Get the free Personal, Business, Commercial Banking ServicesUnion Bank

Show details

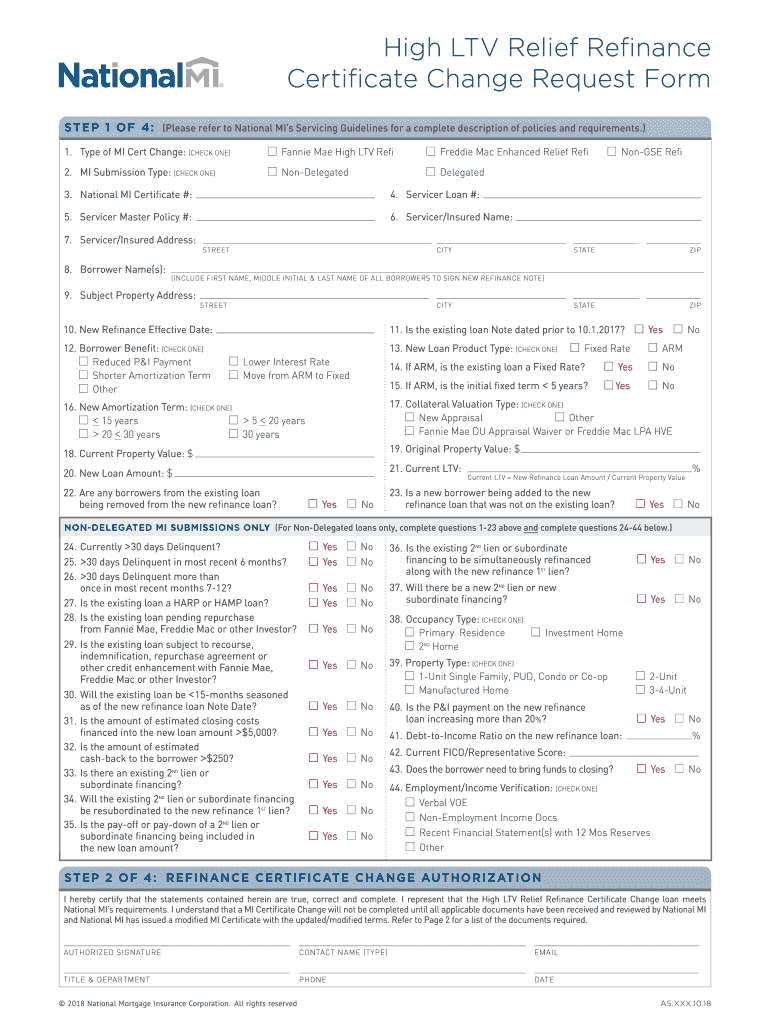

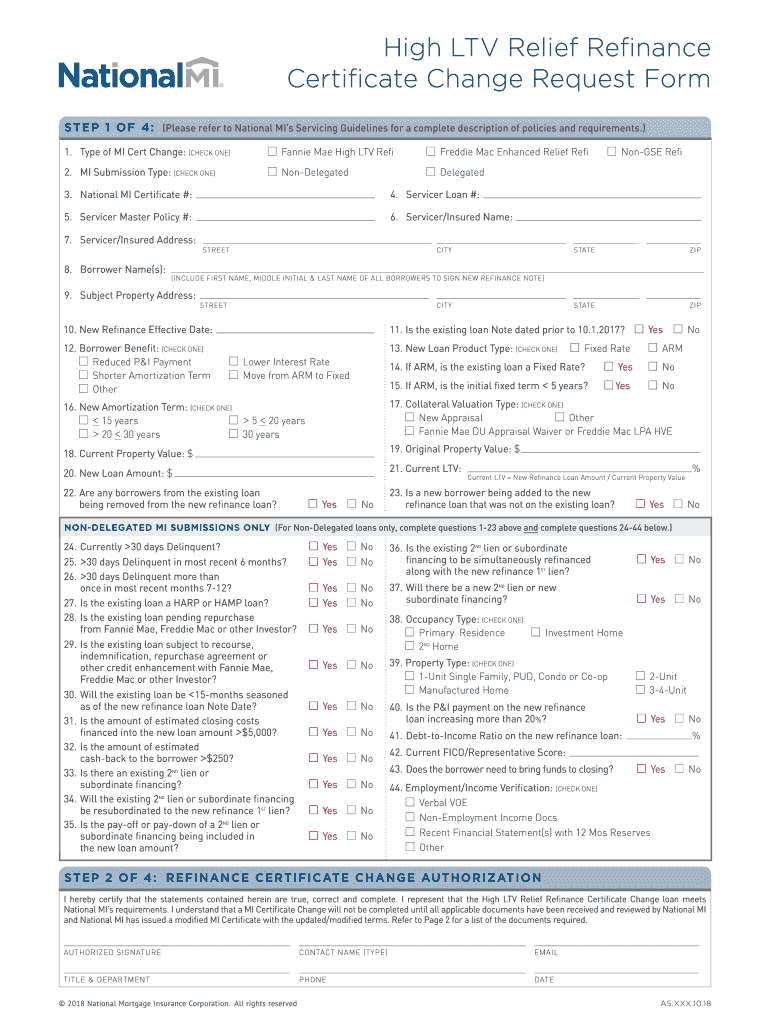

High LTV Relief Refinance

Certificate Change Request Form

ST E P 1 O F 4 : (Please refer to National MI's Servicing Guidelines for a complete description of policies and requirements.)

1. Type of

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign personal business commercial banking

Edit your personal business commercial banking form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your personal business commercial banking form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing personal business commercial banking online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit personal business commercial banking. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out personal business commercial banking

How to fill out personal business commercial banking

01

Gather all necessary personal and business documents, such as identification, proof of address, proof of employment, business registration documents, etc.

02

Research different commercial banks and their offerings to find the one that best suits your needs and preferences.

03

Visit the chosen commercial bank's website or branch to access their personal business commercial banking services.

04

Fill out the required personal information, such as name, address, contact details, etc., as per the provided application form.

05

Provide all the necessary business information, including company name, registration details, nature of business, etc.

06

Provide documentation to support the provided information, such as business registration certificates, tax identification numbers, etc.

07

Review the filled-out form and ensure all the information is accurate and complete.

08

Submit the completed application form, along with the required documents, to the commercial bank's representative or through online submission, if available.

09

Wait for the bank to review your application and contact you for any additional information or verification.

10

Once approved, set up your commercial banking account, including selecting the desired account types and services.

11

Familiarize yourself with the different features and capabilities of the personal business commercial banking account to effectively manage your finances and business transactions.

12

Keep track of your personal and business banking activities regularly, ensuring to monitor account balances, transactions, payments, and related matters.

13

Utilize the various banking services and features offered by the commercial bank to enhance your personal and business financial management.

14

Regularly update your personal and business information with the bank as required, such as change of address, contact details, business structure, etc.

15

Maintain a good relationship with the commercial bank, ensuring timely payments, compliance with banking regulations, and seeking assistance whenever required.

Who needs personal business commercial banking?

01

Personal business commercial banking is beneficial for individuals who own or operate a business, whether it is a small-scale sole proprietorship or a large corporation.

02

Entrepreneurs and business owners can benefit from personal business commercial banking by accessing specialized banking services tailored for their business needs.

03

Individuals who need to manage various financial transactions related to their business, such as receiving payments, making payments to suppliers or employees, payroll management, etc., can benefit from commercial banking.

04

Businesses that require access to credit facilities, loans, business credit cards, and other financial products and services can benefit from personal business commercial banking.

05

Owners of multiple business entities or those involved in complex business structures can benefit from having a consolidated banking platform for efficient management of their diverse financial needs.

06

Individuals who seek professional financial advice and guidance for their business, including wealth management, investment opportunities, risk assessment, etc., can benefit from the expertise and resources offered by commercial banks.

07

Having a personal business commercial banking account also allows individuals to separate their personal and business finances, providing better clarity and organization in managing their financial affairs.

08

Ultimately, anyone who wants to streamline their business financial management, improve efficiency, access specialized business banking services, and enhance their overall financial well-being can benefit from personal business commercial banking.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit personal business commercial banking online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your personal business commercial banking to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

Can I sign the personal business commercial banking electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How do I edit personal business commercial banking straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing personal business commercial banking.

What is personal business commercial banking?

Personal business commercial banking refers to the financial services provided by a bank to individuals and small businesses to help them manage their finances, including checking accounts, loans, and other banking products tailored for this sector.

Who is required to file personal business commercial banking?

Individuals and small businesses who utilize the services provided by commercial banks are required to file personal business commercial banking.

How to fill out personal business commercial banking?

To fill out personal business commercial banking, individuals and small businesses need to provide information about their financial transactions, accounts, and other relevant details requested by the bank.

What is the purpose of personal business commercial banking?

The purpose of personal business commercial banking is to help individuals and small businesses efficiently manage their finances, access credit, and facilitate transactions.

What information must be reported on personal business commercial banking?

Personal business commercial banking requires the reporting of financial transactions, account balances, and other relevant financial information.

Fill out your personal business commercial banking online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Personal Business Commercial Banking is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.