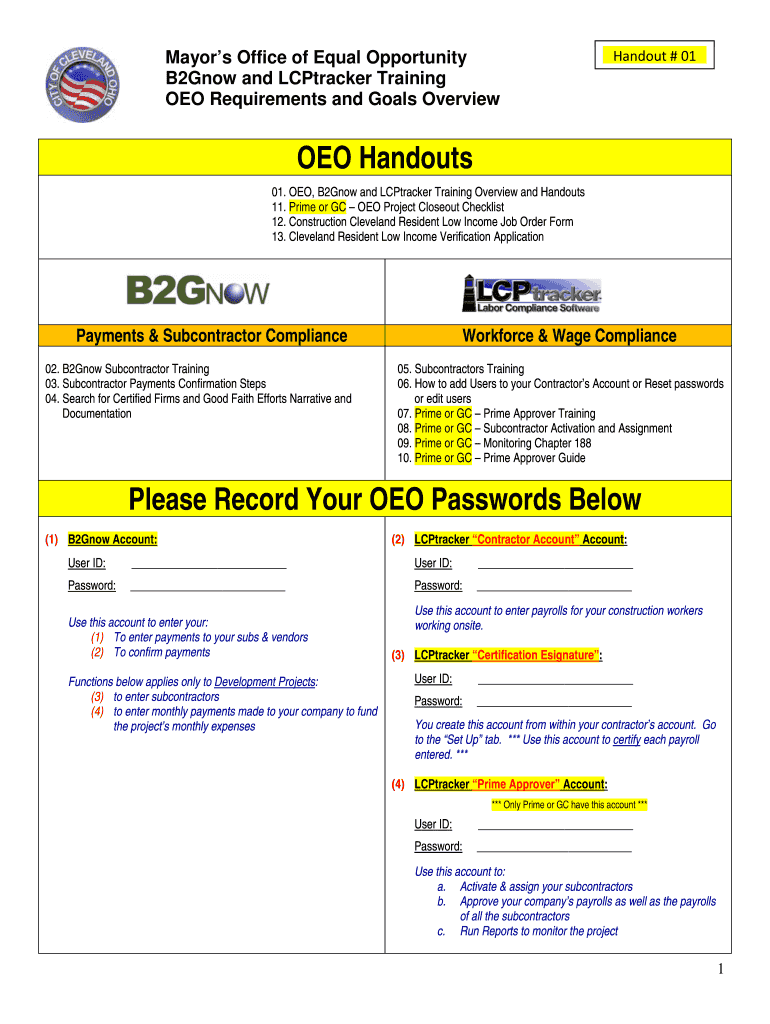

Mayors Office of Equal Opportunity B2Gnow and LCP tracker Training OEM Requirements and Goals OverviewHandout # 01OEO Handouts 01. OEM, B2Gnow and LCP tracker Training Overview and Handouts 11. Prime

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign certified payroll and compliance

Edit your certified payroll and compliance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your certified payroll and compliance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit certified payroll and compliance online

To use our professional PDF editor, follow these steps:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit certified payroll and compliance. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out certified payroll and compliance

How to fill out certified payroll and compliance

01

To fill out certified payroll and compliance correctly, follow these steps:

02

Gather required information: Obtain all relevant documents, such as employee time sheets, pay rates, and certified payroll reports.

03

Understand prevailing wage rates: Familiarize yourself with the prevailing wage rates set by the government for specific job classifications and locations.

04

Record employee information: Enter the details of each employee, including their name, address, Social Security number, job classification, hours worked, and wages paid.

05

Calculate gross wages: Calculate the gross wages for each employee by multiplying their hourly rate by the number of hours worked.

06

Determine deductions: Determine and subtract any deductions, such as taxes, insurance premiums, or retirement contributions.

07

Calculate net wages: Subtract deductions from gross wages to determine the net wages for each employee.

08

Record fringe benefits: If applicable, record and report any fringe benefits provided to employees, such as health insurance or vacation pay.

09

Complete certified payroll report: Fill out the certified payroll report form provided by the government. Include all necessary employee information, wages, deductions, and fringe benefits.

10

Submit the report: Submit the completed certified payroll report to the appropriate government agency or contracting agency within the specified timeline.

11

Maintain records: Keep copies of all certified payroll reports, time sheets, and supporting documentation for future reference and compliance audits.

Who needs certified payroll and compliance?

01

Certified payroll and compliance are required by various entities, including:

02

- Government agencies: When working on government-funded projects, contractors and subcontractors must submit certified payroll reports to ensure compliance with prevailing wage laws.

03

- Contracting agencies: Similarly, contracting agencies often require certified payroll and compliance documentation to verify that project workers receive proper wages and benefits.

04

- Contractors and subcontractors: Individuals and businesses involved in construction, renovation, or public works projects may need certified payroll to maintain transparency and fulfill legal obligations.

05

- Labor unions: Labor unions might request certified payroll reports to monitor fair wages and working conditions for their members.

06

- Auditors and oversight bodies: Certified payroll and compliance records can be subject to review and audit by auditors or oversight bodies to ensure compliance with labor laws and regulations.

07

- Employees: Workers have the right to request certified payroll records to confirm the accuracy of their wages and ensure proper payment.

08

Overall, certified payroll and compliance are crucial for ensuring transparency, fair wages, and legal compliance in various industries.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the certified payroll and compliance in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

Can I create an eSignature for the certified payroll and compliance in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your certified payroll and compliance and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

Can I edit certified payroll and compliance on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as certified payroll and compliance. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is certified payroll and compliance?

Certified payroll and compliance is a process of verifying and documenting that workers on a construction project are paid correctly and in compliance with prevailing wage laws.

Who is required to file certified payroll and compliance?

Contractors and subcontractors working on public works projects are required to file certified payroll and compliance.

How to fill out certified payroll and compliance?

Certified payroll and compliance forms typically require information about the project, workers' hours and wages, classifications, etc.

What is the purpose of certified payroll and compliance?

The purpose of certified payroll and compliance is to ensure that workers are paid the correct amount in accordance with prevailing wage laws and to promote transparency in the construction industry.

What information must be reported on certified payroll and compliance?

Information such as worker names, hours worked, wages paid, deductions, and classifications must be reported on certified payroll and compliance forms.

Fill out your certified payroll and compliance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Certified Payroll And Compliance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.