TSP-1-C 2019-2026 free printable template

Show details

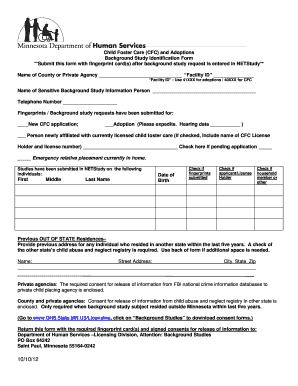

THRIFT SAVINGS PLAN TSP-1-C CATCH-UP CONTRIBUTION ELECTION Use this form to start stop or change your catch-up contribution election to your TSP account. ORIGINAL TO PERSONNEL FOLDER Provide a copy to the employee and to the payroll office. Form TSP-1-C 11/2013 PREVIOUS EDITIONS OBSOLETE TSP-1-C INFORMATION AND INSTRUCTIONS GENERAL Catch-up contributions are in addition to your regular TSP contributions. Required deductions include regular TSP contributions and TSP loan payments. You are...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign catch tsp amount form

Edit your form tsp 1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form tsp 1 c form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tsp 1c online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit up tsp contribution form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TSP-1-C Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out tsp c form

How to fill out TSP-1-C

01

Obtain the TSP-1-C form from the official TSP website or your agency's HR department.

02

Fill in your personal information including your name, address, and Social Security Number.

03

Provide details about your employment status, including your agency and position.

04

Indicate your desired contribution amount or percentage of pay to be allocated to your TSP account.

05

Choose your investment allocations by selecting the appropriate funds offered in the TSP.

06

Sign and date the form to confirm that all information is accurate and complete.

07

Submit the completed form to your agency's HR department or designated TSP coordinator.

Who needs TSP-1-C?

01

Federal employees who wish to enroll in the Thrift Savings Plan (TSP).

02

Employees looking to make changes to their contribution levels or investment allocations.

03

Individuals who are new to the TSP and want to start saving for retirement.

Fill

c1 form

: Try Risk Free

People Also Ask about

How to do a catch-up contribution 401k?

Understanding Catch-Up Contributions If you are age 50 or older, you can make an additional contribution of $6,500 to your 401(k) per tax year (increasing to $7,500 in 2023). 4 This will save you tax in the short term, and it could make a big difference to the size of your portfolio by the time you reach retirement.

How do catch-up 401k contributions work?

More In Retirement Plans Individuals who are age 50 or over at the end of the calendar year can make annual catch-up contributions. Annual catch-up contributions up to $7,500 in 2023 ($6,500 in 2021-2020; $6,000 in 2015 - 2019) may be permitted by these plans: 401(k) (other than a SIMPLE 401(k))

Are catch-up contributions a good idea?

Catch-up contributions help you save more for retirement in the latter part of your career. Many people reach their peak earning years in their 50s, which means they can save more money and trim their taxes substantially.

How do you make a catch-up contribution?

To begin making these extra contributions, you'll need to contact your plan administrator or access your account online. You can make this election at any time and change the amount you wish to contribute each pay period if necessary. Catch-up contributions must be made to 401(k) plans before the end of the year.

What is the catch-up contribution for 2023?

Here are some of the changes for 2023: The limit on annual contributions to an IRA will increase to $6,500. The IRA catch‑up contribution limit for individuals age 50 and over is not subject to an annual cost‑of‑living adjustment and remains $1,000.

What does catch-up contribution mean 401k?

A catch-up contribution is an elective deferral made by a participant age 50 or older that exceeds a statutory limit, a plan-imposed limit, or the actual deferral percentage (ADP) test limit for highly compensated employees (HCEs).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send TSP-1-C for eSignature?

When your TSP-1-C is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I edit TSP-1-C in Chrome?

TSP-1-C can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

Can I create an electronic signature for the TSP-1-C in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your TSP-1-C in minutes.

What is TSP-1-C?

TSP-1-C is a form used for reporting certain financial transactions to the TSP (Thrift Savings Plan) which facilitates the management of retirement savings for federal employees.

Who is required to file TSP-1-C?

Individuals who are participants in the TSP and wish to make specific contributions or changes regarding their investment choices are required to file TSP-1-C.

How to fill out TSP-1-C?

To fill out TSP-1-C, download the form from the TSP website, complete the required personal information, specify the contribution amount, and submit it to the TSP administrative office according to the provided instructions.

What is the purpose of TSP-1-C?

The purpose of TSP-1-C is to allow participants to officially document their contribution choices and any changes to their TSP investment allocations, ensuring that their retirement savings are managed according to their preferences.

What information must be reported on TSP-1-C?

TSP-1-C requires the reporting of personal identification information, such as name, Social Security number, address, and details regarding the desired contribution amounts and investment options.

Fill out your TSP-1-C online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TSP-1-C is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.