Get the free Hourly wage for Food Services ManagerSalary.com

Show details

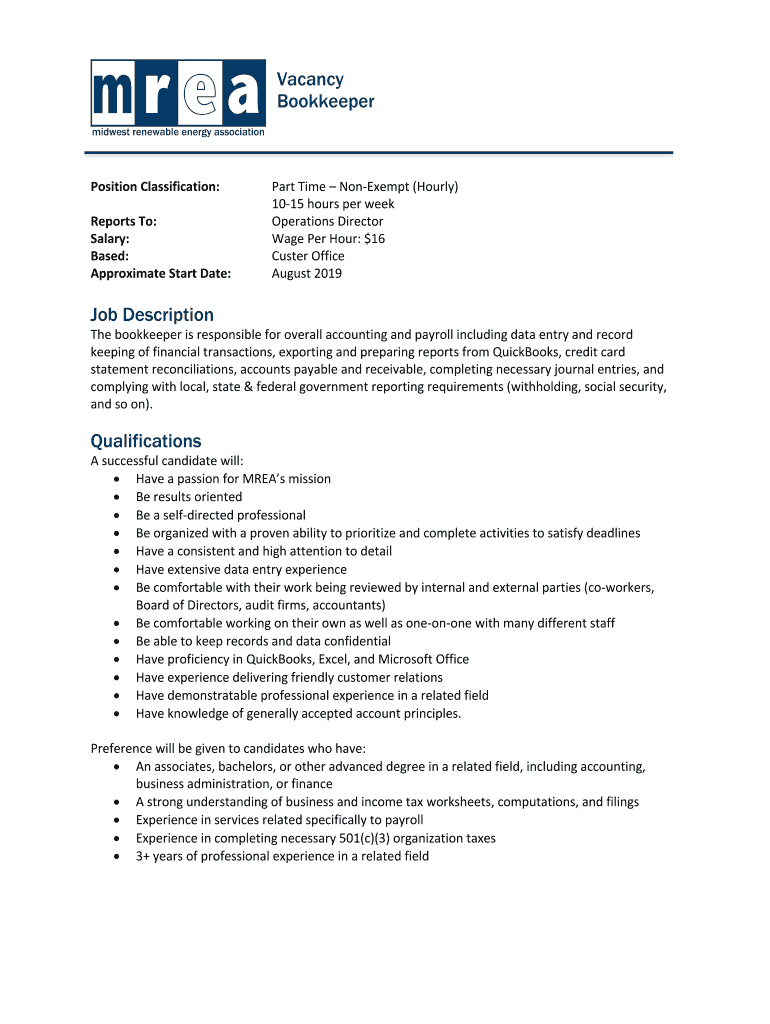

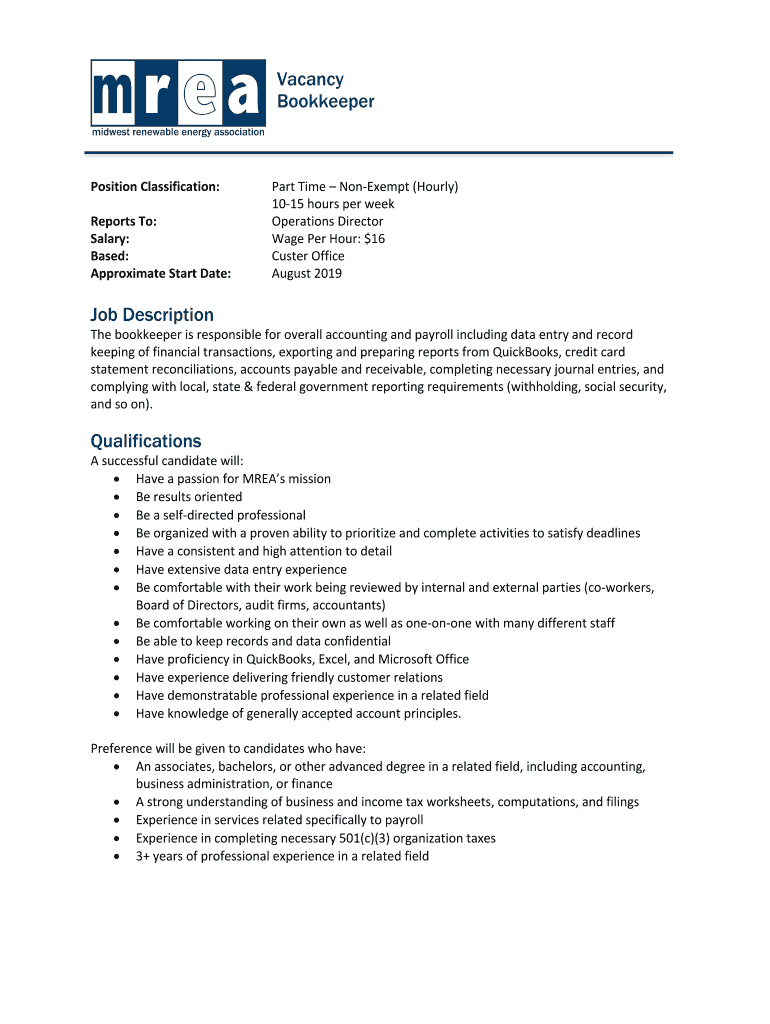

Vacancy BookkeeperPosition Classification: Reports To: Salary: Based: Approximate Start Date:Part Time Nonexempt (Hourly) 1015 hours per week Operations Director Wage Per Hour: $16 Custer Office August

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign hourly wage for food

Edit your hourly wage for food form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your hourly wage for food form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing hourly wage for food online

To use the services of a skilled PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit hourly wage for food. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out hourly wage for food

How to fill out hourly wage for food

01

To fill out hourly wage for food, follow these steps:

02

Find out the hourly wage rate for food service jobs in your area. This information can typically be obtained from job search websites or by contacting local employers.

03

Determine the number of hours you will be working per week. This could be a fixed number or vary from week to week.

04

Multiply the hourly wage rate by the number of hours worked per week to calculate your gross weekly income.

05

Consider any deductions or taxes that may apply to your income. This could include taxes, social security contributions, or union fees.

06

Subtract the deductions or taxes from your gross weekly income to calculate your net weekly income.

07

Alternatively, if you are an employer or manager, you may need to fill out hourly wage information for your employees. Ensure that you have accurate records of their hours worked and any applicable deductions.

08

Keep in mind any legal requirements or regulations regarding minimum wage or overtime pay that may apply to your specific situation.

09

Review your calculations and ensure all information is accurate before submitting or processing any forms or payroll.

Who needs hourly wage for food?

01

Hourly wage information for food is needed by various individuals and organizations, including:

02

- Job seekers: Individuals who are looking for food service jobs need to know the hourly wage rate in order to compare and evaluate job opportunities.

03

- Employees: Workers in the food service industry need to be aware of their hourly wage to ensure they are being paid correctly and fairly.

04

- Employers: Restaurant owners, managers, and other employers need to determine and set hourly wage rates for their employees.

05

- Government agencies: Government agencies may require hourly wage information for food service jobs to enforce labor laws and regulations.

06

- Financial institutions: Banks, lenders, and other financial institutions may request hourly wage information as part of loan applications or financial assessments.

07

- Researchers and analysts: Researchers and analysts studying the food service industry may need hourly wage data for their studies and reports.

08

- Legal professionals: Lawyers, labor unions, and other legal professionals may use hourly wage information in cases involving employment disputes or wage violations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my hourly wage for food directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your hourly wage for food and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

Can I create an eSignature for the hourly wage for food in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your hourly wage for food directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I fill out the hourly wage for food form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign hourly wage for food and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is hourly wage for food?

Hourly wage for food is the amount of money paid to employees who work in the food industry on an hourly basis.

Who is required to file hourly wage for food?

Employers in the food industry are required to file hourly wage reports for their employees.

How to fill out hourly wage for food?

Hourly wage for food reports can be filled out online or submitted in paper form to the appropriate governing body.

What is the purpose of hourly wage for food?

The purpose of hourly wage for food is to ensure that employees in the food industry are being paid fairly and accurately for their work.

What information must be reported on hourly wage for food?

Hourly wage for food reports must include the employee's name, hours worked, rate of pay, and total wages earned.

Fill out your hourly wage for food online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Hourly Wage For Food is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.