Get the free flo ' E ' Sr. s-Itt.- MrzOi

Show details

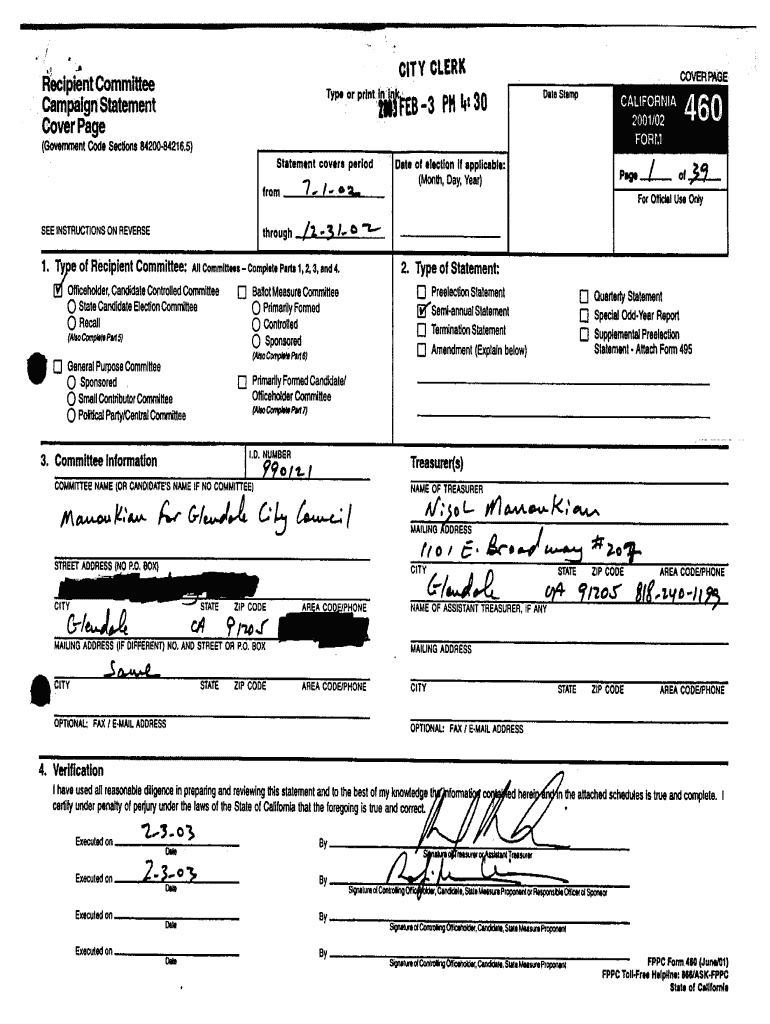

CITY CLERK 3 PH IJ: 39Recipient Committee Campaign Statement Cover Palette or Prlniia9frEBCOVER Date Stamp(Government Code Sections 8420084216.5) Statement covers period from SEE INSTRUCTIONS ON REVERSEthrough1.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign flo e sr s-itt

Edit your flo e sr s-itt form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your flo e sr s-itt form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing flo e sr s-itt online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit flo e sr s-itt. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out flo e sr s-itt

How to fill out flo e sr s-itt

01

Start by opening the flo e sr s-itt form.

02

Read and understand the instructions provided.

03

Begin by filling out the personal information section, including your full name, address, contact information, and social security number.

04

Move on to the next section and provide details about your employment history, including your current and previous employers, job titles, dates of employment, and responsibilities.

05

Fill out the education section, including details about your academic qualifications, degrees, certifications, and any relevant coursework.

06

Proceed to the references section and provide contact information for individuals who can vouch for your character and work ethic.

07

If applicable, complete the additional sections for military service, volunteer work, awards, or honors.

08

Double-check all the information you have entered to ensure accuracy and completeness.

09

Sign and date the form, certifying that all the information provided is true and accurate.

10

Submit the filled out flo e sr s-itt form as per the instructions provided.

Who needs flo e sr s-itt?

01

Anyone who is looking for employment and is required to submit a comprehensive job application may need to fill out a flo e sr s-itt form.

02

Employers often require job applicants to complete this form as it provides a standardized format for collecting essential information about an individual's qualifications, work history, and references.

03

Therefore, individuals who are applying for various positions in different industries or organizations may need to fill out a flo e sr s-itt form to be considered for employment opportunities.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my flo e sr s-itt in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your flo e sr s-itt as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How can I send flo e sr s-itt to be eSigned by others?

Once you are ready to share your flo e sr s-itt, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

Where do I find flo e sr s-itt?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the flo e sr s-itt. Open it immediately and start altering it with sophisticated capabilities.

What is flo e sr s-itt?

FLO E SR S-ITT stands for Form 1099-NEC, which is used to report nonemployee compensation.

Who is required to file flo e sr s-itt?

Businesses or individuals who have paid at least $600 in nonemployee compensation during the tax year are required to file Form 1099-NEC.

How to fill out flo e sr s-itt?

Form 1099-NEC can be filled out electronically or by hand. The form requires information such as the recipient's name, address, and Social Security number, as well as the amount of nonemployee compensation paid.

What is the purpose of flo e sr s-itt?

The purpose of Form 1099-NEC is to report nonemployee compensation to the IRS and the recipient, so that taxes can be properly reported and paid.

What information must be reported on flo e sr s-itt?

Form 1099-NEC requires information on the recipient's name, address, Social Security number, and the total amount of nonemployee compensation paid.

Fill out your flo e sr s-itt online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Flo E Sr S-Itt is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.