Get the free Apportionment Payment Applied to State Mandated Claims

Show details

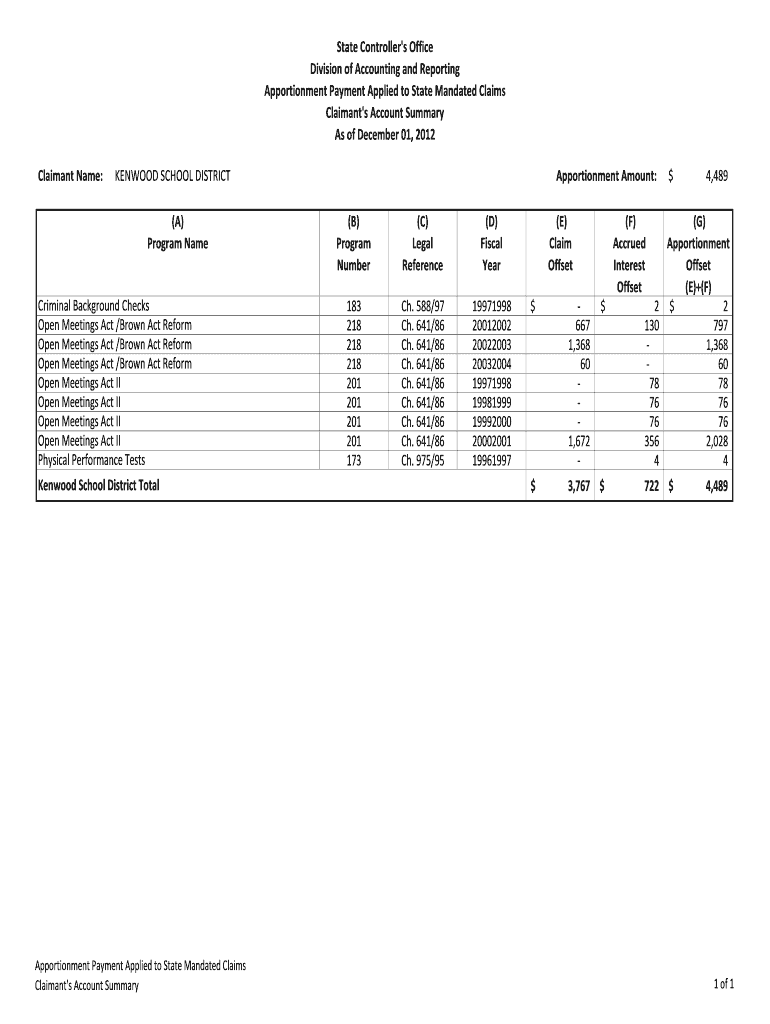

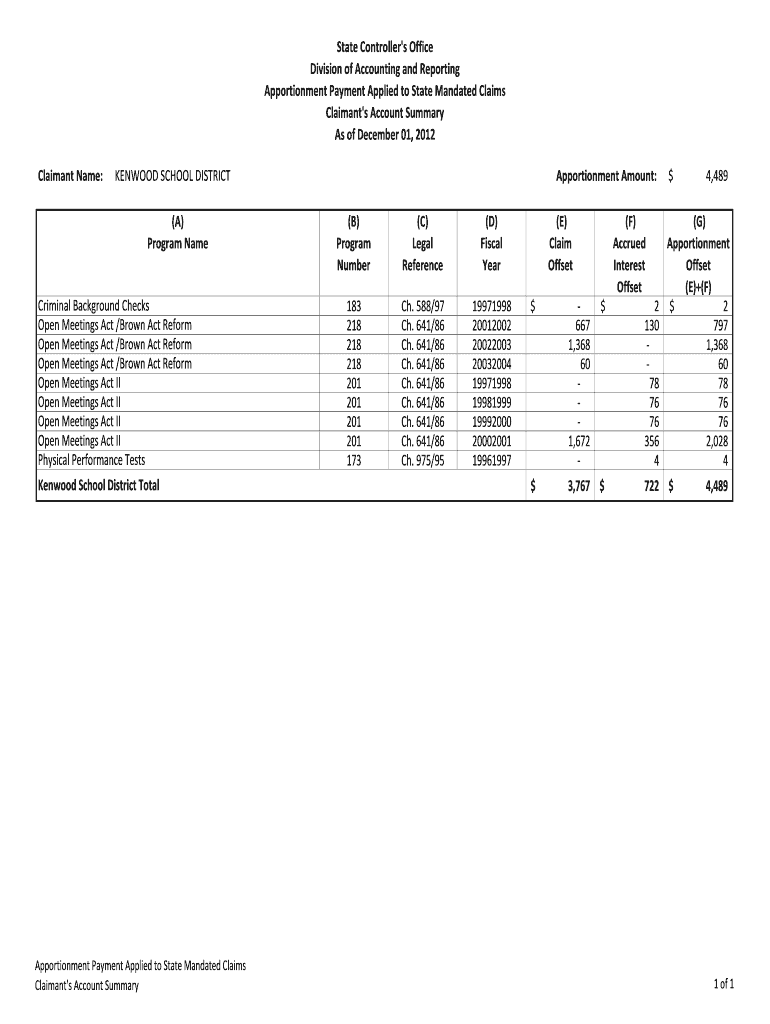

State Controller\'s Office

Division of Accounting and Reporting

Apportionment Payment Applied to State Mandated Claims

Claimant\'s Account Summary

As of December 01, 2012,

Claimant Name:Apportionment

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign apportionment payment applied to

Edit your apportionment payment applied to form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your apportionment payment applied to form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit apportionment payment applied to online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit apportionment payment applied to. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out apportionment payment applied to

How to fill out apportionment payment applied to

01

To fill out apportionment payment, follow these steps:

02

Gather all necessary information, including the amount of the apportionment payment and any relevant documents or receipts.

03

Determine the appropriate payment method. This could be by check, electronic transfer, or any other method specified by the payee.

04

Fill out the payment form or document. Provide accurate details such as your name, address, contact information, and any additional required information.

05

Calculate the apportionment amount to be paid. This may involve dividing the total amount by a specific ratio or formula.

06

Double-check all the information provided to ensure accuracy.

07

Submit the filled-out form or document along with any supporting documents to the designated recipient or payment office.

08

Retain a copy of the completed form and any receipts or confirmation of payment for your records.

09

Monitor the status of the payment to ensure it is successfully processed and allocated according to the apportionment rules and guidelines.

Who needs apportionment payment applied to?

01

Apportionment payment is typically needed by individuals or organizations involved in shared expenses or financial obligations.

02

Examples of individuals or entities who may require apportionment payment include:

03

- Roommates sharing rent and utilities

04

- Business partners splitting costs

05

- Joint borrowers or co-signers on loans

06

- Members of shared ownership properties or timeshares

07

- Condo or cooperative housing associations calculating shared expenses

08

Essentially, anyone who needs to allocate or distribute financial liabilities in a fair and accurate manner would benefit from apportionment payment.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send apportionment payment applied to for eSignature?

apportionment payment applied to is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How can I get apportionment payment applied to?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific apportionment payment applied to and other forms. Find the template you want and tweak it with powerful editing tools.

Can I create an electronic signature for signing my apportionment payment applied to in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your apportionment payment applied to right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

What is apportionment payment applied to?

Apportionment payment is applied to dividing or allocating expenses, income, or resources among multiple entities or jurisdictions.

Who is required to file apportionment payment applied to?

Any entity or individual that operates or does business in multiple jurisdictions may be required to file apportionment payment.

How to fill out apportionment payment applied to?

To fill out apportionment payment, you will need to calculate the appropriate allocation based on the specific requirements of the jurisdictions involved.

What is the purpose of apportionment payment applied to?

The purpose of apportionment payment is to ensure that expenses, income, or resources are fairly distributed among the relevant entities or jurisdictions.

What information must be reported on apportionment payment applied to?

Information that must be reported on apportionment payment includes details of the allocation method used, the amounts allocated, and the jurisdictions involved.

Fill out your apportionment payment applied to online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Apportionment Payment Applied To is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.