Get the free Charitable Giving to Teachers With the Same Name: an ...

Show details

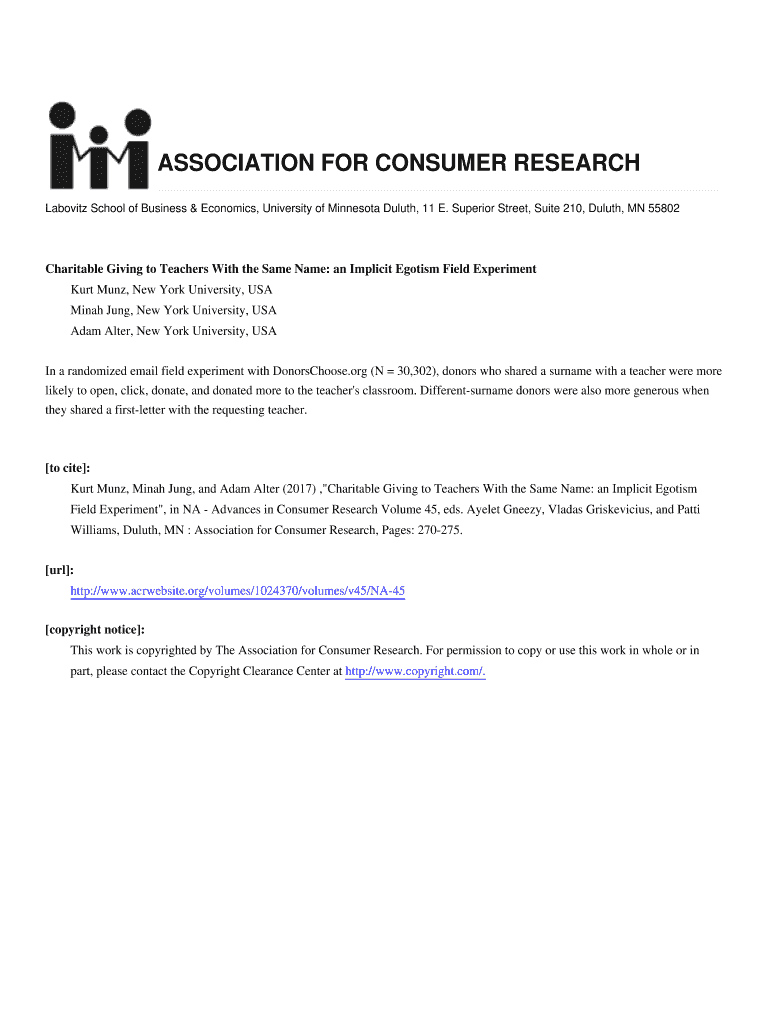

ASSOCIATION FOR CONSUMER RESEARCH Leibniz School of Business & Economics, University of Minnesota Duluth, 11 E. Superior Street, Suite 210, Duluth, MN 55802Charitable Giving to Teachers With the Same

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign charitable giving to teachers

Edit your charitable giving to teachers form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your charitable giving to teachers form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing charitable giving to teachers online

To use the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit charitable giving to teachers. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

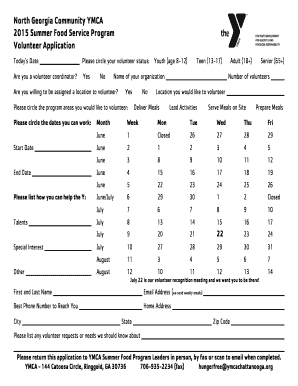

How to fill out charitable giving to teachers

How to fill out charitable giving to teachers

01

Start by researching which teachers or schools you want to support. You can consider reaching out to your local schools, community organizations, or education foundations for recommendations.

02

Contact the chosen teacher or school to inquire about their needs and preferences. It's important to understand what resources or assistance they require to make the most impact.

03

Once you have gathered the necessary information, determine the amount you would like to contribute as a charitable donation. This can be a fixed amount or a range depending on your budget.

04

Decide on the mode of donation. Whether you want to make a monetary contribution, purchase specific materials or resources, or provide services, make sure it aligns with the teacher's or school's requirements.

05

If you are making a monetary donation, consider using reliable platforms or organizations that facilitate charitable giving to ensure transparency and accountability.

06

Complete the necessary paperwork or documentation required by the chosen teacher or school to process the donation. This may include filling out forms, providing receipts, or any other relevant paperwork.

07

If applicable, follow up with the teacher or school to ensure that the donation has been received and utilized as intended. It's always great to receive feedback on how your contribution has made a difference.

08

Finally, consider spreading the word about your charitable giving and encourage others to contribute as well. The more people involved, the greater the impact on teachers and education.

Who needs charitable giving to teachers?

01

Charitable giving to teachers is typically beneficial for various individuals and organizations, including:

02

- Teachers who may lack sufficient resources to enhance learning experiences or meet the needs of their students.

03

- Students who can benefit from improved classroom resources, educational materials, or extracurricular activities.

04

- Schools or educational institutions that may be underfunded and require additional support to provide quality education.

05

- Education foundations or nonprofit organizations dedicated to supporting teachers and enhancing the educational system.

06

- Community members who believe in the importance of education and want to contribute to the betterment of their local schools.

07

In summary, there is a wide range of individuals and organizations who can benefit from charitable giving to teachers.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete charitable giving to teachers online?

pdfFiller has made it easy to fill out and sign charitable giving to teachers. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

Can I create an electronic signature for the charitable giving to teachers in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your charitable giving to teachers in minutes.

How do I complete charitable giving to teachers on an Android device?

Complete your charitable giving to teachers and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is charitable giving to teachers?

Charitable giving to teachers refers to donations or gifts made to educators to support their work and enhance learning opportunities for students.

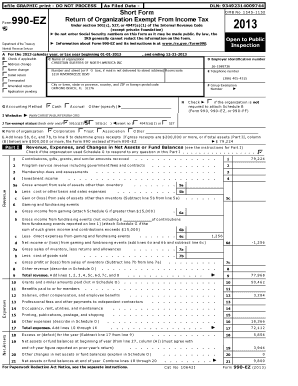

Who is required to file charitable giving to teachers?

Individuals, organizations, or businesses who have made charitable donations to teachers are required to report their contributions.

How to fill out charitable giving to teachers?

To fill out charitable giving to teachers, one must gather receipts or records of donations made, calculate the total amount given, and report this information on the appropriate tax forms.

What is the purpose of charitable giving to teachers?

The purpose of charitable giving to teachers is to show appreciation for their hard work, provide resources for classroom needs, and support educational initiatives.

What information must be reported on charitable giving to teachers?

The information required to be reported on charitable giving to teachers includes the name of the teacher, the amount of donation, the date of donation, and any supporting documentation.

Fill out your charitable giving to teachers online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Charitable Giving To Teachers is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.