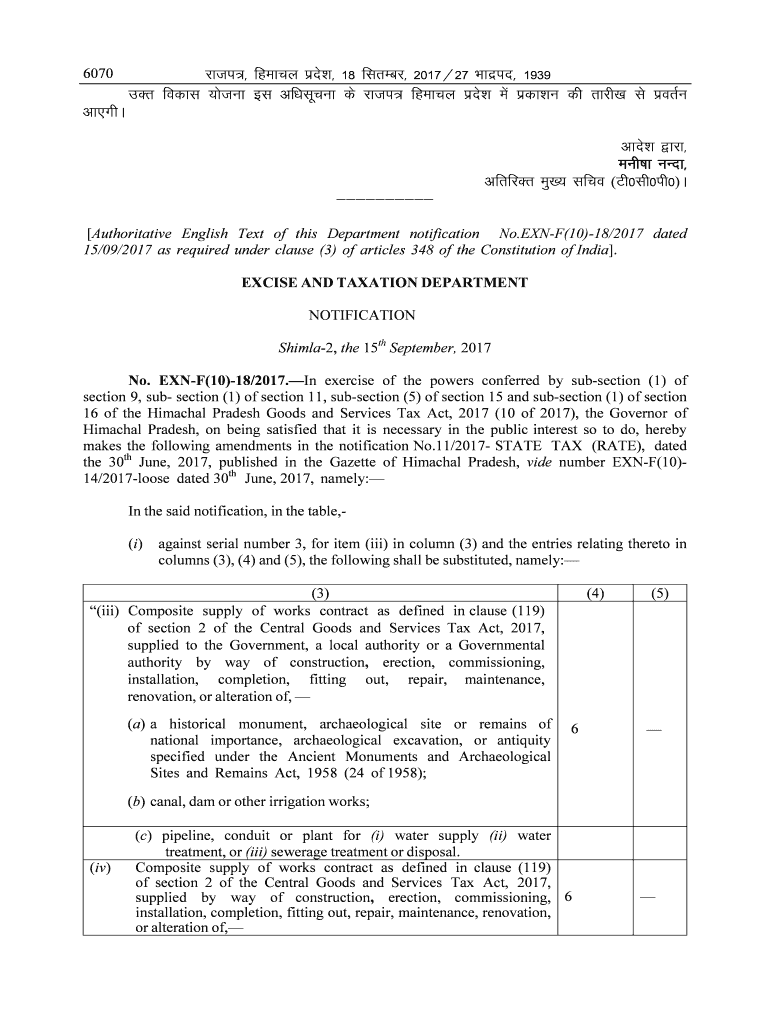

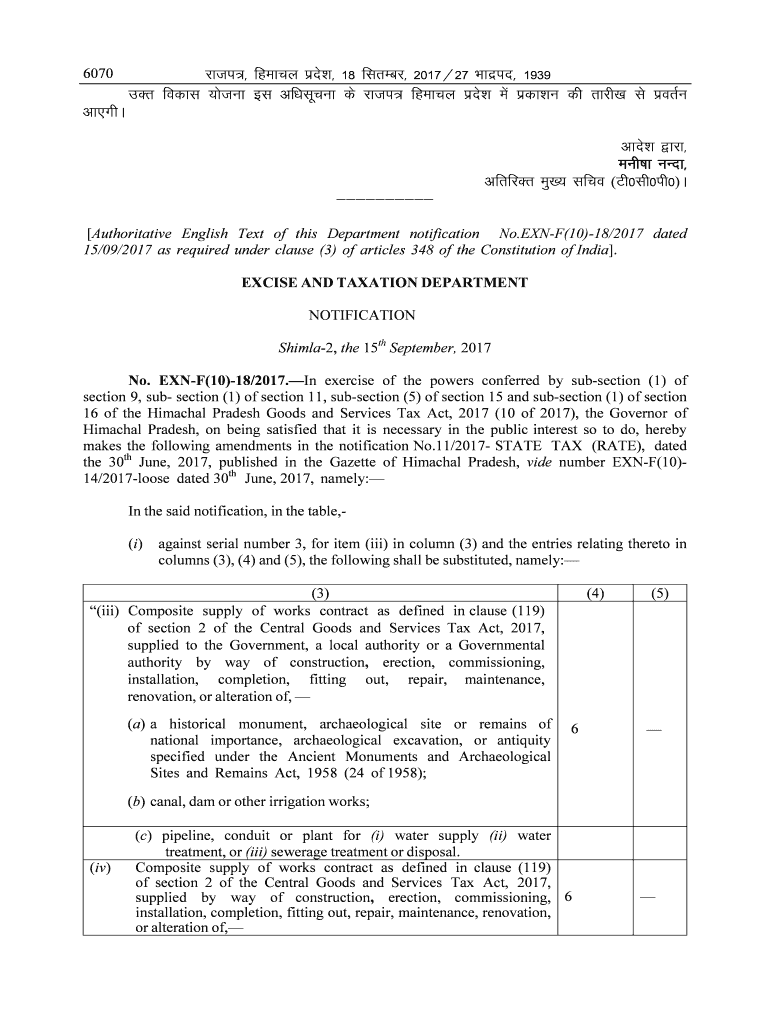

Get the free EXCISE AND TAXATION DEPARTMENT No. EXN-F(10)-18/2017.

Show details

6070jkti agency ions 'k 18 fleece 2017 27 Kenzie 1939 MDR model ;stuck bl VF/Klaus DS anti agency ions 'k ESA IDK 'KU DH rich k ls izorZuvk, FHA vans CJK Skunk punk vfrfjDr EQ ; LFO (Vh0lh0ih0)A &&&&&&&&&&

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign excise and taxation department

Edit your excise and taxation department form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your excise and taxation department form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit excise and taxation department online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit excise and taxation department. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out excise and taxation department

How to fill out excise and taxation department

01

Step 1: Obtain the necessary forms and documents from the Excise and Taxation Department.

02

Step 2: Fill out the forms accurately and completely, providing all required information.

03

Step 3: Attach any supporting documents or evidence as requested.

04

Step 4: Double-check the filled-out forms for any errors or omissions.

05

Step 5: Submit the completed forms and documents to the Excise and Taxation Department either in person or by mail.

06

Step 6: Pay any applicable fees or taxes as per the department's guidelines.

07

Step 7: Keep copies of all submitted documents and receipts for future reference or verification.

Who needs excise and taxation department?

01

Individuals and businesses who are required by law to report and pay various types of taxes, such as income tax, sales tax, property tax, or excise tax.

02

Anyone who wishes to comply with tax regulations and avoid legal consequences or penalties.

03

Government agencies and officials who rely on accurate tax reporting and collection for funding public services and infrastructure.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send excise and taxation department for eSignature?

When you're ready to share your excise and taxation department, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Can I sign the excise and taxation department electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your excise and taxation department in seconds.

Can I edit excise and taxation department on an Android device?

The pdfFiller app for Android allows you to edit PDF files like excise and taxation department. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is excise and taxation department?

The excise and taxation department is a government agency responsible for levying and collecting taxes on certain goods and services.

Who is required to file excise and taxation department?

Businesses and individuals engaged in activities that are subject to excise and taxation laws are required to file with the excise and taxation department.

How to fill out excise and taxation department?

To fill out the excise and taxation department, individuals and businesses must provide information on their activities, income sources, and tax liabilities.

What is the purpose of excise and taxation department?

The purpose of the excise and taxation department is to ensure that taxes on specific goods and services are collected fairly and accurately.

What information must be reported on excise and taxation department?

Reports must include details about the nature of the activities, income generated, applicable taxes, and any deductions or exemptions claimed.

Fill out your excise and taxation department online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Excise And Taxation Department is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.