Get the free MONEY PURCHASE ANNUITY PAYMENT - opers

Show details

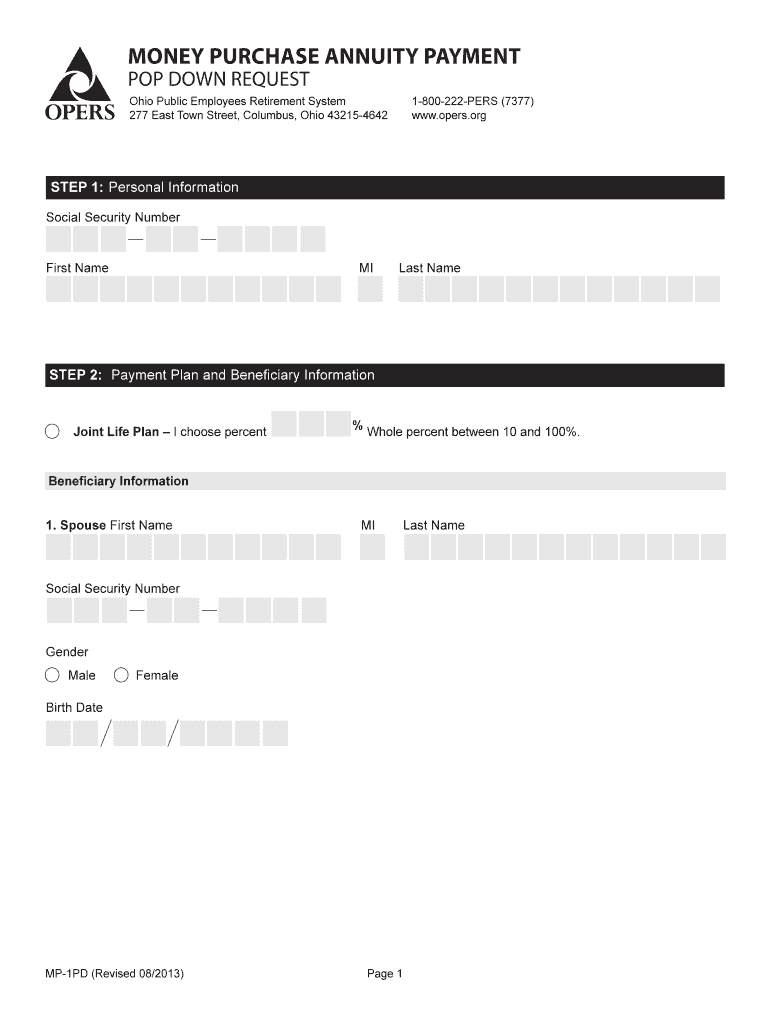

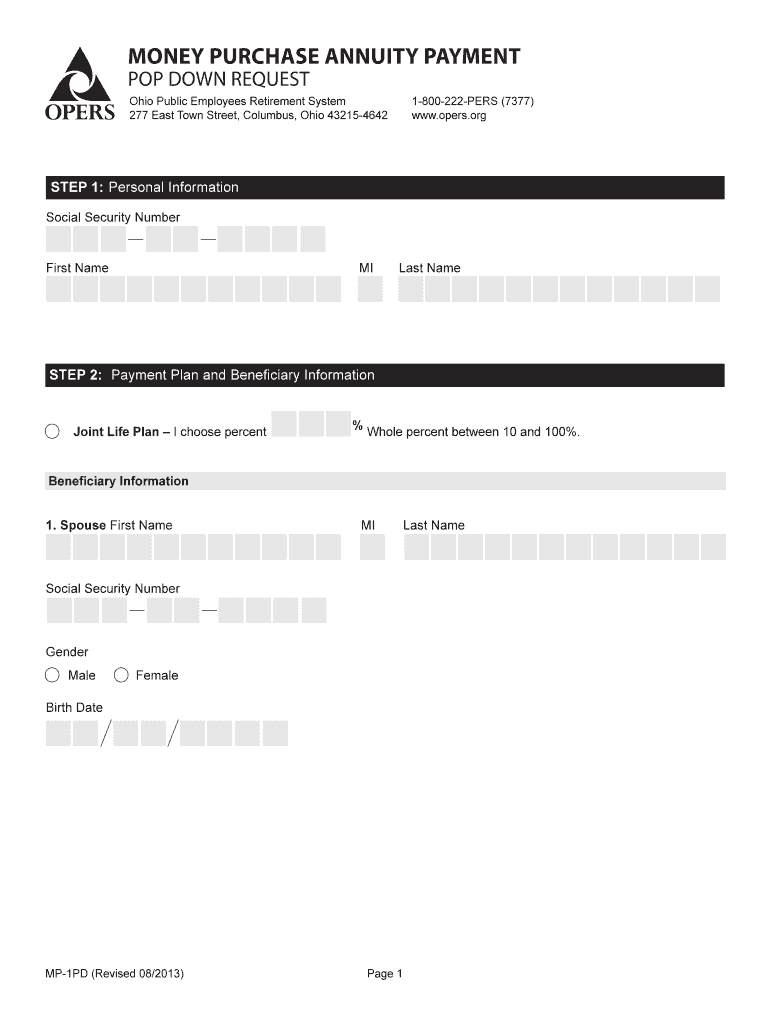

MONEY PURCHASE ANNUITY PAYMENT POP DOWN REQUEST Ohio Public Employees Retirement System 277 East Town Street, Columbus, Ohio 432154642 1800222PERS (7377) www.opers.org STEP 1: Personal Information

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign money purchase annuity payment

Edit your money purchase annuity payment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your money purchase annuity payment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit money purchase annuity payment online

Follow the guidelines below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit money purchase annuity payment. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out money purchase annuity payment

How to fill out money purchase annuity payment:

01

Gather necessary information: Start by gathering all the relevant information needed to fill out the money purchase annuity payment form. This may include your personal details, the annuity policy number, the payment amount, and any specific instructions or options.

02

Review the form: Carefully review the money purchase annuity payment form to ensure that you understand each section and its requirements. Take note of any fields that are mandatory or require additional documentation.

03

Complete personal information: Begin by filling out your personal information accurately. This may include your full name, address, contact details, and any other requested demographic information.

04

Provide annuity policy details: Enter the annuity policy number as requested in the form. This information is crucial for the provider to identify your policy and process the payment accordingly.

05

Specify payment amount and frequency: Indicate the payment amount you wish to receive from the annuity and specify the desired frequency (monthly, quarterly, annually, etc.). Be sure to double-check the accuracy of these details as they directly impact your annuity income.

06

Choose payment method: Select your preferred payment method. You may have options such as direct deposit, check, or electronic transfer. Follow the instructions provided in the form to ensure your preferred method is correctly processed.

07

Review and submit: Once you have completed all the required sections of the money purchase annuity payment form, take a moment to review the entire document. Make sure all the information is accurate and error-free.

08

Attach any necessary documentation: If the form requests additional documentation, such as proof of identification or bank account details, ensure that you have included all the required documents before submission.

Who needs money purchase annuity payment:

01

Individuals planning for retirement: Money purchase annuity payments are often used by individuals as a means to secure a steady income during retirement. Those who want to ensure a regular payout after retirement can opt for this type of annuity.

02

People with substantial pension funds: Money purchase annuity payments are commonly sought by individuals who have accumulated a significant pension fund over the course of their working years. Such individuals may choose to convert their accumulated pension savings into an annuity to provide them with a stable income stream.

03

Those seeking financial security: Money purchase annuity payments can be attractive to individuals who prioritize financial security. By converting a lump sum into an annuity, they can receive regular payments, which can help cover living expenses and provide a predictable income source.

04

Individuals looking to diversify their retirement income: By adding a money purchase annuity payment to their retirement income strategy, individuals can diversify their income sources. This can provide additional stability and peace of mind during retirement.

05

People who want guaranteed lifetime income: Money purchase annuity payments offer the benefit of providing a guaranteed lifetime income. This can be appealing to individuals who do not want to worry about investment risks or fluctuations in the market and desire a stable income for life.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out the money purchase annuity payment form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign money purchase annuity payment. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

How do I edit money purchase annuity payment on an iOS device?

Create, edit, and share money purchase annuity payment from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

How can I fill out money purchase annuity payment on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your money purchase annuity payment, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is money purchase annuity payment?

A money purchase annuity payment is a series of payments made to a retiree from a pension plan that was funded by fixed contributions.

Who is required to file money purchase annuity payment?

Employers or plan administrators are typically responsible for filing money purchase annuity payments with the appropriate regulatory authorities.

How to fill out money purchase annuity payment?

Money purchase annuity payments can be filled out using the required forms provided by the pension plan or regulatory agencies.

What is the purpose of money purchase annuity payment?

The purpose of money purchase annuity payments is to provide a regular income to retirees based on their contributions and investment returns.

What information must be reported on money purchase annuity payment?

Information such as the amount of the payment, the recipient's name and tax identification number, and details of the pension plan must be reported on money purchase annuity payments.

Fill out your money purchase annuity payment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Money Purchase Annuity Payment is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.