Get the free Target Date Retirement Funds - US Department of Labor

Show details

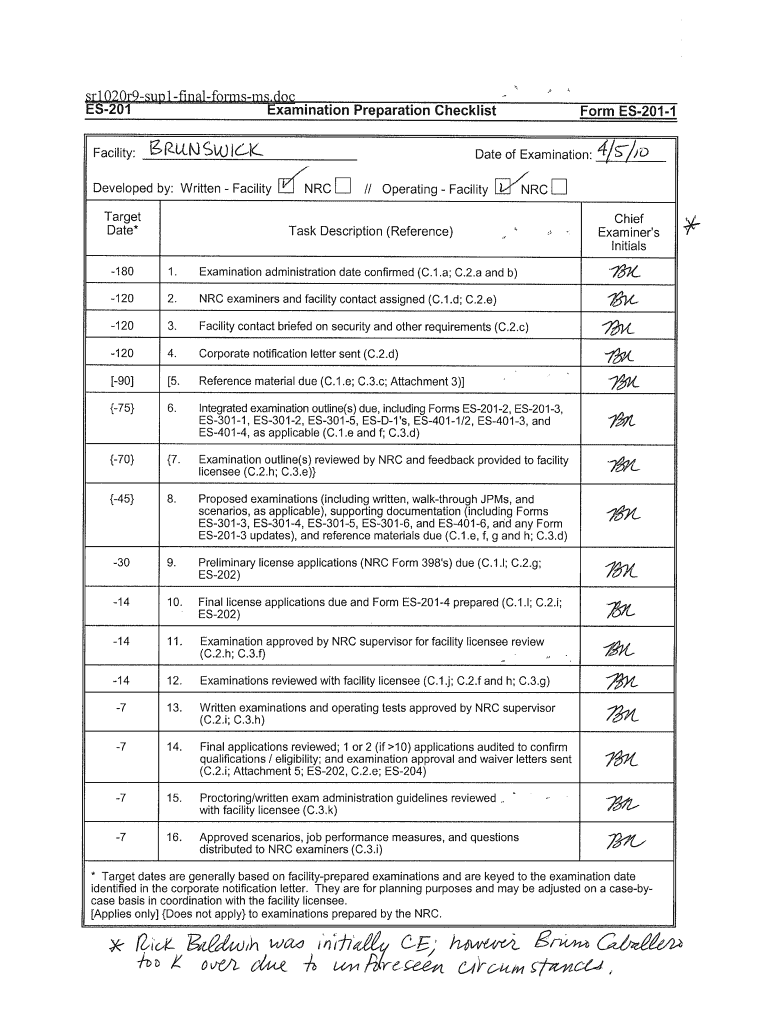

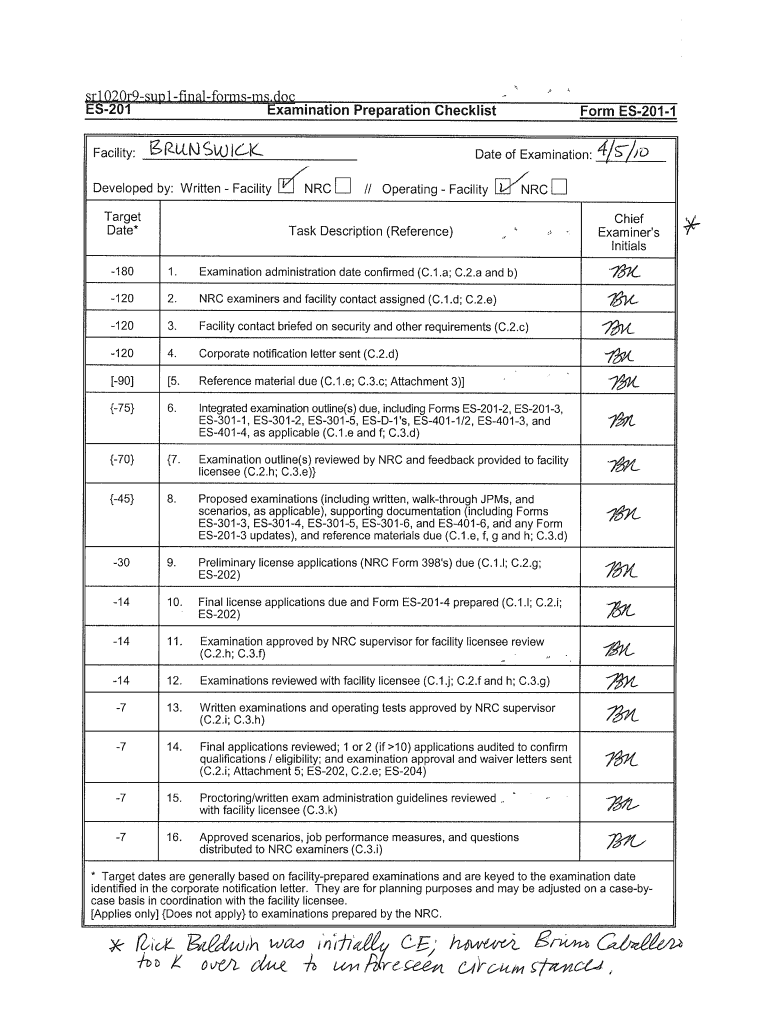

Sri 020r9sunl finalformsrns.doc srQ2Qr9su.PJ fioalformsms. DEC ES201Examination Preparation ChecklistiRLL1JOk. ISR.LTN SW IclcFacility: Facility:Date of Examination: Examination: Date NRC Developed

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign target date retirement funds

Edit your target date retirement funds form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your target date retirement funds form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing target date retirement funds online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit target date retirement funds. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out target date retirement funds

How to fill out target date retirement funds

01

To fill out target date retirement funds, follow these steps:

02

Determine your retirement goal: Determine the amount of money you will need for a comfortable retirement by considering factors such as your desired lifestyle, expected expenses, and inflation.

03

Understand the target date: Target date retirement funds are investment portfolios that automatically adjust their asset allocation based on your target retirement date. Familiarize yourself with the target date and its associated investment strategy.

04

Choose the appropriate fund: Select a target date retirement fund that aligns with your retirement goal and risk tolerance. Each fund has a specific target retirement year, so choose the one closest to your planned retirement date.

05

Consider the glide path: The glide path is the predetermined asset allocation mix of the fund over time. It adjusts the proportion of stocks and bonds as the target date approaches. Understand the fund's glide path and how it fits your investment preferences.

06

Fill out the application: Contact the provider of the target date retirement fund and complete the application form. You will typically need to provide personal and financial information, such as your name, address, Social Security number, employment details, and investment amount.

07

Set up contributions: Decide on the contribution amount and frequency for your target date retirement fund. You can opt for regular contributions from your paycheck or make periodic lump-sum contributions.

08

Monitor and review: Regularly monitor the performance of your target date retirement fund and review your investment strategy. Consider consulting with a financial advisor if needed to ensure your investments stay on track towards your retirement goal.

Who needs target date retirement funds?

01

Target date retirement funds are suitable for individuals who:

02

- Are planning for retirement and want a simplified investment approach

03

- Want a professionally managed portfolio without the need for constant rebalancing

04

- Prefer a hands-off investment strategy

05

- Have a specific target retirement year

06

- May not have the time, knowledge, or interest to actively manage their investments

07

- Want a diversified portfolio that automatically adjusts over time based on their retirement date

08

- Are comfortable with a potentially higher allocation towards stocks early on and a shift towards bonds as retirement gets closer

09

- Are willing to accept some level of market risk in exchange for potential long-term growth

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find target date retirement funds?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the target date retirement funds. Open it immediately and start altering it with sophisticated capabilities.

How do I execute target date retirement funds online?

pdfFiller has made filling out and eSigning target date retirement funds easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

Can I edit target date retirement funds on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as target date retirement funds. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is target date retirement funds?

Target date retirement funds are investment funds that automatically adjust their asset allocation over time to become more conservative as the target date (usually retirement) approaches.

Who is required to file target date retirement funds?

Target date retirement funds are typically managed by investment companies and individuals who invest in these funds are not required to file them.

How to fill out target date retirement funds?

To invest in target date retirement funds, individuals can simply choose the fund with the target date closest to their planned retirement year and invest accordingly.

What is the purpose of target date retirement funds?

The purpose of target date retirement funds is to provide individuals with a diversified investment option that automatically adjusts its risk level as retirement approaches, aiming to minimize risk and maximize returns.

What information must be reported on target date retirement funds?

Target date retirement funds typically report information such as fund performance, asset allocation, fees, and any changes to the target date or investment strategy.

Fill out your target date retirement funds online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Target Date Retirement Funds is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.