Get the free Creating Charitable Gift Agreements with Nonprofits. Best Practices

Show details

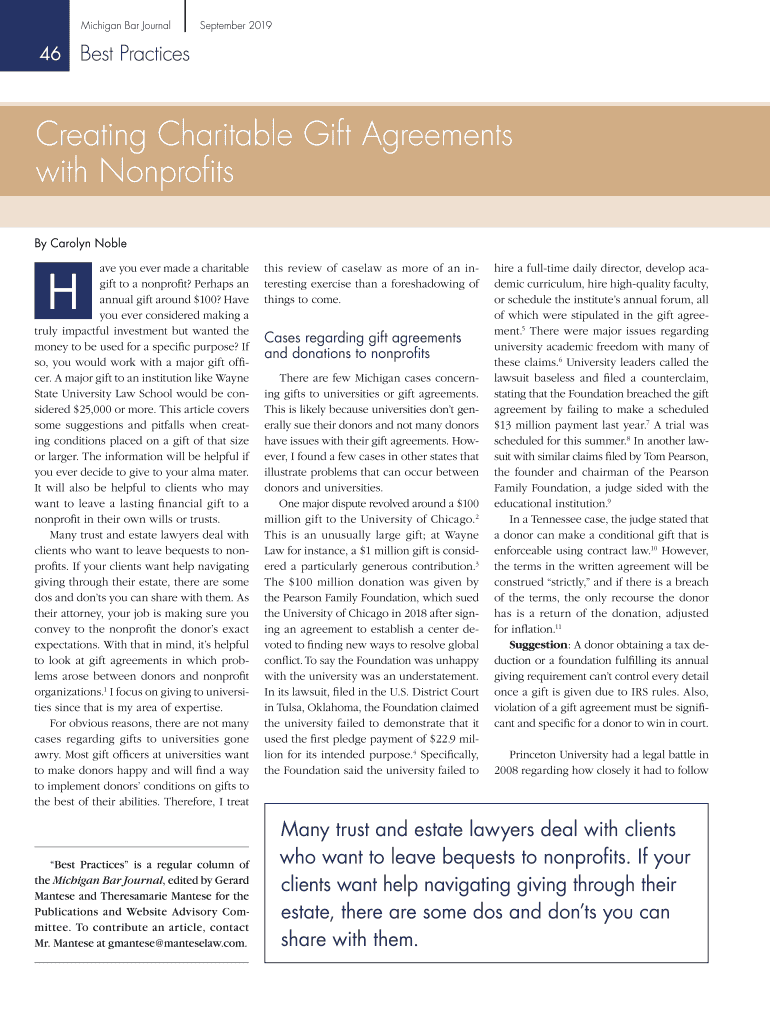

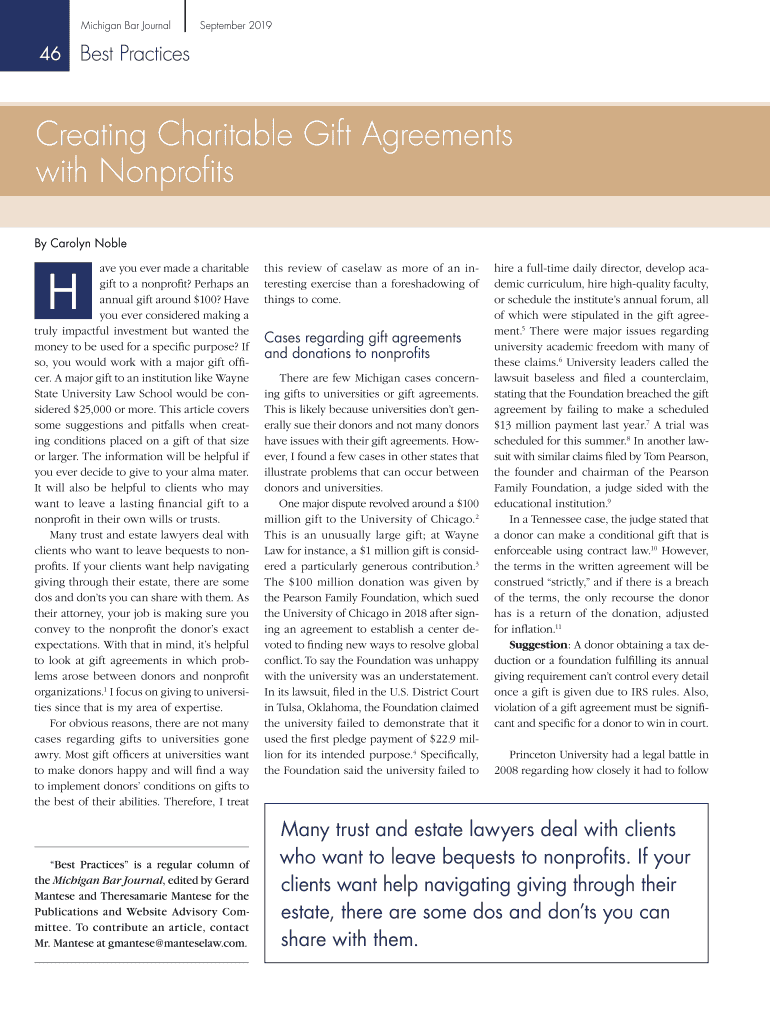

Michigan Bar Journal46September 2019Best PracticesCreating Charitable Gift Agreements

with Nonprofits

By Carolyn Behave you ever made a charitable

gift to a nonprofit? Perhaps an

annual gift around

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign creating charitable gift agreements

Edit your creating charitable gift agreements form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your creating charitable gift agreements form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing creating charitable gift agreements online

Follow the steps down below to benefit from a competent PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit creating charitable gift agreements. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out creating charitable gift agreements

How to fill out creating charitable gift agreements

01

To fill out creating charitable gift agreements, follow these steps:

02

Start by downloading a template for charitable gift agreement or create your own using word processing software.

03

Begin by providing the donor's information, including their name, contact details, and social security number or tax ID.

04

Specify the recipient organization's details, such as its name, address, and tax-exempt status.

05

Clearly state the purpose of the gift, whether it is for general charitable purposes or for a specific program or project.

06

Determine the type of gift being made, whether it is cash, securities, real estate, or other assets, and provide relevant details.

07

Include any special conditions or restrictions associated with the gift, if applicable.

08

Indicate whether the donor wishes to remain anonymous or be acknowledged publicly for the gift.

09

Include provisions for termination or modification of the agreement, if desired.

10

Finalize the agreement by including the dates, signatures of the donor and recipient organization, and any necessary witness signatures.

11

Review the completed agreement to ensure accuracy and address any legal considerations, then retain a copy for both the donor and recipient organization's records.

Who needs creating charitable gift agreements?

01

Creating charitable gift agreements is needed by:

02

- Donors who wish to document their charitable intent and ensure that their gift is used according to their wishes.

03

- Nonprofit organizations that receive charitable gifts and want to provide clarity on the terms and conditions associated with such gifts.

04

- Estate planners and attorneys who assist clients in structuring charitable gifts as part of their overall estate planning strategy.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send creating charitable gift agreements to be eSigned by others?

Once your creating charitable gift agreements is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I make edits in creating charitable gift agreements without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your creating charitable gift agreements, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How do I edit creating charitable gift agreements on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute creating charitable gift agreements from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is creating charitable gift agreements?

Creating charitable gift agreements involves outlining the terms of a donation from a donor to a charitable organization.

Who is required to file creating charitable gift agreements?

Both the donor and the charitable organization are typically required to file creating charitable gift agreements.

How to fill out creating charitable gift agreements?

Creating charitable gift agreements can be filled out by detailing the specifics of the donation, including the amount, purpose, and any conditions attached.

What is the purpose of creating charitable gift agreements?

The purpose of creating charitable gift agreements is to establish a formal agreement between the donor and the charitable organization, ensuring both parties understand the terms of the donation.

What information must be reported on creating charitable gift agreements?

Creating charitable gift agreements must include details such as the names of the parties involved, the amount of the donation, any restrictions or conditions, and the date of the agreement.

Fill out your creating charitable gift agreements online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Creating Charitable Gift Agreements is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.