Get the free PAC Limits on contributions made by nonconnected ... - FEC

Show details

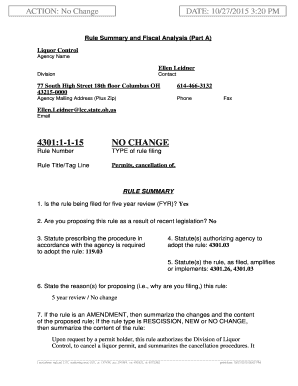

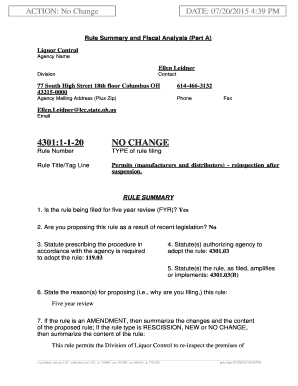

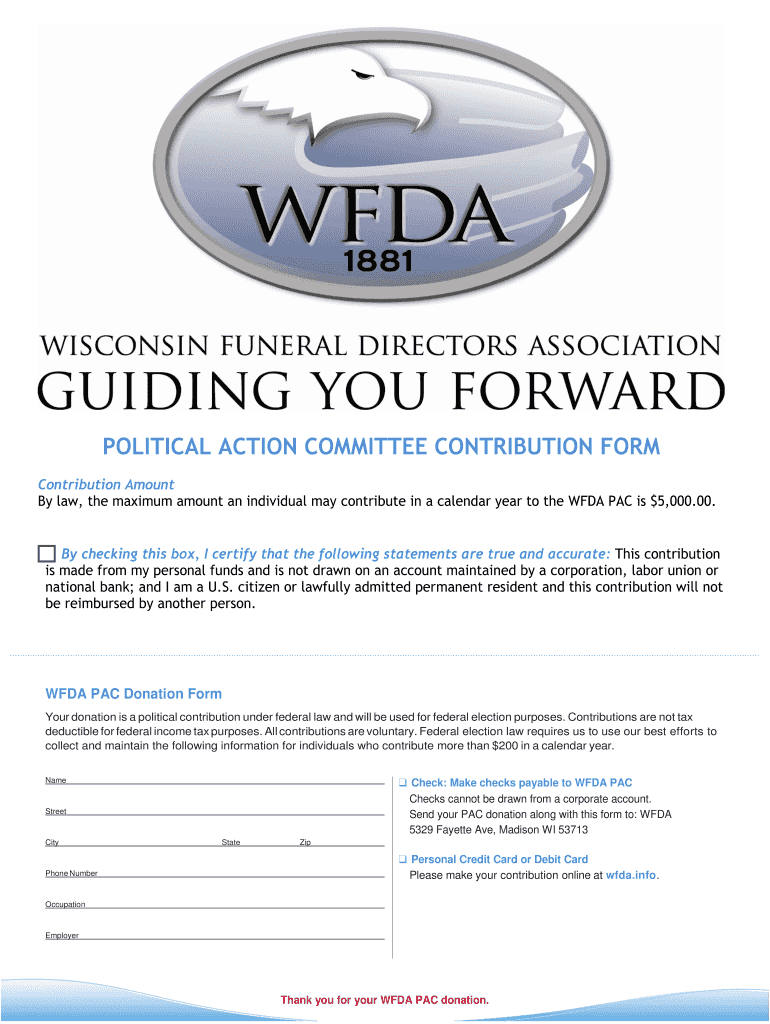

POLITICAL ACTION COMMITTEE CONTRIBUTION FORM

Contribution Amount

By law, the maximum amount an individual may contribute in a calendar year to the FDA PAC is $5,000.00. By checking this box, I certify

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pac limits on contributions

Edit your pac limits on contributions form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pac limits on contributions form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing pac limits on contributions online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit pac limits on contributions. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out pac limits on contributions

How to fill out pac limits on contributions

01

To fill out PAC limits on contributions, follow these steps:

02

Determine the current PAC limits on contributions. These limits can vary depending on the specific laws and regulations of your country or region.

03

Identify the source of the contribution. This can be an individual, a corporation, a labor union, or another type of organization.

04

Determine the type of contribution being made. This could include direct contributions, in-kind contributions, or contributions to independent expenditure committees.

05

Calculate the total amount of the contribution. This may involve adding up multiple contributions if there are any.

06

Make sure the contribution does not exceed the PAC limits. If the contribution amount exceeds the limits, it may be considered illegal and could result in penalties or legal consequences.

07

Fill out the PAC limits on contributions section of the required forms or documents. Provide accurate information about the contribution, including the amount, source, and type of contribution.

08

Submit the forms or documents according to the designated procedures and deadlines. Make sure to comply with any additional requirements or disclosures that may be necessary.

09

Keep records of the contributions and related documentation for future reference or auditing purposes.

10

Note: It is essential to consult relevant legal professionals or authorities to ensure compliance with specific laws and regulations regarding PAC limits on contributions.

Who needs pac limits on contributions?

01

Several entities may need to adhere to PAC limits on contributions, including:

02

- Political Action Committees (PACs): PACs are organizations that raise and spend money to support or oppose political candidates or issues.

03

- Candidates and Campaigns: Individuals running for elected positions or their campaign teams often need to abide by PAC contribution limits.

04

- Donors: Individuals, corporations, labor unions, or other entities making contributions to PACs or directly to candidates may need to consider the limits set by law.

05

- Regulatory Bodies: Government agencies or entities responsible for overseeing campaign finance laws and regulations may require compliance with PAC limits on contributions.

06

- Legal Professionals: Attorneys, lawyers, or legal advisors who work with PACs, candidates, or donors may need to understand and advise on PAC contribution limits.

07

It is important to consult the specific laws and regulations in your jurisdiction to determine who precisely needs to adhere to PAC limits on contributions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my pac limits on contributions directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your pac limits on contributions and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How can I get pac limits on contributions?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the pac limits on contributions in seconds. Open it immediately and begin modifying it with powerful editing options.

How can I edit pac limits on contributions on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing pac limits on contributions, you can start right away.

What is pac limits on contributions?

PAC (Political Action Committee) limits on contributions refer to the maximum amount of money that individuals, organizations, or businesses can donate to a PAC in support of political candidates or causes.

Who is required to file pac limits on contributions?

Any PAC that receives contributions or makes expenditures for the purpose of influencing federal elections is required to file PAC limits on contributions.

How to fill out pac limits on contributions?

PAC limits on contributions can be filled out by submitting the required forms to the Federal Election Commission (FEC) with details of contributions received and expenditures made.

What is the purpose of pac limits on contributions?

The purpose of PAC limits on contributions is to promote transparency and accountability in the political fundraising process, ensuring that contributions are not used to unduly influence elections.

What information must be reported on pac limits on contributions?

PAC limits on contributions require reporting of all contributions received, including donor information, and expenditures made by the PAC.

Fill out your pac limits on contributions online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pac Limits On Contributions is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.