Get the free Cafeteria Special Revenue Fund

Show details

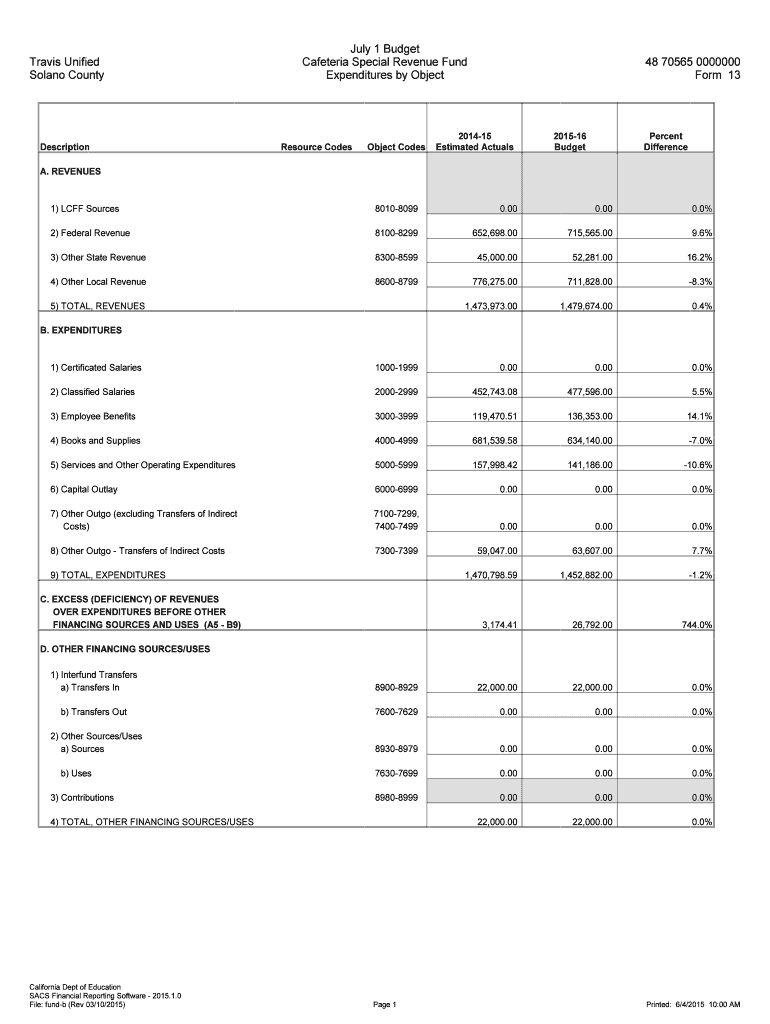

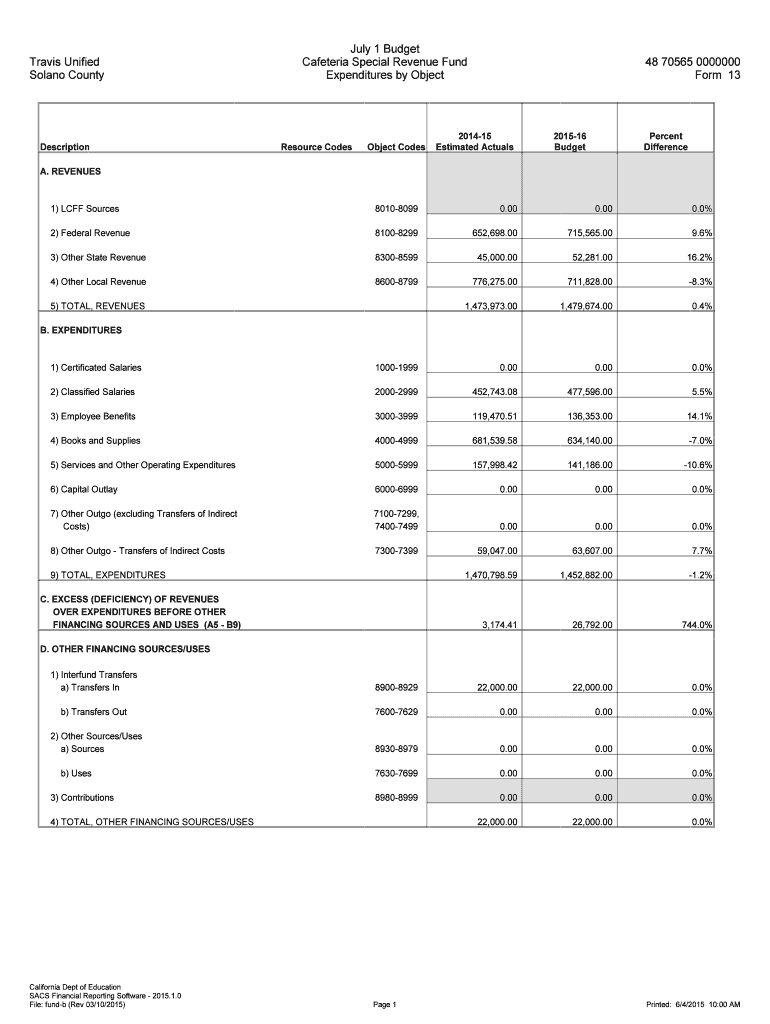

Travis Unified

Solano CountyDescriptionJuly 1 Budget

Cafeteria Special Revenue Fund

Expenditures by ObjectResource CodesObject Codes48 70565 0000000

Form 13201415

Estimated Actuals201516

BudgetPercent

Difference.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign cafeteria special revenue fund

Edit your cafeteria special revenue fund form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cafeteria special revenue fund form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing cafeteria special revenue fund online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit cafeteria special revenue fund. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out cafeteria special revenue fund

How to fill out cafeteria special revenue fund

01

To fill out the cafeteria special revenue fund, follow these steps:

02

Begin by gathering all the relevant financial documents and records related to the cafeteria special revenue fund.

03

Review the income sources and revenue generated by the cafeteria, such as sales of food and beverages.

04

Identify any expenses or costs associated with running the cafeteria, such as purchasing ingredients, paying staff, or maintaining equipment.

05

Calculate the net revenue by subtracting the expenses from the total income. This will give you the surplus or deficit for the cafeteria special revenue fund.

06

Record the net revenue in the corresponding account for the cafeteria special revenue fund.

07

Maintain accurate and up-to-date records of all transactions and financial activities related to the cafeteria special revenue fund.

08

Regularly review and reconcile the cafeteria special revenue fund to ensure accuracy and identify any discrepancies.

09

Prepare financial reports or statements as required, summarizing the revenue, expenses, and overall financial position of the cafeteria special revenue fund.

10

Adhere to any applicable accounting standards or regulations when filling out the cafeteria special revenue fund.

11

Seek professional advice or consultation if necessary to ensure proper management and administration of the cafeteria special revenue fund.

Who needs cafeteria special revenue fund?

01

Cafeteria special revenue fund is needed by:

02

- Educational institutions with cafeterias that generate revenue from food and beverage sales.

03

- Organizations or entities that operate cafeterias as a separate entity and need to maintain separate accounting for the revenue generated.

04

- Government agencies or departments that manage cafeterias and need to track and report on the financial performance of the cafeteria operations.

05

- Non-profit organizations that run cafeterias as part of their operations and need to track the revenue and expenses associated with the cafeteria.

06

- Any entity or individual that wants to ensure transparent and accurate accounting for the revenue and expenses of a cafeteria.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in cafeteria special revenue fund without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your cafeteria special revenue fund, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How can I edit cafeteria special revenue fund on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing cafeteria special revenue fund right away.

How do I complete cafeteria special revenue fund on an Android device?

Use the pdfFiller app for Android to finish your cafeteria special revenue fund. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is cafeteria special revenue fund?

Cafeteria special revenue fund is a fund used to account for revenues generated from cafeteria services in various entities.

Who is required to file cafeteria special revenue fund?

Entities that operate a cafeteria and generate revenue from cafeteria services are required to file cafeteria special revenue fund.

How to fill out cafeteria special revenue fund?

Cafeteria special revenue fund can be filled out by documenting all revenue generated from cafeteria services and reporting it according to the guidelines provided by the governing body.

What is the purpose of cafeteria special revenue fund?

The purpose of cafeteria special revenue fund is to accurately track and report revenues generated from cafeteria services to ensure transparency and accountability.

What information must be reported on cafeteria special revenue fund?

Information such as total revenue generated, expenses incurred, net profit or loss, and any other pertinent financial details related to cafeteria services must be reported on cafeteria special revenue fund.

Fill out your cafeteria special revenue fund online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cafeteria Special Revenue Fund is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.