Get the free INDIVIDUAL CAPITAL TRUST MANAGEMENT AGREEMENT

Show details

Integrity Trading Group Inc. 17 Rue Notre Dame, 2240 Luxembourg Tel.: +39 391 7000 133; +352 22 22 75 1INDIVIDUAL CAPITAL TRUST MANAGEMENT AGREEMENT Date, hereinafter referred to as Investor, from

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign individual capital trust management

Edit your individual capital trust management form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your individual capital trust management form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing individual capital trust management online

To use the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit individual capital trust management. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out individual capital trust management

How to fill out individual capital trust management

01

To fill out individual capital trust management, follow these steps:

02

Gather all relevant financial documents, such as income statements, balance sheets, and investment portfolios.

03

Identify the goals and risk tolerance of the individual seeking capital trust management.

04

Research and select a reputable capital trust management company or financial institution.

05

Schedule a meeting with a representative from the chosen company to discuss the individual's financial objectives.

06

Provide the necessary information and documentation to the company, including personal identification, financial statements, and investment preferences.

07

Review and sign any required legal agreements or contracts.

08

Deposit the desired amount of capital into the trust account.

09

Regularly monitor the performance and progress of the capital trust management, and communicate with the assigned portfolio manager or advisor as needed.

10

Adjust or update the investment strategy and goals as required, considering any changes in personal circumstances or market conditions.

11

Periodically review the overall performance and results of the capital trust management to ensure it aligns with the individual's objectives.

Who needs individual capital trust management?

01

Individual capital trust management is beneficial for:

02

- High net worth individuals who wish to optimize and grow their wealth.

03

- Individuals with complex financial situations who require personalized investment strategies.

04

- Those who lack the time or expertise to manage their own investments.

05

- Individuals who prefer professional assistance and objective guidance in managing their capital.

06

- Those seeking to diversify their investment portfolio and reduce risk through professional management.

07

- Individuals who value long-term financial planning and wealth preservation.

08

- Those who desire access to specialized investment vehicles or markets that may not be easily accessible to individuals.

09

- Individuals who wish to create a financial legacy or pass on wealth to future generations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit individual capital trust management from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your individual capital trust management into a fillable form that you can manage and sign from any internet-connected device with this add-on.

Can I create an eSignature for the individual capital trust management in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your individual capital trust management right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I complete individual capital trust management on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your individual capital trust management, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

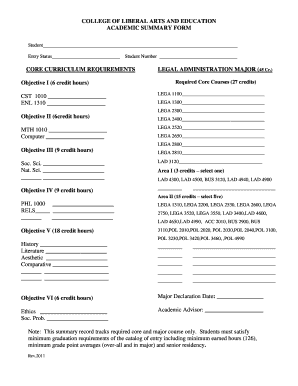

What is individual capital trust management?

Individual capital trust management refers to the management of funds or assets by a trustee on behalf of an individual beneficiary.

Who is required to file individual capital trust management?

Individuals who have appointed a trustee to manage their capital trust are required to file individual capital trust management.

How to fill out individual capital trust management?

Individuals can fill out individual capital trust management by providing detailed information about the assets in the trust, the trustee, and any beneficiaries.

What is the purpose of individual capital trust management?

The purpose of individual capital trust management is to ensure that assets are managed and distributed according to the wishes of the individual beneficiary.

What information must be reported on individual capital trust management?

Information such as the value of assets in the trust, any income generated, expenses incurred, and distributions made to beneficiaries must be reported on individual capital trust management.

Fill out your individual capital trust management online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Individual Capital Trust Management is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.