Get the free Estimates are due by the 15th day of the fourth, sixth, ninth and twelfth months of ...

Show details

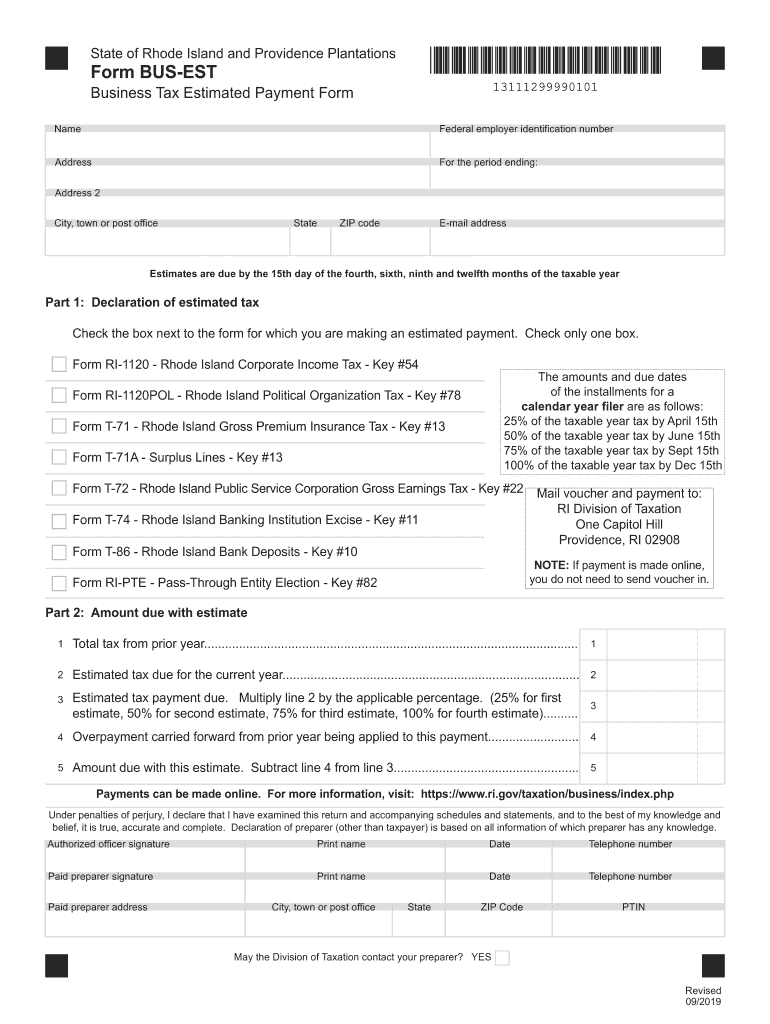

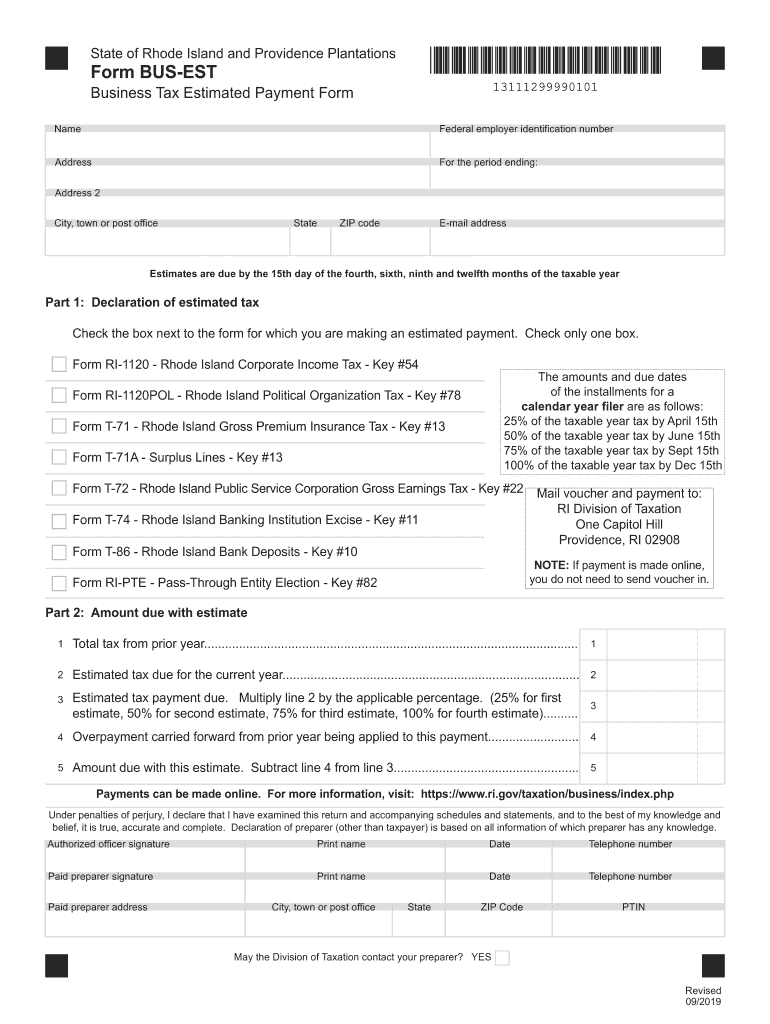

State of Rhode Island and Providence PlantationsForm BUSES

13111299990101Business Tax Estimated Payment Form

Name Federal employer identification numberAddressFor the period ending:Address 2

City,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign estimates are due by

Edit your estimates are due by form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your estimates are due by form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit estimates are due by online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit estimates are due by. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out estimates are due by

How to fill out estimates are due by

01

To fill out estimates are due by, follow these steps:

02

Start by gathering all the necessary information, such as the project details, including the scope, deliverables, and timelines.

03

Identify the key components that will affect the estimate, such as resources required, materials, and any additional costs.

04

Break down the project into smaller tasks or work packages.

05

Assign a timeframe or duration to each task, considering the dependencies and any potential bottlenecks.

06

Consider any risk factors or uncertainties that may impact the estimate and account for them in a contingency plan.

07

Calculate the effort or hours required for each task, considering the productivity levels and expertise of the team members involved.

08

Estimate the cost for each task, taking into account the rates or salaries of the team members, any external vendors or contractors, and any direct expenses.

09

Sum up all the costs and efforts to derive the overall estimate for the project.

10

Prepare a detailed breakdown of the estimate, including the individual tasks, their costs, and the assumptions made.

11

Review and validate the estimate for accuracy and completeness.

12

Communicate the estimate to the relevant stakeholders, such as clients, project managers, or finance departments.

13

Keep a record of the estimate for future reference and tracking purposes.

Who needs estimates are due by?

01

Various stakeholders may need estimates are due by, including:

02

- Project managers: They require estimates to plan and schedule resources, set project budgets, and track progress.

03

- Clients or customers: They need estimates to evaluate the cost and feasibility of a project before giving the go-ahead.

04

- Finance departments: They use estimates to allocate funds, forecast expenses, and ensure budget compliance.

05

- Executives or decision-makers: They depend on estimates to make informed decisions regarding project investments or resource allocations.

06

- Contractors or vendors: They rely on estimates to provide pricing proposals and negotiate contracts with clients.

07

- Team members: They benefit from estimates to understand the effort and timeline required for their individual tasks.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my estimates are due by in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign estimates are due by and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I get estimates are due by?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific estimates are due by and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I make edits in estimates are due by without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your estimates are due by, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

What is estimates are due by?

Estimates are due by a specific deadline set by the tax authority.

Who is required to file estimates are due by?

Individuals or businesses with income that is not subject to withholding are required to file estimates.

How to fill out estimates are due by?

Estimates are usually filled out using a designated form provided by the tax authority.

What is the purpose of estimates are due by?

The purpose of estimates is to ensure that taxpayers are paying their taxes throughout the year, rather than in one lump sum at the end.

What information must be reported on estimates are due by?

Income, deductions, credits, and tax payments made throughout the year must be reported on estimates.

Fill out your estimates are due by online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Estimates Are Due By is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.